The Ten Under $10 portfolio has been trashed in this sell off in the first half of 2022.

Never-the-less, we are very comfortable with the positions held in the Ten Under $10 portfolio.

Natural Resources, mineral and fossil fuels, are still within the theme of “Commodities will rule in this decade”. They are volatile yes and the miners are crushed at this moment.

Keep in mind that in my opinion, is very little risk of these companies going out of business. Personally, I have been or would be dollar-cost-averaging (DCA) into all miners listed in the portfolio below. I like Uranium as well which is not in the portfolio except for some royalty positions held by GoldSpot.

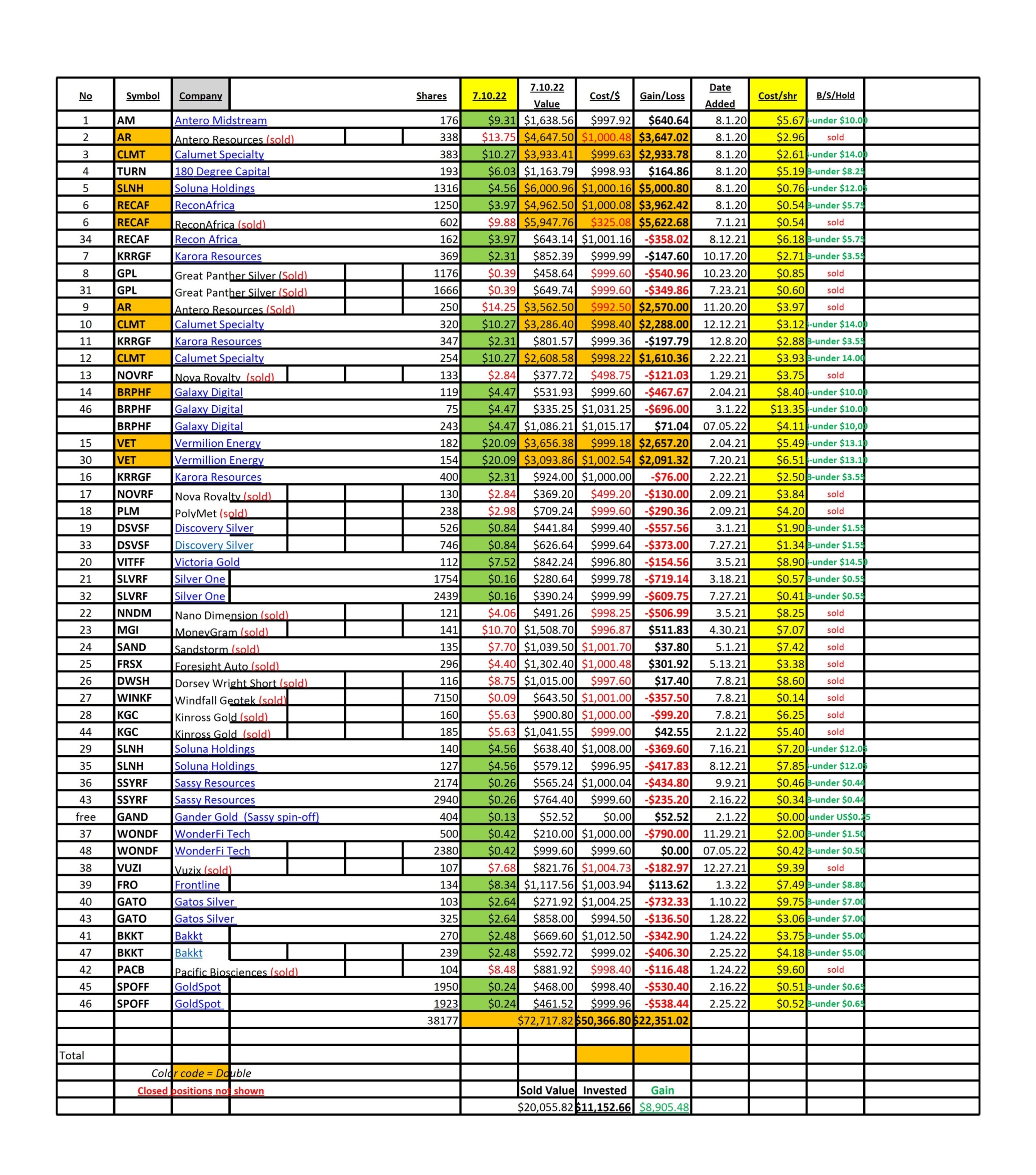

We started this portfolio August 1, 2020. We are coming up on two years in process.

At this moment our cost basis in position still held is $34,053.96.

At this moment our realized and unrealized net gain is $31,256.50.

This is down materially from the market top in November 2021. Still, our performance is not anything we are ashamed of sharing.

We remain very bullish on blockchain/crypto of which we have significant exposure.

We also remain very bullish Natural Resources of which we have significant exposure. Especially Natural Gas stocks.

Therefore, we are content to continue owning and DCA into additional shares of the companies in te ten Under $10 portfolio.

Later, in another post, we will discuss the strong US Dollar its relationship with commodities, emerging countries. This more complicated subject than I might be able to explain but I will give it a shot.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()