BitBonds for refinancing Treasury Debt

Bitcoin Treasury bonds may help US refinance $14T debt — VanEck exec

“BitBonds” would allow the US to save money to refinance $14 trillion of debt even in a scenario where Bitcoin “goes to zero,” VanEck’s Matthew Sigel said.

April 16, 2025 CoinTelegraph

VanEck’s head of research has pitched a new type of US Treasury bond partially backed by Bitcoin to help refinance $14 trillion in US debt.

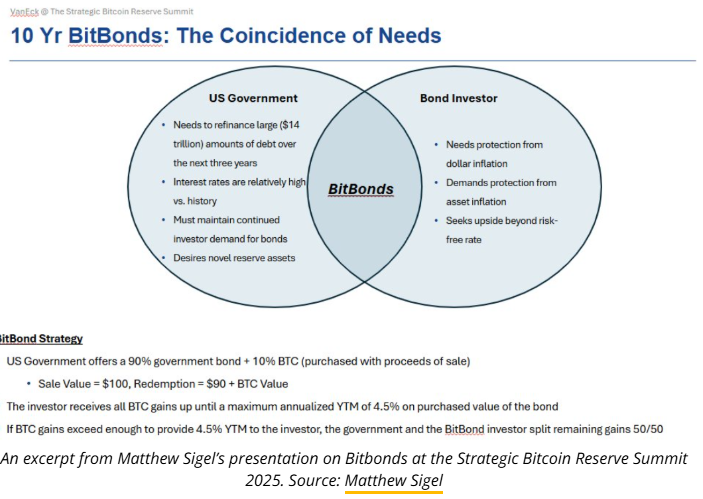

Matthew Sigel pitched the concept of “BitBonds” — US Treasury bonds with exposure to Bitcoin — at the Strategic Bitcoin Reserve Summit 2025 on April 15.

The new 10-year bonds would be composed of 90% traditional debt and 10% BTC exposure, Sigel said, appealing to both the Treasury and global investors.

Even in a scenario where Bitcoin “goes to zero,” BitBonds would allow the US to save money to refinance an estimated $14 trillion of debt that will mature in the next three years, he said. Link to full story here

Link to full story here

LOTM: Never underestimate the ability of human imagination to solve problems.

This would also allow the US Government to acquire Bitcoin without tax payer funding.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()