Crypto Miners are hot. So hot, they bring back recent memories of big moves cannabis stocks of not so long ago. They could move higher but is the risk reward worth it? That is a personal question for each of us. Where will these be trading in a month – three months or six months? At lower prices, there are companies here I like and would own, but most are too rich at this time.

Crypto Miners are hot. So hot, they bring back recent memories of big moves cannabis stocks of not so long ago. They could move higher but is the risk reward worth it? That is a personal question for each of us. Where will these be trading in a month – three months or six months? At lower prices, there are companies here I like and would own, but most are too rich at this time.

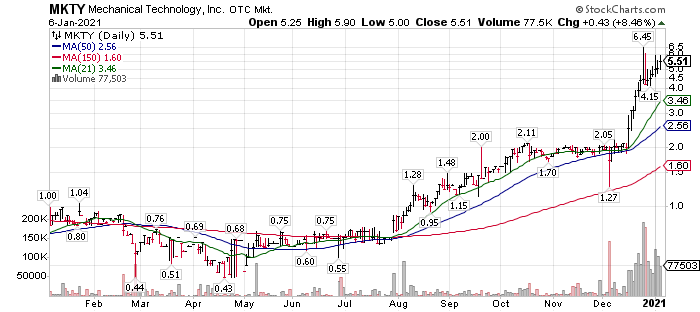

In my humble opinion, only Mechanical Technology (MKTY) is acceptable at these prices. That is not to say that the others are not good companies. Only that the valuation for them is off the charts for what they are. January 6th there was an audio Q&A with a shareholder posted to MKTY’s website linked here.

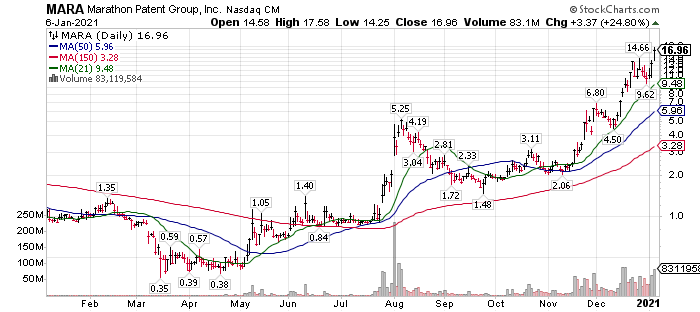

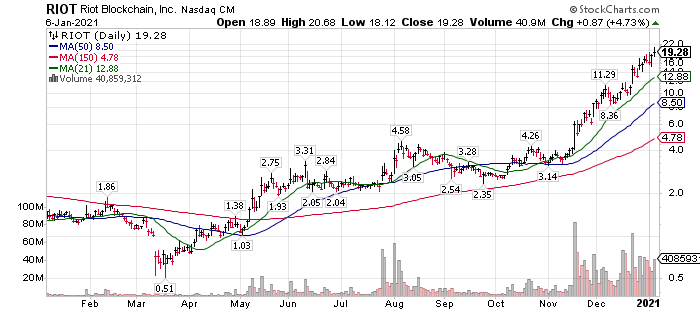

Let’s look at the charts.

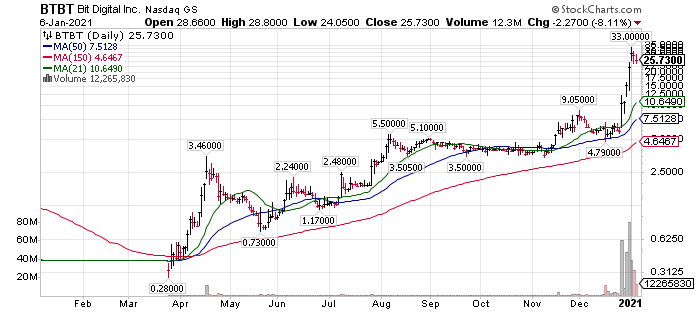

Stock move of $0.28 to $25.73 – a Market Cap of over a billion$ and Operations in China – No Thanks

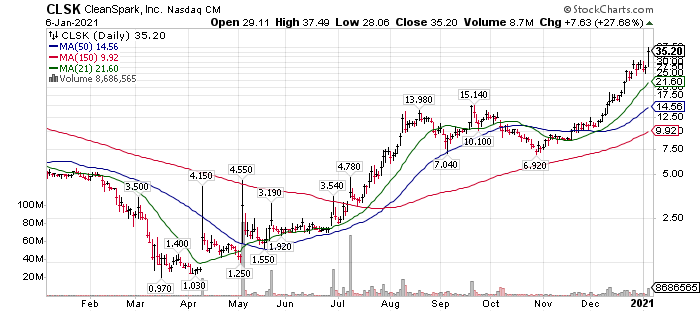

CLSK is a real company, but very extended in price, IMHO. I like their business model but not at these prices.

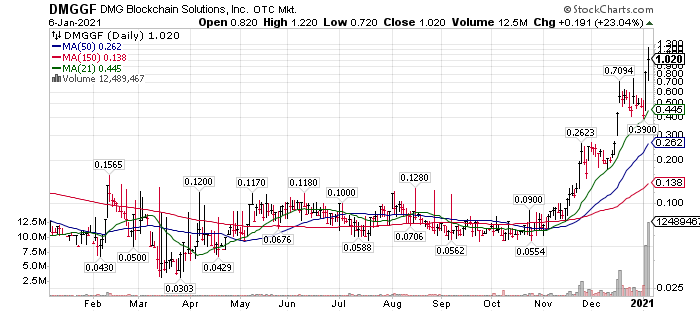

I like the business model, but they have yet to show scalability. Think there will be a better entry point. Likely to merge with a Crypto Miner. Has relationship with Marathon Patents (MARA)

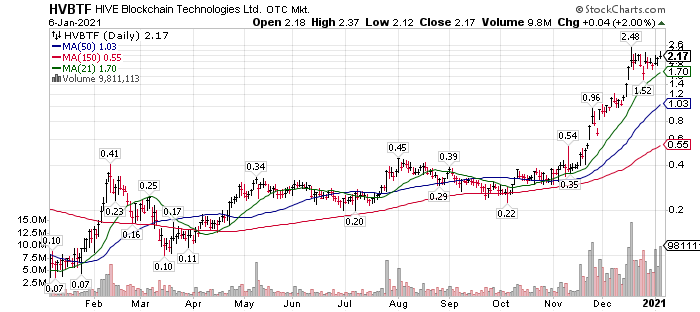

HVBTF – Nice company, too many shares outstanding at this time but that can be cleaned up with a reverse split.

MARA & DMG Blockchain, above are working together and the collaboration makes complimentary sense. I like MARA but at lower prices.

MKTY is the only one that makes sense to me on a valuation basis. There were hints of Q1 news coming in MKTY’s Dec 23 letter to shareholders. We own it, in related accounts, so talking my book.

Nice company RIOT and MARA would be Industry top choices if valuations were comparable in the peer group. They are not, so we default to MKTY on a Risk Reward basis.

We believe Bitcoin, Crypto in general and Blockchain are a new industry now accepted by the Banking and traditional financial industry. Parts of the sector will have key applications. Bitcoin itself we believe is a new asset class and a store of Value. Transparency, ease of exchange, and limited issuance of quantity (dilution) are very attractive features a store of value. Exciting time. Opportunity abounds but watch your back on the risk/reward and have a risk management plan. As fast as these have appreciated, the sell off’s are even quicker.

Be careful out there. Enjoy but avoid the hangover.

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()