CLMT has pulled back enough in price, that we are again thinking it is an attractive purchase.

Technically, the shares are below the 50-day and 200-day moving averages – a negative. Price support is at the present price. The next support level lower is around $12.00. The third lower support zone would be just above $10.00

We are suggesting CLMT is worthy of buying based on fundamental developments happening at the company. Accumulate slowly, now and on weakness is our suggestion. A consistent and methodical accumulation. Yes, we think from the current price you can double in 24 to 36 months. You have an announced “large increases in cash flows expected”. This company must be thought of as a cash flow metric, not on an earnings per share basis.

- Cash flows will grow stronger over the next three year enough for the dividend (now monthly at $0.01) can grow consistently. We think the monthly dividend could grow to the $0.12 to $0.16 area. Cash flow will be strong enough to easily support that level of dividend.

- The Montana Refinery will be spun out as a stand-alone public company. This will allow both companies to trade a higher valuation metrics than as one company together. It is not sure how the Montana Refinery will be spun out. All options are on the table. Some paths could happen sooner than the 18 months discussed as the timeline. This is openly discussed in the last conference call.

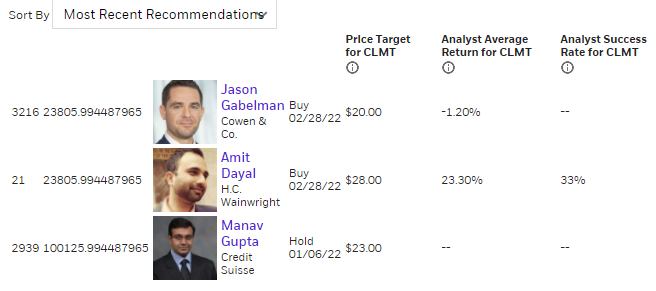

- TipRanks Stock Price Projections:

Calumet is a LOTM: Ten Under $10 for the Double position. We have three separate buy-in prices announced in the Ten Under $10 part of the newsletter.

- $2.61 on 8.1.20

- $3.12 on 12.12.21

- $3.93 on 2.02.21

Saying to focus on:

“Know Your Company”

“Buy Low when the Value is Strong”

“Let Your Winners, Win”

“Determine a Price at which you will start to sell slowly and get your original investment out of the shares.”

“Sell Slowly and Incrementally at Predetermined Increases in Price”

“Predetermine a valuation metric or a technical over-bought price at which time you will close out the entire position”.

This is not our best stock pick, but a good one. We believe there is another double in the price from todays price.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()