Fidelity Survey: 9 Out Of 10 Investors Find Digital Assets Appealing

Sept 13, 2021, Taylor Scott

- This Fidelity 40-slide report outlines survey insights from over 1,000 respondents in Europe, Asia, and the U.S. between December 2020 and April 2021. Respondents included financial advisors, high-net-worth investors, hedge funds, family offices, endowments and foundations, and the like. Roughly half of the surveyed investors already had an investment in digital assets, with Asia and Europe showing higher rates of investment than the U.S.

- Surprisingly, only 21% of surveyed U.S. investors own bitcoin, compared to 46% of surveyed investors in Europe and 45% of surveyed investors in Asia, respectively. Surveyed U.S. respondents also showed lower indexed crypto holdings of other major tokens as well, including ethereum, litecoin and XRP. Full story linked in headline.

Singapore’s Largest Bank DBS Sees Rapid Growth in Crypto Business,

Robust Demand From Investors Sept 13, 2021, Kevin Helms

- DBS’s senior executives said in an interview, published by Reuters Monday, that the bank is seeing robust demand from corporate investors, accredited individuals, and investment firms that manage assets of wealthy families.

- The executives added that the bank expects the number of members trading on its cryptocurrency exchange platform to double by the end of December and grow by 20-30% annually for the next three years. Full story linked in headlines

Why Is Ukraine Is Doing An “El Salvador” And Making Bitcoin Legal Tender?

Sept 13, 2021,

- Last week, Ukraine legalized cryptocurrency in a near-unanimous vote. And it looks like the former Soviet bloc republic is taking things a step further by making Bitcoin legal tender.

- Legal tender refers to a lawfully recognized means of exchange to settle a debt or meet a financial obligation. In other words, if enacted, Bitcoin would have the same status as the Ukrainian hryvnia, meaning paying for everyday things with BTC would become possible.

- According to Professor Vyacheslav Evgenyev, Ukraine President Zelensky hopes to bring in a dual currency system featuring both Bitcoin (BTC) and the Hryvnia by the beginning of 2023. He even broaches the possibility of BTC being pushed as the dominant currency of the two. Full story in the headline.

UK Post Office’s ID App to Enable Crypto Purchases

By PYMNTS Sept 10, 2021.

- U.K-based users of the Post Office’s EasyID identity-verification app will be able to buy cryptocurrencies such as bitcoin using a voucher system from Swarm Markets, a cryptocurrency exchange claiming to be the world’s first regulated decentralized finance (DeFi) protocol.

- Starting next week, the vouchers purchased can be redeemed for bitcoin or ethereum on Swarm’s platform, news outlets reported Friday (Sept. 10).

- Philipp Pieper, co-founder of Swarm Markets, said the lack of a secure and regulated platform had prevented people from accessing DeFi, but “by making it easy and safe to buy real Bitcoin and Ethereum, more people now have the option to get started in crypto and enjoy the benefits of DeFi – and not just those who understand crypto jargon.” Full story in the Headlines

LOTM: The adoption of digital assets is racing ahead faster than Governments can make legislation. At least that is true in the United States. What is the hold-up? Governments around the world aren’t so much afraid of digital assets, after all, the fait system is broken with too much debt and printing of government paper fait. Politicians know a new system needs to be introduced, it’s just – just – “How do we tax it?”.

So, the solution is simple: Crypto is an asset, similar to gold and silver, and not a currency. I suspect that is the eventual outcome. Maybe they will call the use of crypto as a form of barter, but the real question to answer, is how do they track the sale or use of crypto? Systems are not in place to track “sales” for the barter of goods and services, so how can they enforce the tax. The foot dragging isn’t to outlaw Crypto or “protect you and me”. The food dragging is to figure out how to track sales to tax crypto. The secondary reason for foot dragging, is to let banks catch up to the implementation for working with crypto currency technology.

This technology is moving so fast governments are having problems with controls.

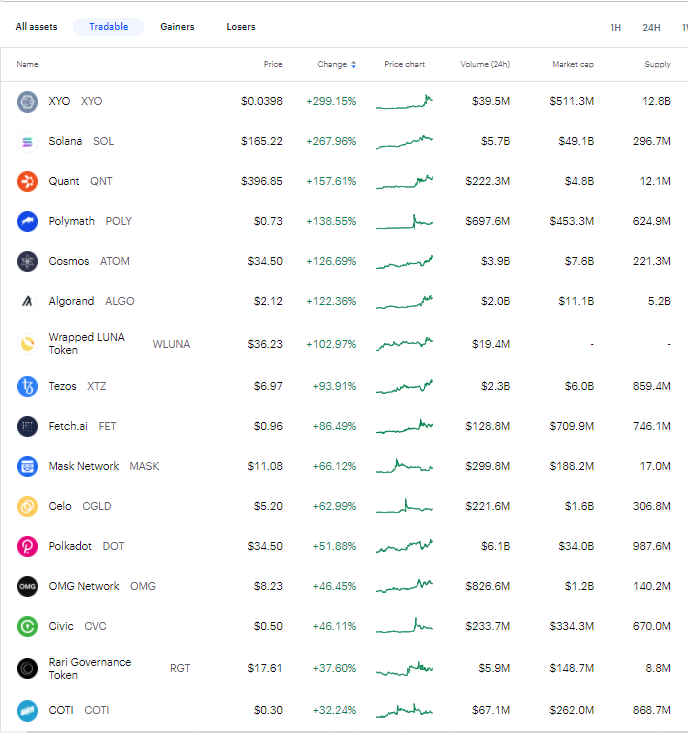

Crypto is moving so fast we have listed the performance change in prices in the last month below for the top performers. Below insert is dated Sept 13, 2021.

The purpose of listing this performance is not for those of you who are already in crypto, but to share with those who are not in crypto how fast this technology is moving.

This is still early adoption days for Blockchain technology. The adoption process will take years for implementation, but the early bird will get most of the worms.

Yes, crypto is volatile. What will work best is consistent accumulation with a dollar-cost-averaging approach. The exchanges have very low entry amounts. The average female crypto investor has invested about $1,200 over a twelve-month period with the average male investing about $1,900 over a twelve-month period. I lost track of the source of these numbers, but I remember them because they were much lower than I expected.

Cryptocurrency investing has a big gender problem

PUBLISHED MON, AUG 30, 2021

- Cryptocurrency is a 21st century financial instrument with a very 20th century problem: not enough women. Twice as many men as women invest in cryptocurrency (16% of men vs. 7% of women), according to CNBC and Acorn’s Invest in You: Next Gen Investor survey, conducted in partnership with Momentive.

- Women are lagging behind men in their rates of cryptocurrency investing, just as they have historically struggled to keep pace with men in more traditional investment verticals. In fact, in the new survey data, the gender disparity in crypto matches or exceeds the gender gaps in ownership of exchange-traded funds (14% of men vs. 7% of women), individual stocks (40% of men vs. 24% of women), mutual funds (30% of men vs. 20% of women), real estate (36% of men vs. 30% of women), and bonds (14% of men vs. 11% of women).

So, here’s the deal. If you are struggling with entering the crypto world, email me and let’s set a time to talk. I will walk you through the good, the bad and the ugly. I will tell you what I think and why I like certain items. I will suggest some resources and encourage you to read or view them. What I will not tell you, is what to do. I am not an investment advisor. I can coach you through the account set up stage. I can help your decision making process, so you are comfortable with the process and more important, talk you through uncertain times.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()