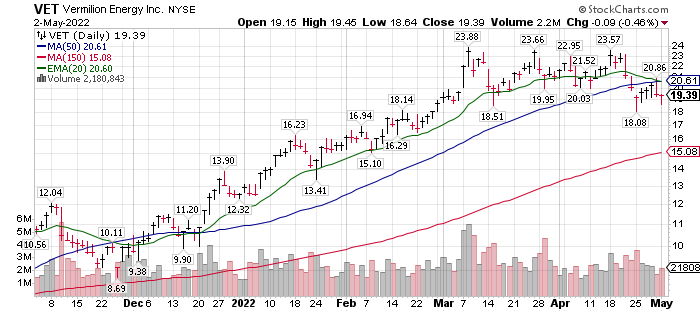

Vermilion (VET)* price is in an intermediate price correction. This is “correction” label defined as such when the stock price is below its own 50-day moving average. “Intermediate” because the price is still above its 150-day MA, considered an indicator of the longer-term trend. LOTM has said we consider VET an attractive purchase when the price is below $20.

Vermilion (VET)* price is in an intermediate price correction. This is “correction” label defined as such when the stock price is below its own 50-day moving average. “Intermediate” because the price is still above its 150-day MA, considered an indicator of the longer-term trend. LOTM has said we consider VET an attractive purchase when the price is below $20.

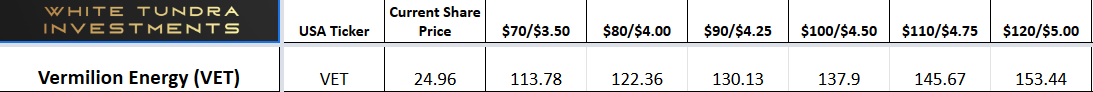

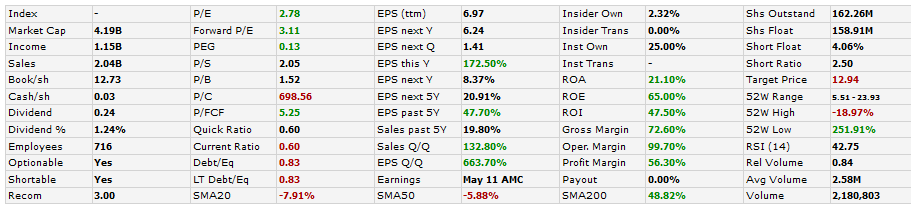

We state this because the cash flows for Vermilion are exploding. Currently the shares trade at about 5 times trailing cash flow and 3 times forward cash flow. The current P/E ratio is 2.73 with a forward P/E projected at 3.1. VET produces Natural Gas in Eastern EU where Nat Gas prices are much higher than in North America. VET also produces oil and gas in the North Sea – close proximity to sales in the EU.

White Tundra website with price projection for 56 Canadian energy companies linked here. Values above are in Canadian dollars

White Tundra website with price projection for 56 Canadian energy companies linked here. Values above are in Canadian dollars

- From the above numbers, with oil at $100 the C$137.90 converts to USD number of $106.50

- Price of North American Nat Gas futures chart.

Nat Gas is likely to stay high because of shortages caused by drilling restrictions, pipeline closures and no gas or oil flowing to Europe from Russia. North America Nat Gas will be sold into the higher prices paid by Europeans. Product goes to highest bidder when supply is tight. Law of the Jungle.

Recent article in Seeking Alpha:

Vermilion Energy: Still A Buy At CAD$26 – Offering Attractive Shareholder Returns Apr. 08, 2022

Summary

- Free cash flow (FCF) yield FY 23e at 55% on March strip prices.

- Optimal debt level reached – three years earlier than targeted.

- Capital return to shareholders is expected to ramp up in FY 2023

LOTM: Expect increasing dividend payouts, continued share buy-backs and potential for special dividends.

TipRanks:

Analyst Price Target on VET C$25.73

32.70% Upside Based on 10 Wall Street analysts offering 12 month price targets for Vermilion Energy in the last 3 months. The average price target is $25.73 with a high forecast of $41.20 and a low forecast of $17.10. The average price target represents a 32.70% change from the last price of $19.39.

LOTM does not have a price target. We only believe the next leg higher has potential to double from the current price.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()