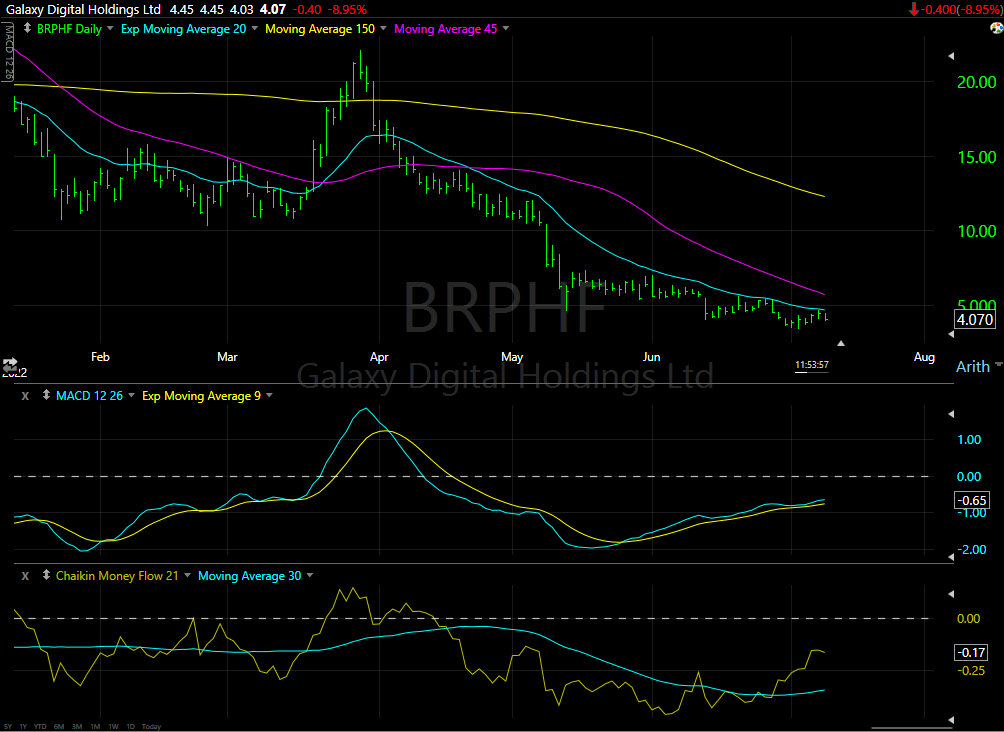

Galaxy Digital (BRPHF)* $4.07 is in what LOTM judges to be a Stage one basing chart pattern. We could have an other drop in the share price sure but $20 to $4 in 120 days discounts a lot of te future. Blockchain is still the fastest growing technology in human history and Galaxy is still the #1 Investment Banking firm for institutions in the world. The intensity of the crisis in crypto related coins and exchanges seems to be fading into the past. Vulture funds are forming to scoop up distressed assets. This “should” put a base under coins or exchanges that get into difficulties. If there are exchanges or funds that are over leveraged after the recent bouts of de-leveraging, they likely deserve to go out of business.

Galaxy Digital itself is raising funds for their own sponsored Vulture fund. They also initiated a 10% percent of float (10 million shares) share buyback program. Both of these actions indicate that the company is fine financially.

In the chart above we are not seeing the share price crossing above either of the two major moving averages that indicate a trend reversal. It would not take much of a move however, for the price to cross above its 45-day moving average in the chart above.

The more sensitive (leading) indicators MACD is on a buy-signal and the CMF is also on a buy signal. The CMF especially indicates suggests accumulation of shares.

So much of the market is driven by computers today, that we need to see multiple indicators triggered before the Algo’s begin buying.

In some ways it is easier to trade (in general) today, than a decade or two ago because the computers are all triggered by similar signals.

Note: the price move in March of this year in Galaxy’s shares. The price went from $11 to $22 in ten trading days! Of course, the move from $22 to below $5.00 happened in about 90-days. So, looking for a trading stock? Volatility is your friend unless of course you are on the wrong side of the move. Accounts related to LOTM have not sold any shares of Galaxy and in the past ten days have accumulated shares below $5.00. Our average cost is still high in the $14.00 area, but we will nickel and dime with our accumulation of Galaxy shares. At some point in our position management process, we will sell our highest cost shares to shelter gain in other palaces and lower of carrying cost in Galaxy. We still have cost in Soluna at about $0.56 per share with the stock at $4.25 area.

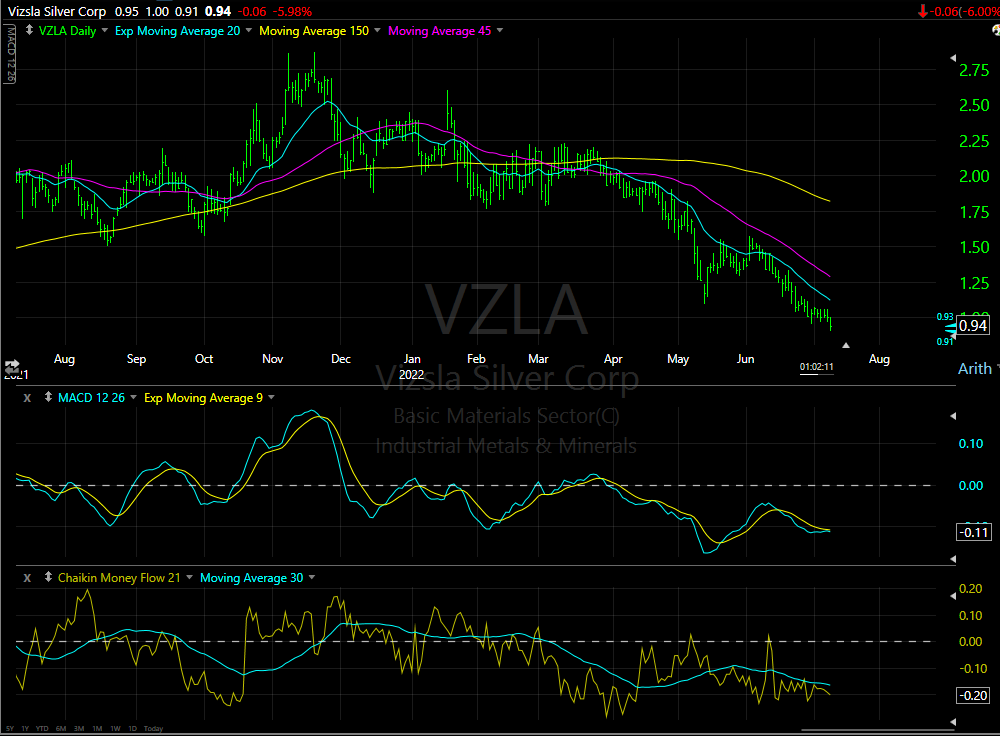

Speaking of low costs, we see an outstanding opportunity to buy shares of Vizsla Silver (VZLA)* at unbelievable prices we thought we’d never see!

Vizsla has the best silver discoveries I have see in the last two years of looking at the industry. The district scale size of the property is large, and the grades are outstanding. This is still an exploration stage company, so the development and production phases are in the future. The location is about 80 miles east of Mazatlan Mexico so all the needed infrstructure is at hand. The main road between Mazatlan and Durango splits Vizsla’s property. Management is world class led by Craig Parry and Michael Konnert of Inventa Capital. Vizsla, IMO, is a great asset to own if you want exposure to Silver and Zinc.

While the current market price situation is not pleasant if you own Vizsla Silver, I am suggesting that in a four or five-year window we have potential for a 5X or more return on investment in the stock from the current price.

The negative I see with Vizsla is its location in Mexico as a mining jurisdiction. I do not think it is likely, but we should be aware of jurisdictional risk of Mexico nationalizing some of its natural resources. I do not think it will happen with silver and gold, but one never knows. This needed to be mentioned as this as the subject has been discussed in multiple countries around the world. Politics opinions are unstable in a number of countries globally.

There’s always something right?

Written by Tom Linzmeier @ #LivingOffTheMarket.com on July 11, 2022.

Keywords: #silver #miningstocks #bitcoin #blockchain #equities #batterymetals #microcaps

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()