Select Comments:

Select Comments:

- Recon Africa (RECAF):

Recon Africa is in a quite period where they have had surprising success in finding oil and gas of each of the first three exploratory drill sites. This is not normal. In fact, it is quite extraordinary. 2022 will be continued drilling to define the property for the location for drilling for production. IMO, it will still be two to three years before production begins on the property. Yes, news flow can come from successful or unsuccessful exploratory drill sites. I doubt strongly that the price will break out during this next two to three years. For this listing in LOTM: Ten Under $10 positions, we will hold the position since we have pulled out an amount above our cost. It is free held position. Recon could still increase five to ten fold (optimistic view) from the current price, but it could take three to five years to unfold.

- 180 Degree Capital (TURN)

TURN is very inexpensive Vs it Net Asset Value (NAV). Stock price $6.36 vs $9.81. Small caps have sold lower by a stronger degree than other sectors of the market. This makes TURN attractive to us as TURN trades about 35% discount to its NAV. There isn’t, however, a catalyst to trigger higher prices. Our perspective is:

1) put TURN on a technical watch list and buy on a technical breakout.

2) look for dips in the stock price and buy or add shares on weakness.

Insiders have been constant buyers of the shares for more than four years. 71 separate purchases of TURN by insiders over the past 12 months – with no sales of stock.

- Silver One – Discovery Silver – GoldSpot – Sassy Resources – Gander Gold – Victoria Gold

We are incredibly positive on the mining sector. So, we are not blinking on these positions – and if or when we have cash, we would add to the shares. These companies are not going to go out of business. The stocks have declined more (percentage-wise) than the price of the physical metals. This is a disconnect not to be worried about but an opportunity to add cheaply to the positions. The mining stocks could explode when the US$ backs down and /or interest rates decline. We have a long list of mining companies we like. We’ll share this list in a future mailing.

LOTM: Comments on Select Companies LOTM Follows or Owns

Posted on May 26, 2022 by Tom

- Soluna Holdings (SLNH)*

- EQT Corp (EQT)*

- Frontline (FRO)*

- Vermilion (VET)*

- Galaxy Digital (BRPHF)*

- Calumet (CLMT)*

- Karora Resources (KRRGF)*

LOTM: we commented on a number of the other companies in the Ten Under $10 companies on May 26. Follow the headline link if you did not see our previous Blog Post.

- Buying Through the Correction:

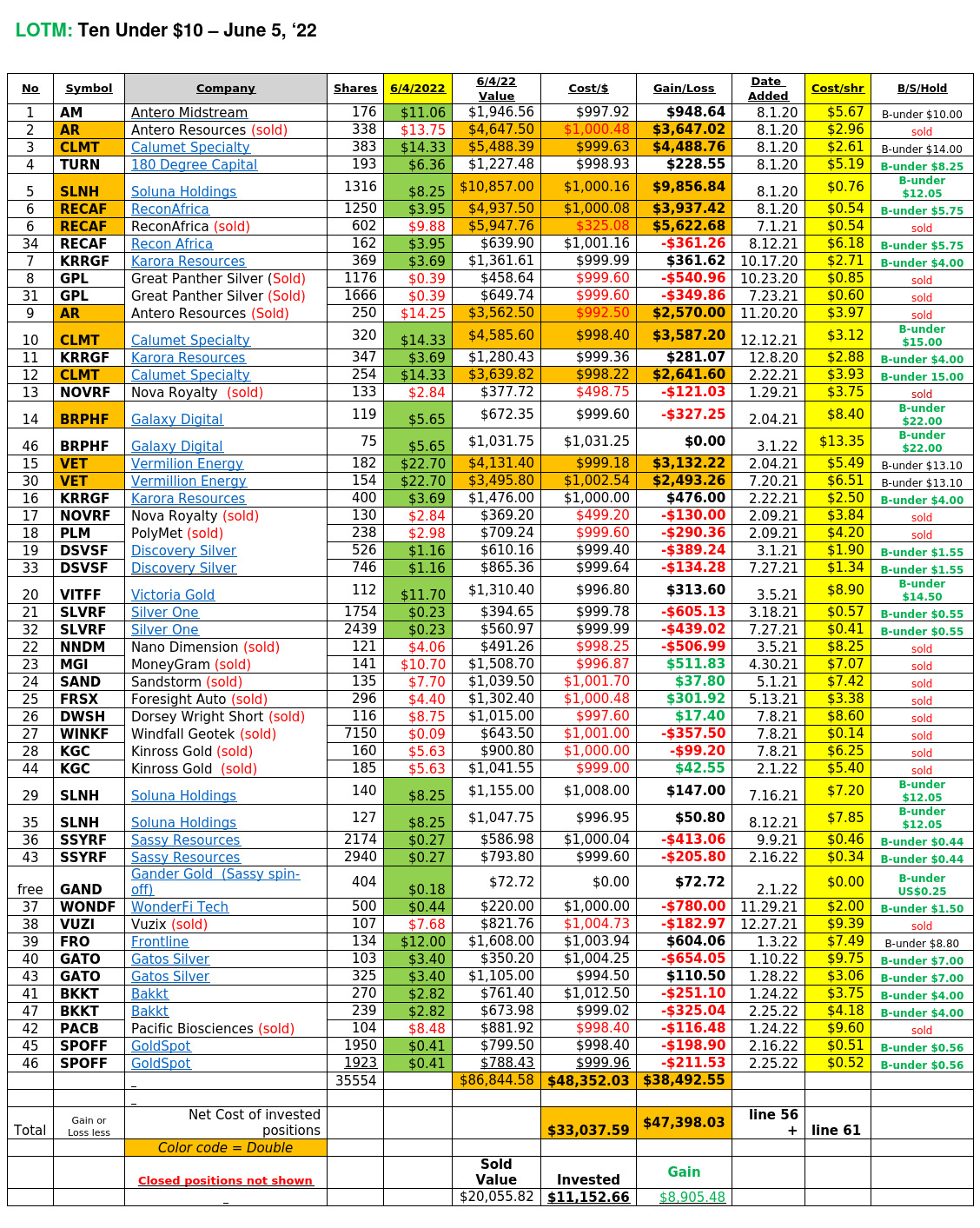

When you look at the spreadsheet above, you can see that “market cycles,” heavily influence the ability of stocks to double or more. We had many doubles prior to February 2021, and fewer doubled after February 2021. We were perfect on out call into Natural gas stocks / Energy stocks in October 202. This group has held up well in the last twelve months of the market decline.

We are setting up (already started?) for a move higher driven by “risk on” market cycle trades. We could see softness in the oil & gas sector on this next risk on market rally. We don’t see that indication yet, however. Expectation of a risk-on rally over the next couple of months is what is behind our comments above, about dollar-cost-averaging into many of the companies in which we have losing positions. As mentioned above we are especially bullish on the metal miners. If you look back to 2019 the charts would show you that the miners are in a strong bull market with extended consolidation period from August 2020 to the present day. The odds are very high that the break-out will be upwards and soon.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()