In this write-up:

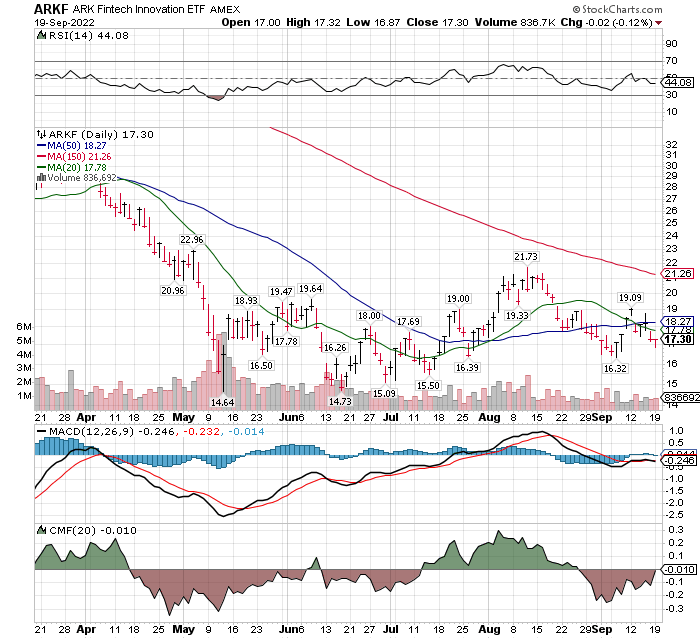

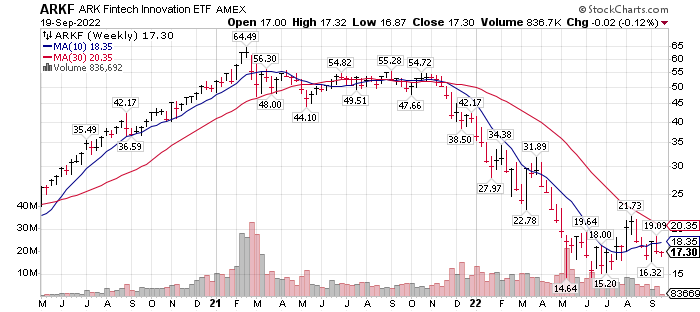

- ARK Fintech (ARKF)* $17.30

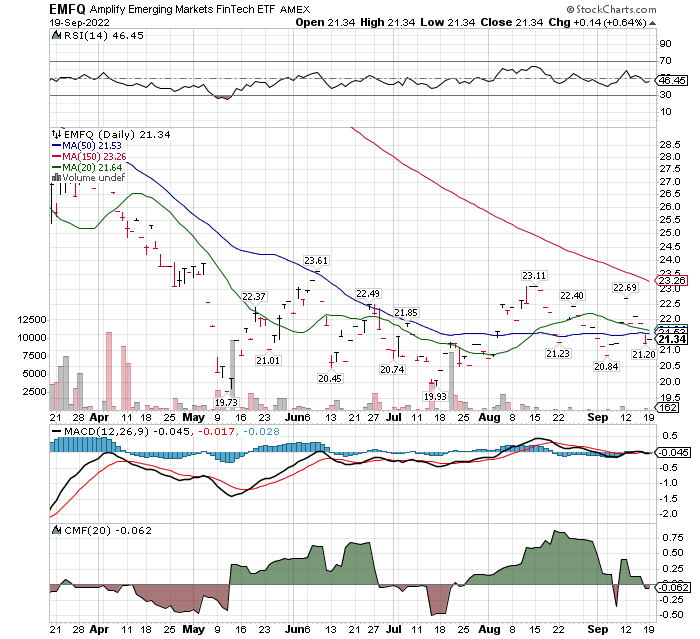

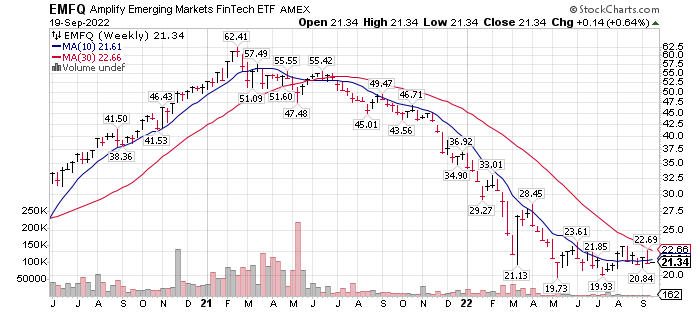

- Amplify Emerging Markets FinTech ETF (EMFQ) $21.34

- PagSeguro PAGS)* $15.36

- StoneCo (STNE)* $9.38

Why do you want to own a FINTECH portfolio:

Fintech will grow fastest outside the EU and United States because it is an underserved market and people have far more smartphones than they have bank accounts!

According to the World Bank, 1.6 billion people are “unbanked” globally, with Morocco, Vietnam, Egypt, Philippines, and Mexico having the largest unbanked populations. By contrast, 80.6% of the world ’s population owns a smartphone, or 6.4 billion people. It is estimated that financial identities for the world’s unbanked population, could add $250 billion to global GDP, mainly from developing nations in Asia and Latin America.

Sourced from EMFQ Fact sheet

Basing Chart Pattern – Stage 1 into Stage 2, Rally Phase.

By now, regular readers are familiar with our style of technical analysis. We have been owning, tracking and positioning two companies in the FinTech industry. PagSeguro (PAGS)* and StoneCo (STNE).*

The world is transitioning to digital commerce and integrating Blockchain and Crypto into the banking, payments and transaction business. This is especially true when it comes to international payment and transactions. This will be many years of faster than normal growth.

According to Precedence Research, the global digital payment market was valued USD 89.5 billion in 2021 and is expanding to USD 374.9 billion by 2030 with a CAGR of 17.25% from 2022 to 2030. Sept 2022 story link.

StoneCo and PagSeguro have based (Stage 1) and are now entering the rally phase – Stage 2. These are our two Brazilian companies that play into rapid growth at a low price in a country that will benefit from a falling US dollar. We have spent a year positioning and feel this is the time to maximize what we have learned in the process.

In order to maximize the time invested in this process, we are suggesting adding exposure to two FinTech ETFs that are also close to entering the rally phase – Stage 2. PAGS and STONE are running faster into the rally phase than the two ETF, ARKF and EMFQ. Our projection is that these ETFs will move into a Stage 2 chart pattern in the next two to six weeks.

When the US dollar declines (could be doing so in the next two weeks), Money will rotate in Emerging markets. This FINTECH ETF, EMFQ, is focused on Digital transformation in Emerging Markets. Fintech is one of favorite market sectors. we believe 2023 will have a money rotation into Emerging markets as the US dollar pulls back in price.

- Mighty dollar may be about to crack, says this strategist MarketWatch, September 19, 2022.

ARK Fintech ETF (ARKF) $17.30

Portfolio holdings link as of September 15, 2022 StoneCo (SYNE)* is the 17 largest position in this portfolio.

Two-year, weekly chart:

Early buy on anticipation that this will go positive in the coming weeks.

Amplify Emerging Markets FinTech ETF (EMFQ) $21.34

All Holdings September 19, 2022, link – PagSeguro is the second largest holding in this portfolio.

Two-year, weekly chart:

Emerging markets will especially fast growing as they have less establish infrstructure to compete with and smartphone as widely held. Early buy on anticipation that this will go positive in the coming weeks.

Emerging markets will especially fast growing as they have less establish infrstructure to compete with and smartphone as widely held. Early buy on anticipation that this will go positive in the coming weeks.

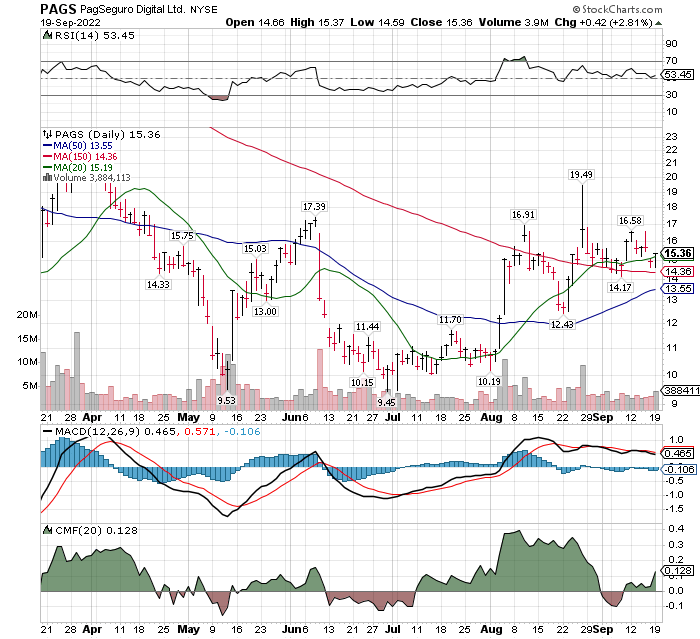

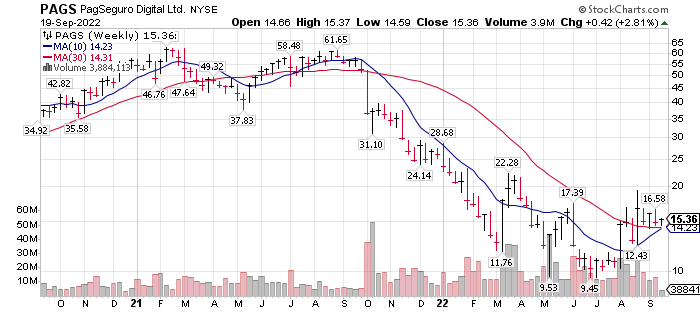

PAGSEGURO (PAGS)*

Two-year weekly chart

An aggressive “buy” chart pattern in our opinion.

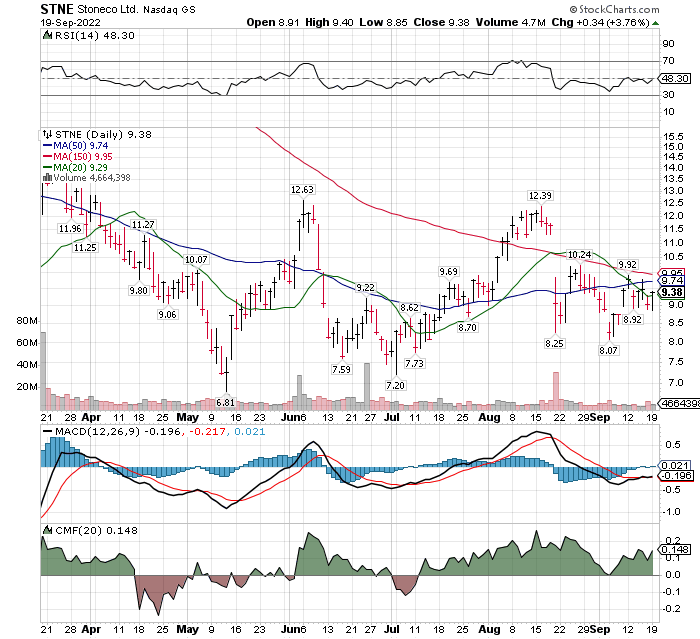

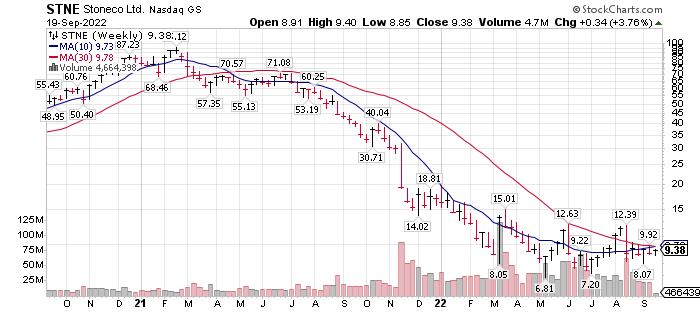

StoneCo (STNE)*

Two-year weekly chart

This chart also looks great. We would also call this an aggressive buy chart formation.

Our timeline is owning for 24 to 36 months forward, however these are delightful and fast trading stocks. You can have fun trading and long term position. We suggest owning 70% and trading 30% but structure this to your preferences and financial positions.

Our initial price goal for both StoneCo and PagSeguro are for a double to triple in price.

Written September 19, 2022, by Tom Linzmeier, editor pf Tom’s Blog at www.LivingOffTheMarket.com

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()