Karora Resources (KRRGF)* $2.53

Trailing P/E is 5.4

Revenue is expected to Double by 2024

Earnings and Cash flows expected to expand faster than revenue growth.

All in sustain Costs is $996 – expected to decline

LOTM price prediction is $10 by 2024

Nickel deposits alongside KRRGF’s gold deposits provides an add-on product with little extra expense.

Karora is a LOTM related accounts, core holding and largest single position in precious metals.

Interview with Chairman/CEO Paul Huet – July 9, 2021

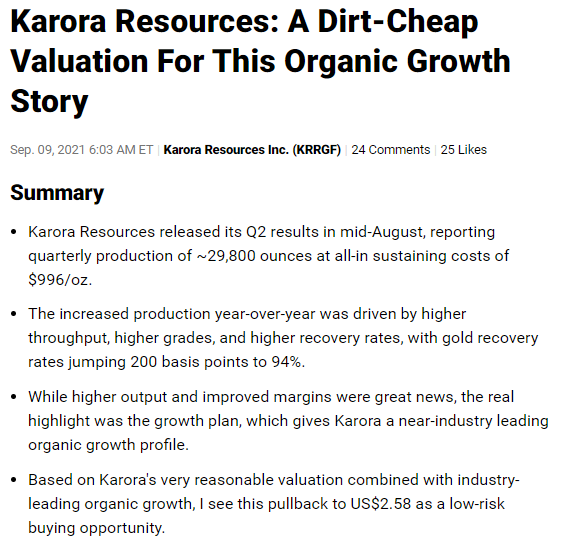

Third Party comment at Seeking Alpha.

Article linked here:

By Taylor Dart, Sept 9, 2021

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()