OK, now I am a bit nervous. I am seeing many headlines in the algo directed world of YouTube and News flow that are saying what LOTM has been doing. Too much weight on one side of our canoe. When the market is this bullish with my thinking, my contrarian brain gets very nervous. Never-the-less, I tend to get in positions too early and leave too early in investment positions. So, I am riding the wave of optimism in the news flow and hope it continues.

HEADLINE THEMES TODAY:

- Precious metals is “the” place to be – especially Silver.

- Bitcoin, crypto, is the technology to be invested in (basically for the same reason some are buying precious metals.)

- Trump is surging in the polls! – A Trump election being very good for Bitcoin.

HEADLINE SAMPLES:

“Global Macro Update: Bitcoin Surges as China Stimulates and Trump’s Trade War 2.0 Looms”

“Anthony Scaramucci: Why Bitcoin is the Best Investment Idea”

“Smart Money Sees the Opportunity in Silver Stocks”

Massive shift to the Right in PA – Rasmussen Reports, a conservative leaning poll.

Kamala Harris Now Losing the Race – Young Turks, a progressive new source

Democrats PANIC as Trump’s SHOCKING Surge Shakes 2024 Election – don’t know its perspective

Political Polls above are shared only for the purpose of knowing the investment planning strategies effect. A Trump election win is bullish for Oil Service companies with a drill baby drill policy, A Pro Bitcoin and by default crypto and blockchain related companies as stated by Trump. Pro Infrstructure companies as reshoring manufacturing gets tax breaks. Likely a small stock rally that draw money away from big companies. Defense stocks get sold should the Ukraine / Russia conflict closes down. If we are awash with oil and gas then interest rates should fall, good from bonds.

ACTIONABLE INFO:

SILJ is the Junior silver ETF. I just checked what are their largest holding as this is an actively managed fund. SILJ holding are linked here. I am still under weight CDE Vs some of the other miners. FYI, SILJ is an excellent way to be invested in the silver industry as a way to minimize “company” risk. By company risk I mean something goes wrong with a company’s operations and poof there goes the money invested in that company. It happens and buying a package of companies within an industry is one way to avoid “Company Risk.”

Coeur (CDE) is now SILJ’s second largest position. In related accounts we too have rotated out of Endeavor Silver (EXK) and into CDE. This is confirmation that our thinking is similar to SILJ’s thinking about CDE.

Thoughts running through my mind: considering increasing our Vizsla Silver (VZLA*) as potentially being the largest single location, high grade silver deposit globally. We added and plan to add more Outcrop Silver (OCGSF*) as an emerging high grade deposit with a sizable land package. OCGSF is a speculative early stage exploration company. Coming back into owning I-80 Gold (IAUX) as a value play . Wishing I owned Aya Gold and Silver (AYASF).

Over on the Crypto side of the barbell approach that we have taken.

DeFi Technologies (DEFTF*) $2.10 purchased Stillman Digital Inc following up on a partnership arrangement with Capital Management Partners. DEFTF makes me a bit nervous because they are growing so fast that surely something will break or not be integrate smoothly – and on the other hand – I am drawn to them because, “if they pull this off, it has massive potential upside.” The push – pull between risk and opportunity.

- DeFi Technologies Completes Acquisition of Leading Digital Asset Liquidity Provider Stillman Digital – October 7th 2024

Previously announced:

- DeFi Technologies and Professional Capital Management Partners to Enter U.S. ETF Market – Sept 5th, 2024

Link to Professional Capital Management co-founder statement about the company. Anthony Pompliano

Anthony Pompliano is partnered with Mark Yusko in co-founding Morgan Creek Digital. I have the highest regard for Mark Yusko and though I know little about Anthony Pompliano, Pompliano’s relationship with Yusko means a lot. Birds of a Feather Flock Together so to say.

Select charts of stocks mentioned in this blog:

The trends are all up in the 1) metal mining and 2) crypto / blockchain sectors. We are in Stage Two Chart Patterns for both sectors.

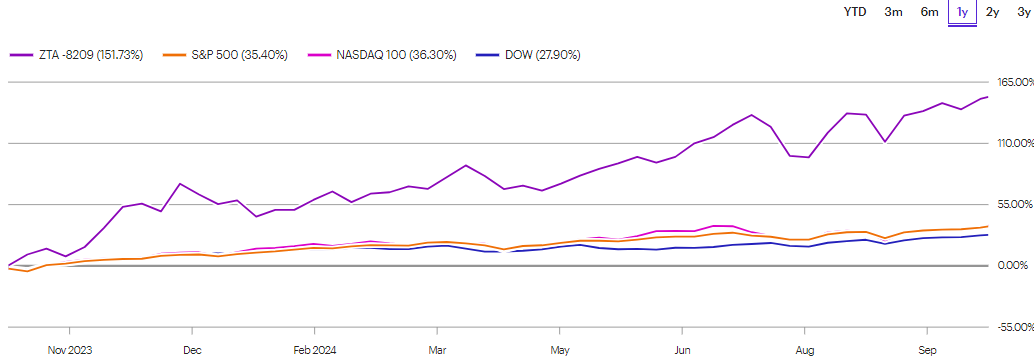

So far ,being invested in a barbell approach with Hard Assets with a focus on precious metals and Technology – with a focus on crypto/blockchain has worked in our LOTM related accounts as represented by our ZTA Limited Partnership (ZTA) performance chart below:

We are monitoring a number of inverse (bearish) ETFs in the S&P 500 (SH), in Gold (GLL), Silver (ZSL) and the NASDAQ 100 (QID). We “could” be entering the last three to nine-months of this powerful bull market. We do not wish to ride the down-trend, so we are watching the inverse ETFs mentioned above. Even if we do not buy them, when the Inverse ETFs start a new-trend upwards is a indicator for us to begin our selling plan of stocks we own.

Have fun, be flexible and ready adapt to change. Keep your emotions neutral. Let the market do the talking.

Best to us all. Tom

![]()