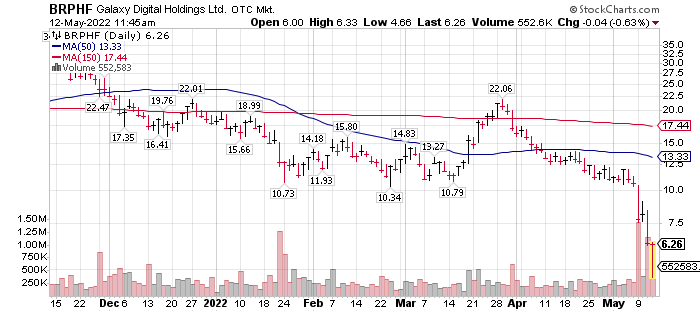

Galaxy Digital (BRPHF)* issued a press release May 11 providing an company update and the approval of a share buy back of up to 10% of the public float.

The share price has cratered. No other way to say it. What is public is all things are fine at the company level. Operations are profitable, but there is a non-cash loss due to mark-to-market of their crypto portfolio holdings.

I added a small number of shares relevant to the position size on May 12. This is an example of know your company and your commitment to the ownership of the company. While anything can happen in this uncertain world, panic sell offs are opportunities to add shares at low prices.

There has been talk that the Fed will raise interest rates until something broke. The first big visible break is the break in the PEG to the Us dollar by a stable coin. You can read more here. The government is not likely to step in to save a stable coin. In fact, they are probably happy. The number one concern for the government, is the US dollar. Not you, not the middle class and not the markets unless it threatens the financial system. They are not really serious about checking inflation other than its impact on their position in office. Governments need inflation to keep the debt based system working now more than ever.

- LOTM remains a believer in the long-term growth of Blockchain.

There is massive development happening in merging blockchain into the financial community. The “Big Dog” in blockchain development is Mastercard (MA) followed closely by Visa (V). the payments industry is the first mover in use of blockchain, but it is spreading to settlements, lending and title companies as well.

There is no assurance of the survival of Galaxy Digital. However, at the moment they are the global leader in institutional blockchain / crypto activity. At the moment they are not in financial difficulties. A fact backed up with their approval to buy back 10% of the floating shares. More profit for the partners, right? Think like a partner and co-owner of the company. Share prices are emotional representations while companies are more stable. Panics in the market can be very opportunistic.

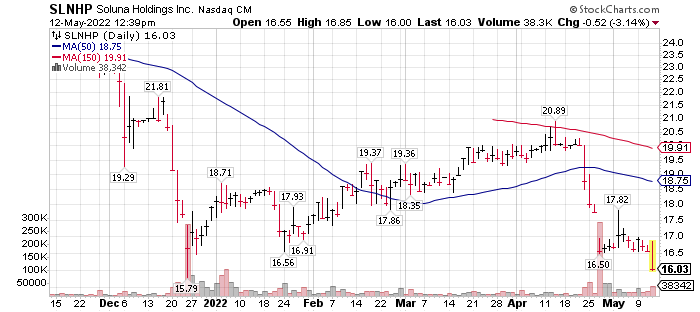

Soluna Holding cumulative preferred (SLNHP)*: $16.03 13.65% annual yield, distributed monthly.

Cumulative means if they miss a payment, it is still owed to you. The company can buy back the preferred in 2026 at $25.00 to retire the preferred. Other than that, there is no stated end-point to the preferred. Need income? – this is distributed at $0.187 per share monthly. The preferred is illiquid from a price perspective but trades regularly. Price drops in harsh market environments can be an opportunity to get an excellent return on cash invested plus the potential of capital gain if/when the preferred is redeemed.

The parent company, Soluna Holding (SLNH)* is not having any financial problems. Just an idea.

Good fortune to us all!

Written May 12, 2022, by Tom Linzmeier, editor, LivingOffTheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()