- Galaxy Digital*

- WHAT IS THE TRUMP GAME PLAN? – Mark Moss

- Bitcoin Is Primed To PUMP As The Dollar Collapses – Jordi Visser

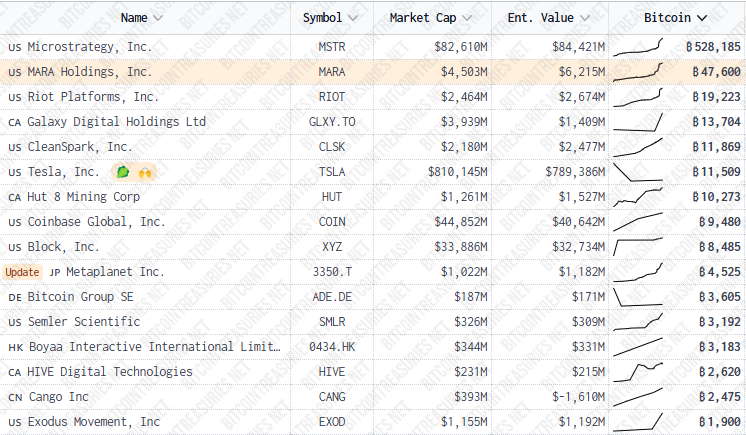

- Leading holders of Bitcoin Treasury Reserves of Public Companies

- “a new report from Galaxy Digital suggests a partial resurrection is underway, led by a familiar cast of survivors. Tether, Galaxy and Ledn have emerged as the dominant players in centralized finance (CeFi) lending, holding a combined $9.9 billion in outstanding loans at the end of 2024. That’s nearly 90% of the CeFi market, according to Galaxy’s research associate Zack Pokorny.”

LOTM COMMENT: Tether will play a strong role in USA refinancing of $7 to $8 Trillion of US debt over the next seven to nine months. Galaxy Digital will up-list to a major USA Stock Exchange in Mid-May of this year. Market conditions permitting, traditional stock trading behavior suggests the probability of Galaxy’s stock will rally into the Up-listing date. Galaxy Digital is held in accounts related to LOTM, so be aware we are talking our book.

We are entering a new financial system – a decentralized financial system, anchored in Crypto & Blockchain

LOTM Message: US Dollar down – Gold up – Bitcoin to follow gold higher soon.

- WHAT IS THE TRUMP GAME PLAN?

Trump’s 4D Chess: Inside the Mar-a-Lago Accords!

Presented by Mark Moss April 11, 2025– 33 minutes in length

Trump’s tariffs aren’t what you think—this is 4D chess, and the Mar-a-Lago Accords are the real play. Yes, it starts with tariffs… then trade—but it goes way deeper. We’re talking global alliances, financial warfare, and a full-scale reset of the world order. Miss this, and you’ll miss the biggest geopolitical and financial shift of our lifetime—and the chance to front-run it. This fits perfectly into the Cycles Thesis I’ve been making videos about for the last 5 years. And what I just uncovered… shocked even me. By the end of this video, you’ll see how tariffs were just the bait—and how Trump may have hijacked the global monetary system without firing a single shot. Mark Moss.

Jordi Visser is a macro investor with over 30 years of Wall Street experience. In this conversation we discuss how the market broke, what is going to happen, what that means for your portfolio, how US gets out of this situation, how China will react, and how bitcoin plays into all of it. With Anthony Pompliano 41 minutes. April 12, 2025

- Amongst Volatility in The Markets, More Organizations Embrace Bitcoin,

Adding Cryptocurrency to Their Treasury

PALM BEACH, Fla., April 10, 2025 (GLOBE NEWSWIRE) — FN Media Group News Commentary – A growing number of organizations are embracing Bitcoin as a financial asset, adding the cryptocurrency to their Treasury in order to safeguard wealth, as well as capitalize on other benefits. A recent article by industry insiders, Consultancy-me.com, outlines the opportunities that arise from integrating Bitcoin into corporate treasury strategies. It said: “The radical perception of Bitcoin in corporate treasuries is now a strategic reality, fostering a fundamental reassessment of traditional financial management. Well-known examples of companies embracing Bitcoin as a financial reserve include MicroStrategy (which holds over 100,000 Bitcoins), Tesla, Block (formerly Square), Galaxy Digital, energy multinational Aker, and even traditional financial institutions like Fidelity. Other companies worldwide too have made headlines by strategically allocating significant portions of their capital to Bitcoin, solidifying their perception as a crucial hedge against growing global economic uncertainties and an effective store of long-term value. The accelerating adoption of Bitcoin has prompted businesses to seriously consider integrating cryptocurrencies into their core treasury strategies. Link to full press release here.

- Publicly traded companies with Bitcoin Reserve Treasury, for the week ending April 14, 2025.

Linked here

Top 16 Public Companies with Bitcoin Treasury Reserves:

NOTE: Of interest to owners of Galaxy Digital* & Mara*. Galaxy recently increased their ownership of Bitcoin from a little above 3,000 Bitcoins to 13,704 Bitcoins. Mara Holdings* is interesting because their Bitcoin ownership value is very close to the Market Cap of Mara Holdings. Mara is the second largest holder of Bitcoin in the public company grouping. Galaxy Digital moved up from #12 to #4. Could be fun “if” Bitcoin makes a run into Q4 of this year.

![]()