Within the Q3 earnings video release linked here, including the October update, management projected their Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) “run rate” numbers for early Q1 2022 and early Q4 2022.

NOTE – these are not revenue numbers but subject to crypto prices – EBITDA numbers. They are very big and frankly startling Vs what Soluna (Mechanical Tech) was doing. Almost a fairy tale story!

- Early Q1 2022, run rate for EBITDA between $20 and $40 million subject to crypto prices – about 10:20 into the video

- Early Q4 2022, run rate for EBITDA between $120 million and $140 million subject to Crypto prices – about 13:15 into the video

If you weren’t paying attention and half listening, you might not have caught this.

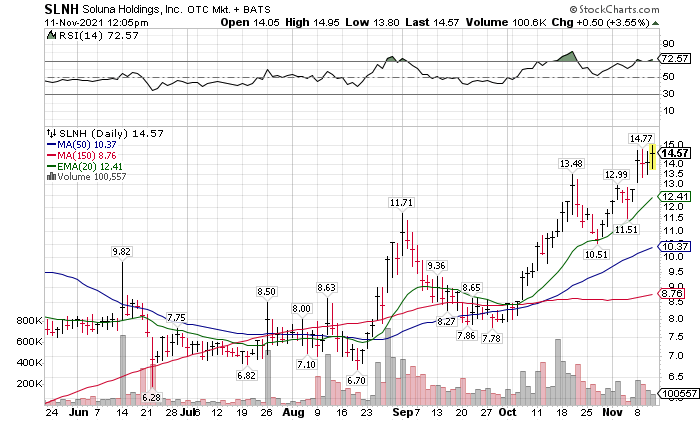

These are numbers that can take the share price much higher and likely why the shares moved higher this morning.

We continue to suggest that $30 price by June 2022 is a very real goal. Look for market sell-offs and SLNH price weakness to accumulate shares.

You can Read, you can watch Videos, but nothing beats Personal Interaction for accelerated learning.

This game has levels of understanding that could take a lifetime of Trial and Error to learn.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()