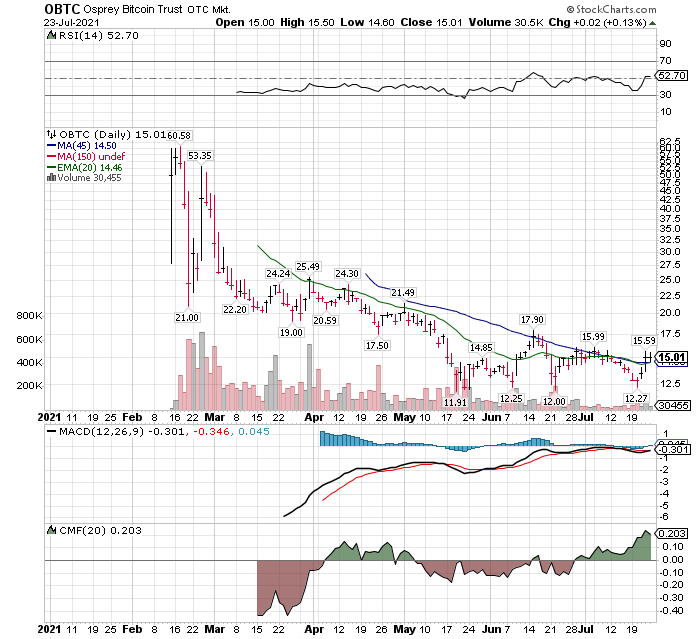

Osprey Bitcoin Trust (OBTC) $15.01

It appear that the correction is ending in the bitcoin correction. One approach to participating in a Bitcoin recovery is to buy share in Osprey Bitcoin Trust OBTC) $15.01.

Technically Speaking:

- The price is above its short and intermediate moving averages as shown below.

- MACD is neutral to turning positive as the blue “fast signal crosses above its slower difference of the 12 and 26 day moving average.

- Chaikin Money Flow (CMF) is showing accumulation of the share over distribution of its shares.

From a technical profiling perspective, these are the three main technical studies we initially use to look for ideas emerging from a stage 1 chart pattern. We are usually early but with the various indicators simultaneously producing positive signals, we have a high probability of being on an intermediate buy signal.

Bitcoin has no fundamental Valuation Metrics to add to the conversation. Its price movement is pure, supply and demand based. Therefore, it is perfect for technical analysis trading.

From StockTA.com – Technical Opinion:

- The Osprey BTC low price during the week ending July 23, 2021, was $12.27 – the closing price Friday July 23rd was $15.01. Up 22% from the low.

- The low on Bitcoin last week was $29, was around $29,302. The current price (24/7 trading) is $34,130. This is up 16.6% from the low.

We would buy a 1/3 unit or ½ investment unit and adjust the trade from there. We would buy into weakness of strength. If we buy more on weakness, we are mindful of our time horizon. We might be accumulating long term, in that case, have we would have no stop loss activity. If your holding period is two months or less, we would stop out at 8% of our average cost of the multiple purchases for this trade goal.

Happy trading or investing. Know which one you are doing going into the position. HaHa.

Contact LOTM For One-on-One consultations.

Rates are $125 per hour / less for retainer

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()