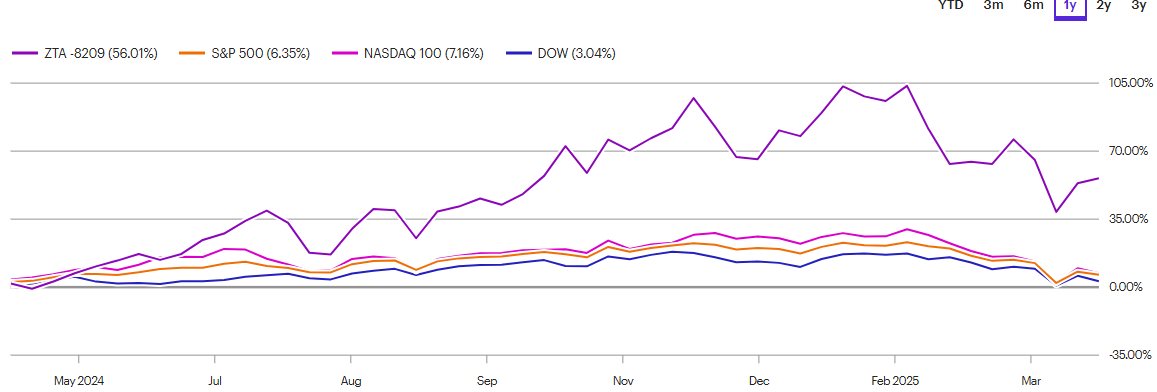

ZTA One-year performance:

In ZTA, we have added to positions in Galaxy Digital (BRPHF*) and added a new position in digital assets, Bitwise 10 Crypto Index (BITW*). In Galaxy we added 1000 shares to a 4000 share position. I believe the selloff in Galaxy is over-done. Good news is within three weeks when Galaxy becomes listed on a major USA stock exchange. Our second largest position, DeFi Tech, has also applied for listing on a USA exchange. I believe this will happen but so far, we have not hear anything from the SEC concerning this news.

Because we use margin, we became defensive over the past four-weeks to protect the account from the sharp selloff. We sold most of our positions with exposure to South America and Mexico. We also consolidated some positions in the gold and silver sector. We are still positive on the flow of money out of USA markets to Mexico and South America, but this play was not our primary focus, so we let it go in the market correction.

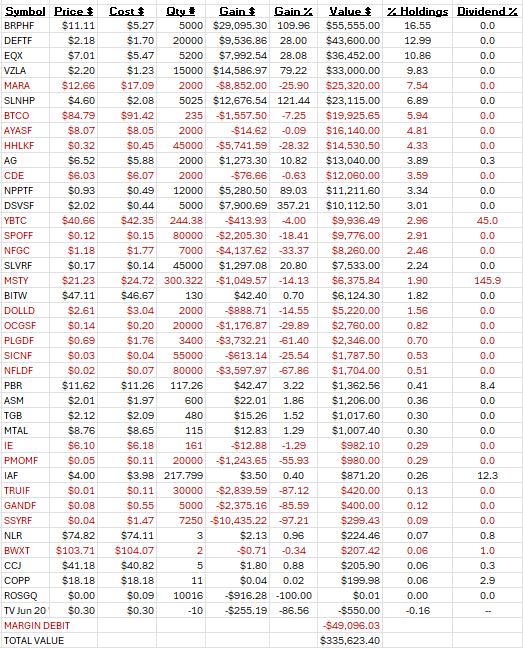

ZTA POSITIONS AS OF APRIL 20, 2025:

Now that the market has found some firmness, we have begun purchasing positions in areas related to Copper and Nuclear Energy. The top fifteen positions are basically concentrated in the Gold, Silver and Crypto/Blockchain sectors. This approach is working as seen in our performance Vs the broad market indices. If you look at the position below 0.50% of holdings, you see new symbols in the Copper and Nuclear Energy area. We are looking forward twelve plus months in establishing these positions and plan to accumulate as we harvest profits from Gold Silver and Crypto. We have not purchased yet, but we think we have identified an AI company working in the area of Medical efficiencies that is growing very fast, has revenue above $100 million and is priced under $1.00. More on this as we move forward.

Our two favorite metal stocks are EQX (Equinox Gold) and Vizsla Silver (VZLA). EQX “could” have big news in expanding revenue and profits, if the merger with Calibre Mining (CXBMF) goes through. We will know in the next four weeks. EQX plus Calibre together, at full production, is projected to have positive cash flow of $100 million per month. This “should” result in a reappraisal of the value of EQX higher. There is opposition to the deal, but the deal is expected to pass shareholder approval. This is expected to be a May event. Vizsla is simply the biggest high concentration of high grade silver deposit in the world.

Our move into Copper and Nuclear is a play on AI and Robotics. Both are expected to explode upwards in the next eighteen to twenty-four months. Copper and silver for the electronics need for 1) rebuilding the grid and 2) the electronics needed for AI and Robotics. Nuclear for the energy needed to power these industries and ultimately replace fossil fuels.

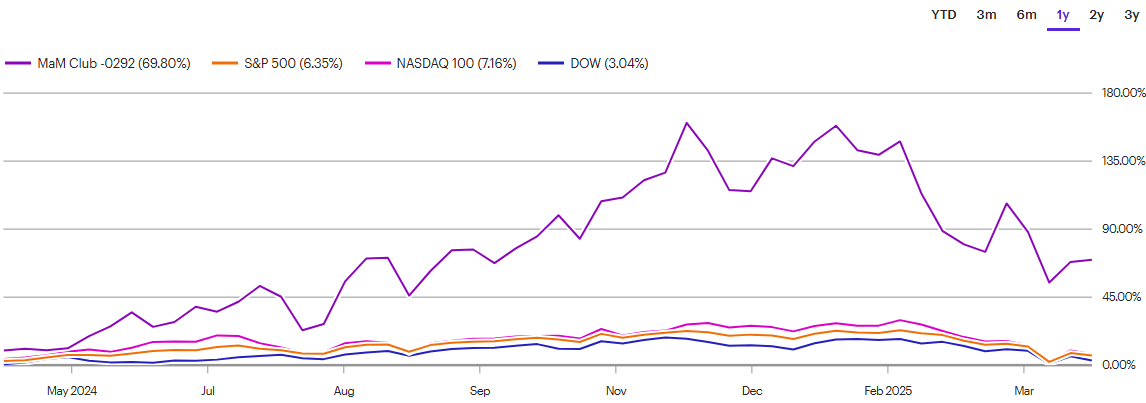

No position changes in our Let’s Make a Million (M&M Club) account. Our biggest positions in the M&M Club are Galaxy Digital (BRPHF*), DeFi Tech (DEFTF*) and Vizsla Silver (VZLA*). We have no reason or desire to sell or change the positions. We hold the opinion that the second half of 2025 will produce outsized performance in these stocks.

Our performance in this account has suffered with the market correction (below), but if we had excess cash, we would be adding to the positions mentioned above. We did add to Galaxy Digital position in the ZTA account listed above.

Good fortune to us all – 2025 is going to be a great year for making money baring a world war happening.

Contact me with thoughts, comments or questions. Tom

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()