Calumet (CLMT) $3.00 in aftermarket trading, Friday.

I do not have a love affair with CLMT, but I do recognize the Fundamental progress the company has made. Management has executed this turnaround and transition from commodity oil refiner to Specialty Chemical company almost perfectly – in my opinion. Some would say they could have done better. Real life is messy. Not perfect, as an academic or researcher “believes” it should be. It is professionalism in the face of adversity, the ability to solve problems and adapt that is the most important. CLMT management did this.

There are multiple paths I see for CLMT that will unfold from here, all positive for the stock short-term.

- They become a growth company or a large distribution dividend payer.

- They stay public or go private. Cash flow is very large (noted below). They are an attractive target for either a Private Equity group, CLMT management buy-out or a combination to the two, to buy-out the company and take them private. I am sure this has been discussed internally. Management has mentioned they have discussed whether to follow a growth stock path or remain a L.P. and return to being a dividend payer. Seems all options are on the table – all are from a positive position for the stock.

The chart has been close to breaking out technically for months.

Fundamentally a lot is happening:

- Fundamental: Thursdays announcement that a Private Equity group is interested in buying the branded oils division for $500 million.

- Fundamental: Sale of the Montana Refinery is likely, post elections. Estimated sale price is $300 to $400 million.

- Fundamental: One of the branches in the Specialty Chemical division is growing at 25% annual rate even through the pandemic

- Fundamental: Free Cash Flow is strong. Above $2.00 per share and about $175 million in gross dollars

So no, I am not in love with CLMT. I recognize the opportunity and want to maximize the benefit from that recognition. We are now a momentum buyer of CLMT (with stops).

In the chart below

Two indicators are related to accumulation and distribution of share volume.

- On Balance Volume (OBV) is breaking out upwards

- CMF (Chaikin Money Flow) is showing strong buying

- MACD indicator is on a trading buy.

Technical Notes:

Thursday’s & Friday’s volume and price activity shows clear institutional behavior.

Price is now clearly clearing above key moving averages of 50-day and 200-day and 150-day (not shown).

Price action has shown higher lows on light volume ever since the $3.30 high price spike in June. This is considered a bullish chart pattern. That move itself was from $0.82 to $3.30 – a bullish move. Sometimes we just have to deal with time and space – Sigh.

Accounts related to LOTM expect to buy on Monday (Oct 5) to add to current positions. My belief is that this is a new price break-out with upside trading targets of $4.00 – $4.50 and $5.00. Yes, you can say I am piling on the momentum band wagon. Related accounts will try to buy under $3.00. Let’s see. Weakness is made for buying!

Looking back at the weekly chart, below, you can see the resistance at $3.00 and slightly above. The June to October period is a consolidation of the $0.82 to $3.30 price move off the March bottom. All is well in the long-term bullish stock trend.

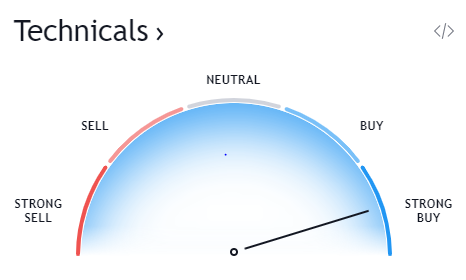

TradingView Technical Reading for Calumet:

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()