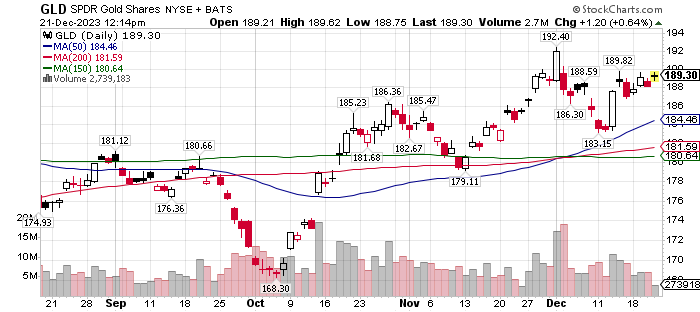

Physical gold has had a Golden Cross moment. A Golden Cross is a very bullish long-term indicator. A Golden Cross is when the 50-day moving average (MA) crosses above its 150-day or its 200-day moving average. Physical gold, 50-day MA, has crossed above both its 150-day and 200-day MA. It will not take much to have gold march into new all time highs.

GLD – Physical Gold above

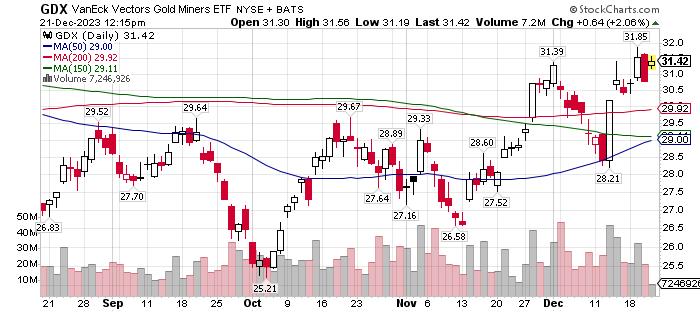

GDX – VanEck Gold Miners Below – Physical moves first – Miners follow Physical.

I like Michael Oliver, founder of Momentum Structural Analysis (MSA), a lot. He is one of the best technicians in commodities there is. Linked below are two recent interviews.

- +$8,000 Gold, +$250 Silver, Uranium Upheavals & Slingshots | Michael Oliver – interview two weeks ago. 93 minutes.

A Shorter Interview with Michael Oliver follows below.

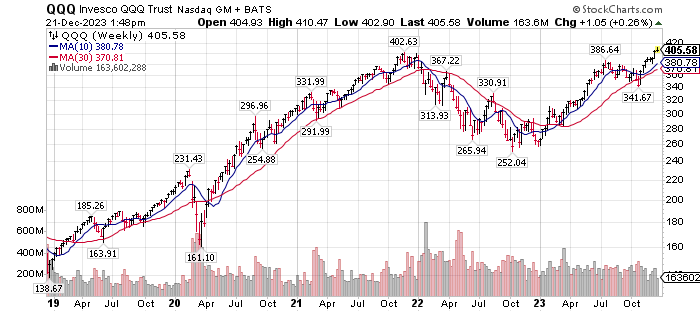

Oliver believes we are making top in the Nasdaq 100 (QQQ). In his view this is not a new leg higher for tech stocks. In this second interview Oliver shares his opinion that money will shift from growth stocks and rotate into commodities. His favorite commodities are The Grains and Gold & Silver. Oil & Gas are ok but not where the focus will be in the coming rally.

As money leaves the traditional equity market it will seek other paths. Commodities are historically cheap and the most likely home for these exiting funds. Oliver has no issues with crypto. He just has not added them to his investing and trading world.

Keep in mind there is a lot of click bait in headlines and titles. While Oliver is very bullish on gold, silver and grains, he has very disciplined risk management policy. When commodities are overpriced, he does sell them and sells them short.

As we rally into year-end and pass into the new year, we might attract selling simply because of a calendar change. Asset managers who are paid for performance and asset values are hesitant to dump winning stocks going into year-end. It simply is not in their best interest to do this.

Consider taking some money off the table from traditional growth equities before year-end. Perhaps gold and silver miners are the new kid on the block. As always consult your investment advisor. A warning though, investment advisors are not usually fans of gold and silver. Certainly not physical gold and silver and rarely of the miners either. It is a speculative area to have money. .

May the force be with you!

.

![]()