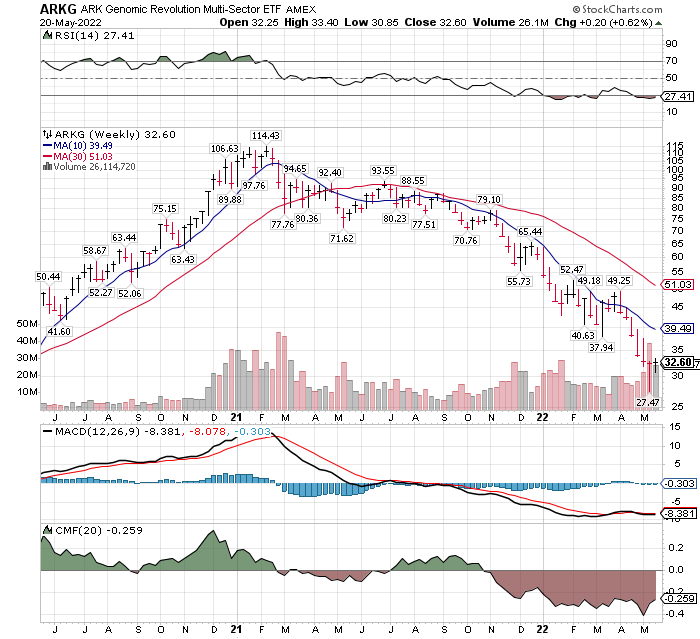

I have placed a number of Cathy Wood’s Genomic stock picks in a watch list. The purpose was to monitor them for an attractive entry point. It appears that a bottom might have been found. Ask me again in 90 days to confirm that. Wood’s Ark Genomic ETF symbol is ARKG of course. Closing price Friday was $32.67. The weekly two-year chart looks like this.

Note the volume surge at the high water mark in February and March 2021. Now look at the volume surge at the recent low of May 2022.

- Volume tends to surge at major turning points. A greater force is needed to change the trend direction.

- RSI is still over-sold Vs the comp to February 2021’s, over-bought. Risk while never eliminated, is a lot less after falling from $114 high to the $27 low.

- On the daily chart the MACD has given a positive cross over for a trading buy signal. It is hard to see here on the weekly chart.

- CMF is rising from its lows but this isa longer and more trend following signal and it not quite there yet.

I will pick one company (ETF actually) to illustrate what I am seeking to suggest “the bottom is in” for genomic stocks. I said the bottom is “IN.” I did not say the sector was going to leap into rally mode. Chances are there will be some short sharp rallies but retreat and build a base for three to six months. Odds favor a base building period, so scale in, start doing some trades to get a feel for the movement, if interested in this sector.

In the chart below the Stochastic and MACD are momentum indicators and short-term trading indicators. Ignore them for this conversation. What I want you to view are the accumulation / distribution indicators MS (Money Supply, BOP (Balance of Power), Chaikin Money Stream (CMS) & TSV (Time Segmented Volume). These indicators are showing accumulation is beginning in this industry. Institutions are buying the industry or said better “accumulating” the industry. It is early days, so buy some, add some on weakness. This is a two to three-year, maybe longer, ride the trend as long as you can stand it, purchased with the goal of a double in price as a minimum. Three to four fold is a realistic goal over three to four years.

OK, LABU is a 3X levered ETF designed for TRADING! It is very volatile and changes direction on a dime. I am using it as an illustration because most of the names in the list below, have the patterns in the indicators mentioned above and shown in the chart below. Also note volume. Volume precedes price.

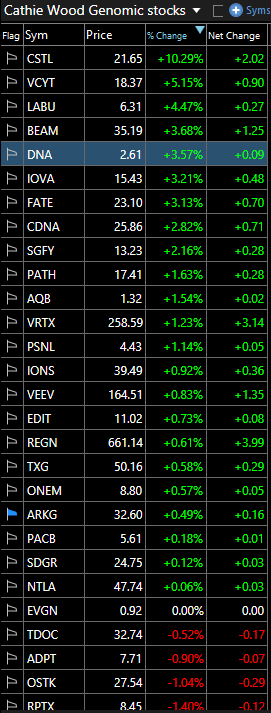

Listed below is Friday’s performance for some of the genomic stocks in Cathie Wood’s ARKG ETF.

You might consider buying three to five names with equal dollars, and Dollar-cost-average into the names over time. Treat the package as one investment play in the genomics industry. Volatility will be high, but the company risk, is about 80% lower than a year ago.

Written May 22, 2022, by Tom Linzmeier editor, LOTM

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

Pingback: LOTM: Watchlist of Cathie Wood’s Genomic Companies in ARKG ETF -