Michael Saylor invested $1 billion USD into Bitcoin. $400 million in July 2020 and $600 million in Dec 2020. He has already doubled his money. The videos linked below share his views of what is happening in Bitcoin world from a Michael Saylor’s perspective.

After watching multiple interviews of Michael Saylor, these are the best two in our opinion.

#1 SALT TALK: with Michael Saylor

* https://www.youtube.com/watch?v=5_nrqJxpJbQ 55 minutes

#2 Real Vision Finance; Bitcoin Infiltrates Corporate America (w/ Michael Saylor and Raoul Pal)

*https://www.youtube.com/watch?v=Cg10yYZjK94 2 hours that could transform your life!

Saylor’s company is an interesting substitute for investing in Bitcoin directly. His publicly traded company is MicroStrategy (MSTR) $388.55. The market cap is about $3.61 billion. I am not sure if Bitcoin position is included in that number or not. There are about 9 million shares outstanding thus making this a volatile stock and thinly traded stock.

Link to FINVIZ for chart news and analyst opinion. This stock trades more on its large Bitcoin position, not on its operational performance. MSTR’s operational performance is excellent but the impact of its Bitcoin position overwhelms the operations results. Annual revenue is in the $500 million area. Website link.

ADDITIONAL WAYS TO INVEST IN BITCOIN:

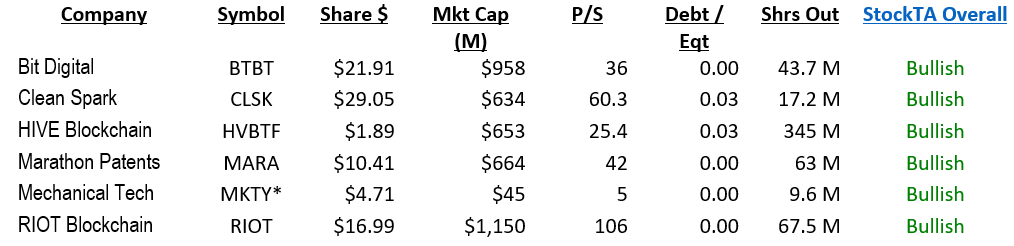

What follows is a table of publicly traded Crypto Miners. All are between $5 million and $15 million in annual revenue. Tiny companies. All are debt free or virtually debt free. Raising money for these companies is not a problem. Can you find the company that is the anomaly of the peer group? It is also the only one that is profitable in 2020.

Top companies recognized by investors in LOTM’s order of ranking.

This is followed by our LOTM investment related comment as to our choice to buy. Company links are to their websites.

#1 RIOT Blockchain (RIOT)

- LOTM #1 Investment choice as an established and recognized leader in small publicly traded Crypto Miners.

- LOTM #3 Investment choice as an established and recognized leader in small publicly traded Crypto Miners.

- LOTM #4 Established company. With by far the highest share count, we don’t like HIVE from a stock price volatility from a trading perspective. As a long-term investment, non-trading perspective, they will likely do a reverse split and balance the share count to the peer-group.

- LOTM #2 Investment choice as an established and recognized leader in small publicly traded Crypto Miners. They have a non-Crypto business that is doing very well.

- LOTM N/A: Headquartered in NY City but primarily a Chinese company with majority of operations in China. Not an option for LOTM.

#6 Mechanical Tech (MKTY)* and its 100% owned Crypto mining subsidiary EcoChain.

- LOTM #1 investment choice for LOTM based on Valuation. MKTY has the biggest upside price potential, “IF” they successfully execute their business plan and catch-up to its peer group valuation. MKTY, like Clean Spark, has a non-crypto business that is doing well.

Bitcoin is a globally traded asset. It trades 24/7. The price chart below is from Jan 2, Sunday morning. Odds are good; it will be different by the time you see this.

Here is a link to TradingView for an instant update. https://www.tradingview.com/symbols/BTCUSD/

LOTM has accepted the belief that Bitcoin is:

- Bitcoin is a new asset class and is not a currency.

- Bitcoin is limited in its size to 21 million coins. This is unique in the financial industry which makes its living raising money and issuing additional shares of stock, thus diluting current owners.

- Bitcoin is the dominant crypto asset (currency) with 70% market share among 7,000 different crypto coins. At its peak valuation in 2017 above $19,000, Bitcoin had a 30% market share.

- 2020 was the year traditional, publicly trade companies in the USA recognize Bitcoin as a new asset class. These companies include PayPal, Square, MicroStrategy and more linked here.

- Regulated industries like banking and insurance are moving to invest in Bitcoin as a new asset class. 169-Year-Old MassMutual Invests $100 Million in Bitcoin

- We are in the early stages of Trusts and ETFs being formed to make investing in Bitcoin easy for the general public. Grayscale Bitcoin Trust (GBTC) – Amplify Transformational Data Sharing ETF (BLOK) – Reality Shares Nasdaq NextGen Economy ETF (BLCN)

- Bitcoin is a global asset and what is happening in the USA, is happening globally.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()