In this post are multiple ideas from within the Fintech movement. FinTech is the one the first applications of Crypto and Blockchain used in real world situations. These uses are different from buying crypto directly. Real world applications are what give Crypto currencies and Blockchains their value. Some of the companies listed below own crypto assets or safekeep crypto assets. They also use the blockchain applications that crypto allows.

Dominate examples of crypto assets being used in applications include:

I: Bitcoin as a store of Value. There are currently 13 asset managers applying to offer Bitcoin Spot ETFs (linked). Among these thirteen companies are the largest assets managers in the World. Blackrock, Fidelity, Invesco with Galaxy Digital, Franklin, and Wisdom Tree. The biggest asset managers in the world, say that Bitcoin is a store of Value similar to Gold but in digital form.

II: Visa (V) $262 is rolling out a global payment platform based on the Layer 1 crypto Solana (SOL). This is a real world application being implemented today by one of the biggest payment companies in the world.

III: The Society for Worldwide Interbank Financial Telecommunications (SWIFT) has implemented Chainlink (LINK) a Layer two crypto asset, that runs on the Layer one crypto platform Ethereum (ETH) to allow the international banking system transfer money and messaging faster and more securely on a global bases.

IV: Ripples (private company) XRP has been adapted by a lengthy list of domestic and international banks around the world to transfer money. XRP is a Layer one crypto blockchain.

Layer one blockchains are the base layer upon Layer two and Layer three application are built. More linked here.

Crypto is a new asset class. The tool kits (Blockchains) enabled by crypto are in the very infancy of being put into use. This movement will \unfold over the next decade and probably a longer time-line.

Public companies working with Crypto/Blockchain are in what is called FinTech (Financial Technology). This is the next technological development from TradFi (Traditional Financial) companies.

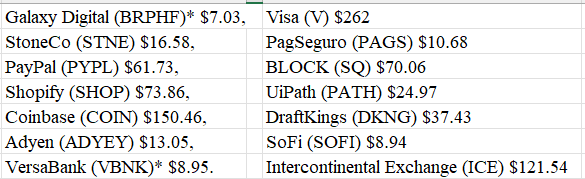

Companies LOTM has found of interest in owning or trading include the following:

Accounts related to LOTM have been active in many of the above names. The ones marked with an Asterisk are the ones currently owned but we may buy or sell any of these names without notice.

Do you own homework and build your comfort level.

The following companies from above, are included on the LOTM Ten Under $10 for the Double listing: Galaxy Digital, StoneCo, PagSeguro, & SoFi.

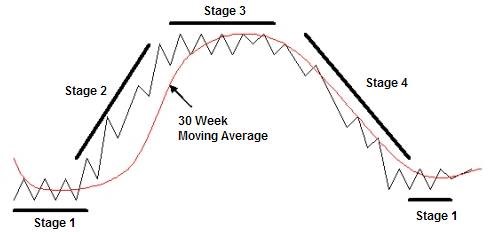

This industry started a rally in late October / early November of 2023. There are already some price doubles in the group above. We suggest dollar-cost-averaging approach into these names if you find one or more of interest. Check the company financials, growth rates and technical chart patterns. This industry is moving from Stage Four and Stage One chart patterns and into Stage Two chart pattern. Stage Two is the Rally Phase. More on Stage Analysis linked here.

Visual Example Of Stage Analysis

Source: Secrets for Profiting In Bull and Bear Markets By Stan Weinstein

Traders might find this group interesting from the Price volatility perspective. Finviz.com is a good site to check financials, charts and news flow on companies listed on USA trading exchanges. Tradingview.com is a good site for non-listed companies for stats and charts

Good Fortune to all. T.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

Written December 13, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()