Comments on three Uranium/Nuclear positions and on two newly acquired positions in Bitcoin Treasury stocks.

For forward Information: LOTM does not have a very big positions in the Nuclear industry.

Accounts related to LOTM own small positions in:

- Cameco (CCJ*) $57.40

- VanEck Uranium & Nuclear ETF (NLR*) $95.77

- BWX Technologies (BWXT*) $114.74

We are treating the three companies as one industry focused position. If we see weakness in the general market that causes us concern, we will sell these position very quickly to reduce margin. We might sell these three if we see something more interesting as well. News out of D.C. has these stocks strong at present. These are some of the highest quality ideas in the Uranium/Nuclear space. We treat them as a trade idea. Others might treat them as core holdings.

We have great concern over the global bond/interest rate situation. We are prepared to exit a number of positions quickly should market weakness happen related to interest rates rising and bonds prices falling. While we like this sector, it is not a core holding for us.

IN THE NEWS:

May 22, 2025 Nuclear-industry stocks were trading higher after Reuters reported that President Trump is expected to sign executive orders by as soon as Friday that aim to jumpstart the nuclear-energy industry.

The report, which cited sources familiar with the matter, said the orders would attempt to ease the regulatory process on approvals for new reactors, as well as strengthen fuel supply chains.

In after-hours trading, shares of Lightbridge rose 11% to $11.87, shares of NuScale Power climbed 11% to $28.08 and shares of Centrus Energy jumped 12%, to $103.94. VanEck Uranium & Nuclear (NLR*), an exchange-traded fund comprising uranium and nuclear stocks, ticked 2% higher, to $89.99, in post-market trading.

A draft summary of the orders noted that Trump will invoke the Cold War-era Defense Production Act, allowing him to declare a national emergency over U.S. dependence on Russia and China for enriched uranium, nuclear fuel processing and advanced reactor inputs, the Reuters report said. From press release on NLR news feed.

A related account today bought very small positions in new names who have Bitcoin Treasury reserves.

- Kindly (NAKA*) $22.75

- Fold Inc (FLD*) $5.15

Interview with Fold Management, Will Reeves. LOTM: I like the concept of Fold but I’m not excited about selling Bitcoin through vending machines in retail outlets. The Bitcoin treasure and the use of credit card holding Bitcoin that can be used as US dollar purchases is very interesting trend.

Kindly (NAKA) – the stock is already moved up on this news, so the new position is tiny and we plan to DCA down as the stock pulls back – not chasing it on the way higher as a tactic.

Interview with NAKA (Kindly) driving force, David Bailey, CEO of Bitcoin Magazine and co-founder of Nakamoto/Kindly (NAKA).

Article: David Bailey and Bitcoin-Native Holding Company Nakamoto Announce Merger with KindlyMD to Establish Bitcoin Treasury May 12, 2025

Both ideas above are likely trades and not core positions

Strategy/Tactics Used by LOTM:

Every stock purchased by LOTM related accounts starts as a project.

We decide to own “the company” first and then accumulate shares in such a way as to “work” on getting to the lowest cost possible for being a long-term capital gain tax. So – we DCA on the way down, sell the highest cost shares along the way, for a tax loss (if needed) and when the stock price rallies above our average DCA cost basis. This gives us a profitable trade on our average cost – gives us a tax loss for keeping taxable events low. We also will sell our highest cost shares for a small gain to lower our average cost. Our intent is to exit the highest cost shares (for a gain or loss at prices above our average DCA cost per share. This lowers our average cost per shares held, while pushing forward for a long-term capital gain tax.

Another goal is to build as large a share position as we can within the context of the total holdings. We try to let our winners run and keep winning, once we catch a trend.

LOTM Related accounts will trade but we do not consider ourselves traders. We are company first accumulators of shares – work on building a share position in companies we like for long-term capital gains.

We are speculators in the sense we like concentrated positions in one to three industries.

Volatility is our friend and tool in accumulating large positions in illiquid stocks.

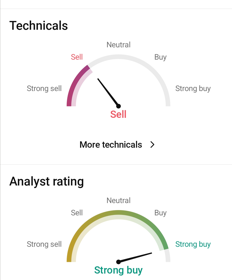

This is our favorite Technical and Fundament profile:

As you probably see and feel, this style of investing isn’t for everyone. You need thick skin, cool emotions and financial staying power to make it work. We welcome you to the team if this sounds like a fit.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

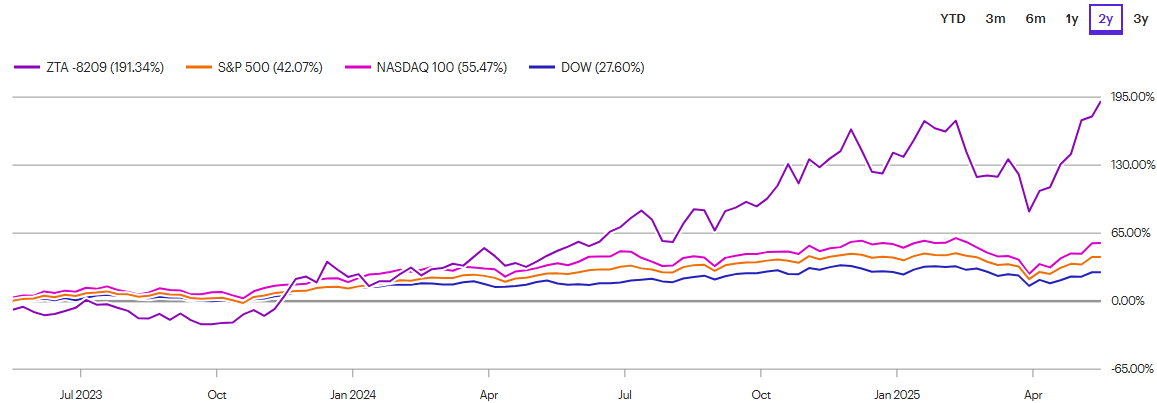

This is one of those moments for saying Ahhhh – and then worrying if “our” market is over-heated:

LOTM related account ZTA limited Partners performance.

![]()