It’s nice to get various points of views of themes for the next year. Knowing these themes can be used as bench marks to follow or adjust to get on track. Below, I’ve put together comments from different experts with different perspectives on what they expect in 2024. Each of these people could be right but different on the timing of the “when.”

In this summary we have,

I: Felix Zulauf with Julia La Rouch produced about mid-December 2023. Felix is a macro investor / long-term trader who lives and works out of Switzerland.

II: Larry Williams, a pure cyclical / technical Trader. News, be it company, economic or Geo-political news is not a consideration in Larry’s decision making process. Larry is a shorter-term trader.

III: Mike Novogratz in his company sponsored weekly show presents comments on crypto, political, regulatory and a summary and what is coming for Galaxy Digital in 2024. Mikes focus is in crypto, blockchain and growing Galaxy Digital to be a global institutional leader in this area.

IV: Tavi Costa from Crescat Capital has a wonderfully presentation back by charts and graphic backing up Tavi’s projection for 2024. I think he did a great job making his projection and providing his supporting evidence.

Intro and Welcome Felix Zulauf 1:12 Macro view, geopolitical impact, changing world order 2:40 Equity markets likely to go up first, then drop 3:50 Inflation could rise above 10% 5:20 Nimble and flexible 7:29 Playing the markets in the environment 9:40 Fund managers piling into Magnificent 7 stocks, never seen this kind of concentration 14:24 FOMC reaction, Fed outlook, rate cut likely 17:40 Late 2020’s, higher inflation, debt trillion 19:38 Inflation cycle similar to late 60’s/70’s 21:15 Next inflation cycle will create a problem for the bond market 22:15 Yield curve control 23:30 Hell will break loose, next big crisis will be a shocker 24:30 Addressing the fiscal problems 25:37 Gold not just a monetary asset, but a geopolitical asset 30:40 Parting thoughts, Japanese Yen

At about the 30-minute mark, Mike recaps 2023 for Galaxy Digital the company and thoughts about 2024. Insights from direct activity on topics related to the Banking System, Fed Policy & Political happenings in Washington.

Link to Galaxy Digitals Insight & Research sight. https://www.galaxy.com/insights/

00:00 – Intro 00:37 – Larry Williams 05:10 – 2023 Natural Cycle 10:05 – 2024 Re-Election Year Cycle 11:55 – Industrial Production Conditions 13:17 – Thoughts on Rate Cycles 16:41 – Commodities: Gold, Crude Oil 18:40 – Larry’s Premium Service ‘Focus on Stocks’ 21:48 – StockCharts Holiday Special

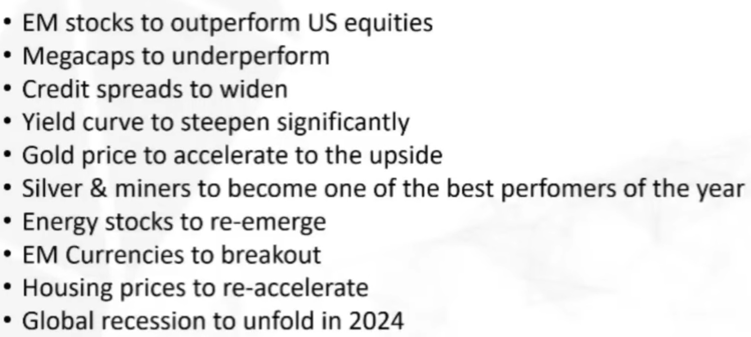

- “Crescat Looks Ahead to 2024, Tavi Costa” December 29, 2023 31 minutes. Themes projected are below.

Another interview this week was from MiningStockEducation’s Bill Powers, Ten Investing Lessons Learned in 2023.

Introduction 1:40 #1 View junior resource stocks as call options with limited time value 5:29 #2 Consider intrinsic value as much greater than time value…Don’t let big profits slip away 8:33 #3 Remember non-captured unrealized gains are not losses 10:16 #4 Choose to be a self-directed investor and not a victim 14:47 #5 Lack of information/coverage in small caps allows for dishonest bashers 18:15 #6 Do not invest unless you have a (legal) competitive advantage 23:52 #7 You’ll never out-smart Vancouver insiders, but you can outperform dumb retail 25:39 #8 Stay liquid (private deals and private placements are becoming increasingly unattractive) 28:03 #9 Be willing to change your mind 31:08 #10 Increased wealth will only amplify your existing character (for better or worse).

I am going to substitute the word “Speculation” instead of “Investing.” Bill’s focus is on small mining companies, of which I have a strong interest in at this time, but actually his comments are appropriate for any market when a narrow, non-diversified approach is used. A narrow, non-diversified approach to the market is speculating. The trick is to do it in a repeatable, high probability and systematic way. Comments in this presentation are Bill’s personal experiences learned from his journey in turning tens of thousands of dollars into millions of dollars through a focus on small companies.

Hope this is of interest. Good Luck to us all!

Written January 6, 2024, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

We are more speculators than investors or traders.

Featured market approaches include.

- Under $10 Stock Ideas for a Double.

- Deep value for three to five baggers and long-term gains.

- High Dividend Paying Ideas.

- We like and own Crypto and Blockchain ideas.

- We share an ongoing, show & tell, for Compounding one grand to a Million$

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()