- Account I – Single stock account. This simply means we might go down to one single stock position on our path to compounding to One Million$ value. Currently this “game” has four positions. The timeline goal is one double a year.

- Account II – Multi-position Account but targeting Three industries at this time. Precious Metals / Crypto-Blockchain / Fintech – a variation in theme is our new position in ORGN which is a specialty chemical company focused on replacing oil based plastics with organic material (wood chips) based plastics.

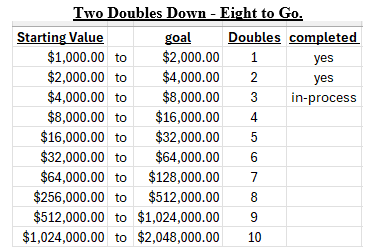

I: Make a Million$ Club (M&M Club)

Goal: Achieve 10 doubles, at a rate of one per year to build the account above $1 million dollars after tax.

Starting Date: July 22, 2022

Starting Amount: $1,000 with no money added. For your personal account if following, contributions to the account will increase the rate of compounding. In this account we will not add any funds along the way.

Perspective: The mental perspective is that in this account, the money at risk is what you deposited. The rest is score keeping in the Game of Doubling. It is not real. It is, but mentally we want you do detatch, while still managing risk. This is not gambling. It is Speculating. It is hard to explain here but it helps if you detach from the gains being something real that you can lose. If you want more on this contact me.

The Game of Doubling to a Million$

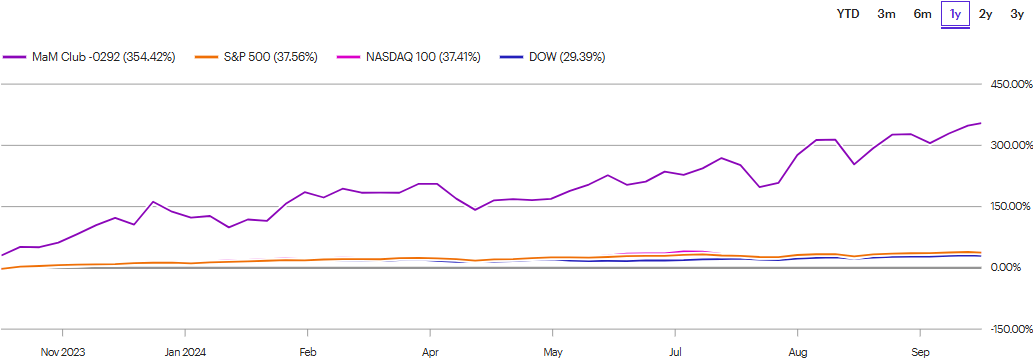

One-Year Performance as of October 23, 2024:

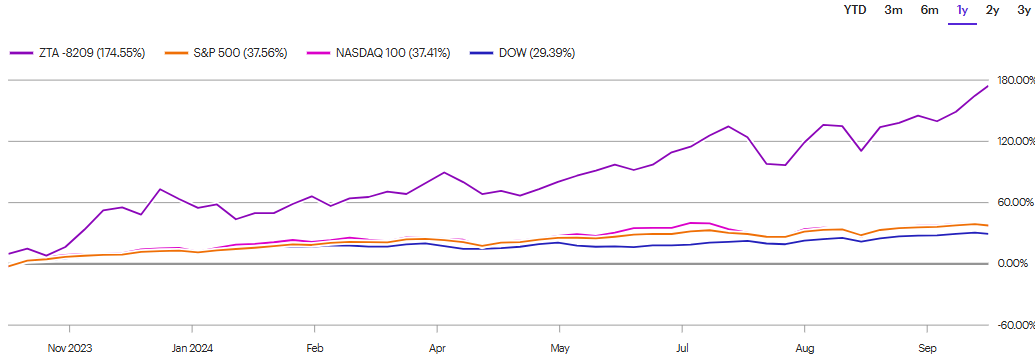

II: ZTA-9999 positions and valuation as of October 12, 2024.

We are maintaining our debasement of the US Dollar theme with most of out positions allocated in the areas of

1) Natural Resources – with a concentration in precious Metal Miners

2) Technology with a concentration in Crypto/Blockchain.

In working this approach, we want to 1) follow the theme of preservation of purchasing power and ride the trend higher in a major Precious Metals bull market. The second (2) focus on Technology. Where to be in technologies are those disrupting the status quo and are deflationary by increasing efficiencies and increasing productivity. Crypto and Specifically Blockchain applications do this very well.

Positions reserved for subscribers. Positions held in the portfolio number between 10 to 15. This is not a diversified portfolio on purpose. We are after max performance.

This is a Speculative Venture.

It is volatile and not for everyone.

It is presented only as a real money example of what we are actually doing to coach, teach and educate.

One-year ZTA performance as of October 23, 2024:

If you have questions on the why action was taken feel free to call or email and ask.

Sometimes we buy small amounts of shares just to keep track of a potential position. Other times we may buy a few shares before looking more deeply into a position and then change our mind. We limit my margin to about 10% of the total account value. Most of the positions owned are not marginable. This is a safety valve against myself getting too far over the ledge but sometimes we need to sell something to maintain a boundary with margin.

The top fifteen positions are most likely to be core positions. As you can see, we stage into and stage out of positions. Some of the stocks at the bottom we keep for future tax loss candidates for when we take a big profit.

Interesting Headline just out:

Russia Turns to Silver in Strategic Shift That Could Reshape Markets

October 10, 2024

BlackRock Reveals It’s Quietly Preparing For A $35 Trillion Federal Reserve Dollar Crisis With Bitcoin

Predicted To Spark A Sudden Price Boom

Forbes – published Sept 19, 2024

Previously, BlackRock had purchased 5% ownership of the Sprott Physical Silver Trust (PSLV). Interesting because they have their own ETF for owning physical silver. This suggests they have a hard time finding enough physical silver on the open market to buy into their own ETF.

The odds are turning more favorable for a Trump win in the Presidential race. Should Trump win and he follows through with adding Bitcoin to the Federal stockpile, I believe the lid could blow off the price of Bitcoin. We added Mara Holdings (MARA*) as a position along with Galaxy Digital (BRPHF*) and DeFi Tech DEFTF*) for exposure for bitcoin. We are considering re-purchasing Bitdeer (BTDR) . They are launching their own chip for processing crypto. This is for their own use as well as a new revenue stream in selling to others. We are not sure we will add Bitdeer back to the portfolio. I really like a new Silver idea in Outcrop Silver (OCGSF*). They have a claim in Columbia that is 17 kilometers long with very high grade discoveries. This is very early days in their process. They will do a reverse stock split to clean up their capital structure. They also need to raise money to move forward. Management is experienced and passionate about what they are doing. Recent presentation linked here. 12 minutes in length. Outcrop Silver is a four year project for us. Our goal is five X in that time line. We will Dollar-cost-average through that time period.

I am here to work and serve your interests within the stock market, so let me be of help if I can.

Tom –

![]()