Precious Metal Miners are at historic lows Vs the physical metals they mine. Valuation Metrics are at positive levels for cash flow – low PE ratios – healthy Balance Sheets. The outlook for higher metal prices going forward is a high probability with the governments globally desiring inflation and devaluing currencies.

Below are companies and ideas we find of interest. You can see the ones we own in related accounts market with an *. With the debt levels globally at ratios to GDP that cannot be repaid or paid by growth, multiple government are devaluating their currencies as a way to pay back the debt with weaker currencies. Gold has historically been “real” money as it has no liability attached to it like fait currencies have with debt obligations. Gold has survived every currency human-kind has invented. There is no reason to think that will change going forward. Silver, while the poor man’s gold, is in such demand as an electrical conductor, the price is expected to increase multiples of its current price. Government legislated laws have outlaw combustion engines and greenhouse gases and at the same they legislated restrictions on mining the same minerals, need to electrify for the replacement of fossil fuels. Silver is the perfect play to get rich from the insanity of our political ruling classes.

- New Found to List on the NYSE American Stock Exchange

7:30 AM ET 9/24/21 | Dow Jones

VANCOUVER, BC, Sept. 24, 2021 /PRNewswire/ – New Found Gold Corp. (“New Found” or the “Company”) (TSXV: NFG) (OTC: NFGFF) is pleased to announce that the Company intends to list its common shares on the NYSE American stock exchange (“NYSE American”) in the United States. New Found expects its common shares will commence trading on the NYSE American on or about September 29, 2021, under ticker symbol “NFGC”. New Found’s common shares will continue trading on the TSX Venture Exchange under ticker symbol “NFG”.

New Found Gold is arguably the hottest prospect in Newfoundland. It is “the” company that triggered Newfoundland being the hottest gold rush area in the world for buying or staking gold claims in the last thirty or forty years.

- Vizsla Silver has applied for an up-listing; however, the share price needs to trade above $2.00 for a thirty-day period before gaining approval.

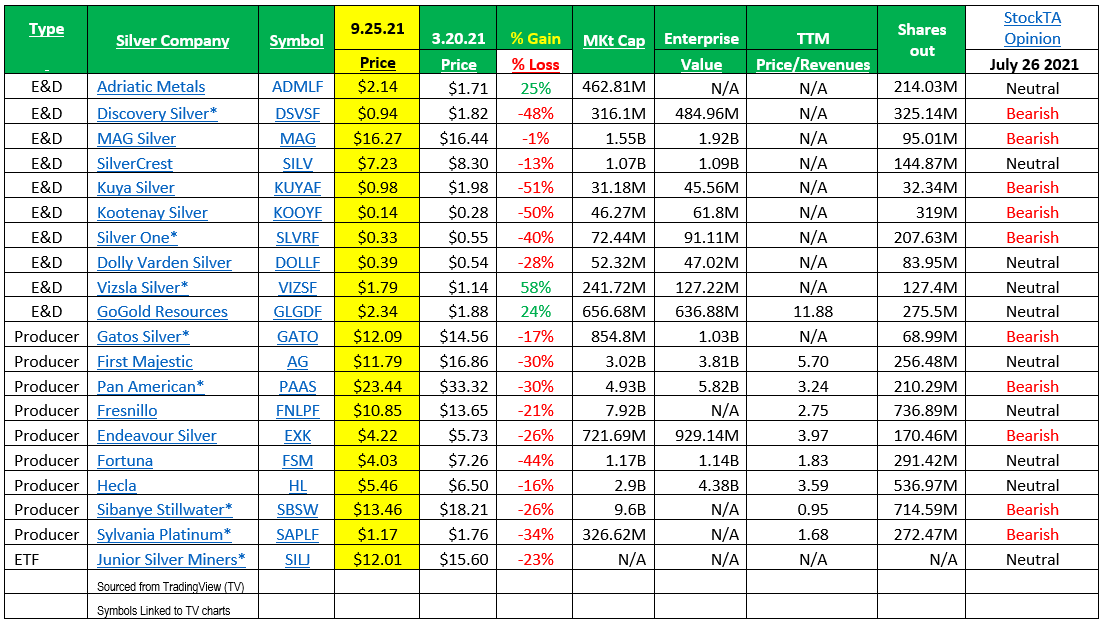

As can be seen in the chart below Vizsla is the best performing silver company in terms of share price. They are do a great job in developing a world class silver district just 100 miles east of Mazatlán Mexico.

- Keith Neumeier, Founder, Chairman, CEO of First Majestic Silver, is now suggesting, Silver prices can trade in the upper three digit area based of what he sees as supply short falls vs increasing demand from electrification. He also believe silver will be in such demand that companies like Apple and Samsung will buy mining companies to assure themselves a supply of silver for their electronic conductors.

Keith Neumeyer upgrades silver outlook to ‘high ranges’ of triple-digits Sep 24, 2021

There is no question in my mind that gold and silver miners are the best “value in the stock market based on historic valuation metrics as well as comps to other assets value in in the market. Value is so out of favor few are interested. To LOTM, this presents the greatest appreciation potential in traversing from deeply undervalued to over-valued metrics.

We suggest a dollar cost averaging approach to miners.

- The industry is subject to company merger & acquisitions (M&A). It is now rumored Kirkland Lake (KL) is involved in M&A talks.

- LOTM’s top choice in the Gold mining area is Karora Resources (KRRGF) $2.50. Karora trades at a ridiculous 5 times trailing earnings with the company saying they can double revenue in the next three to four years. Earnings are a high probability to grow faster than revenue. We are thinking KRRGF is a minimum $10 stock in three to four years.

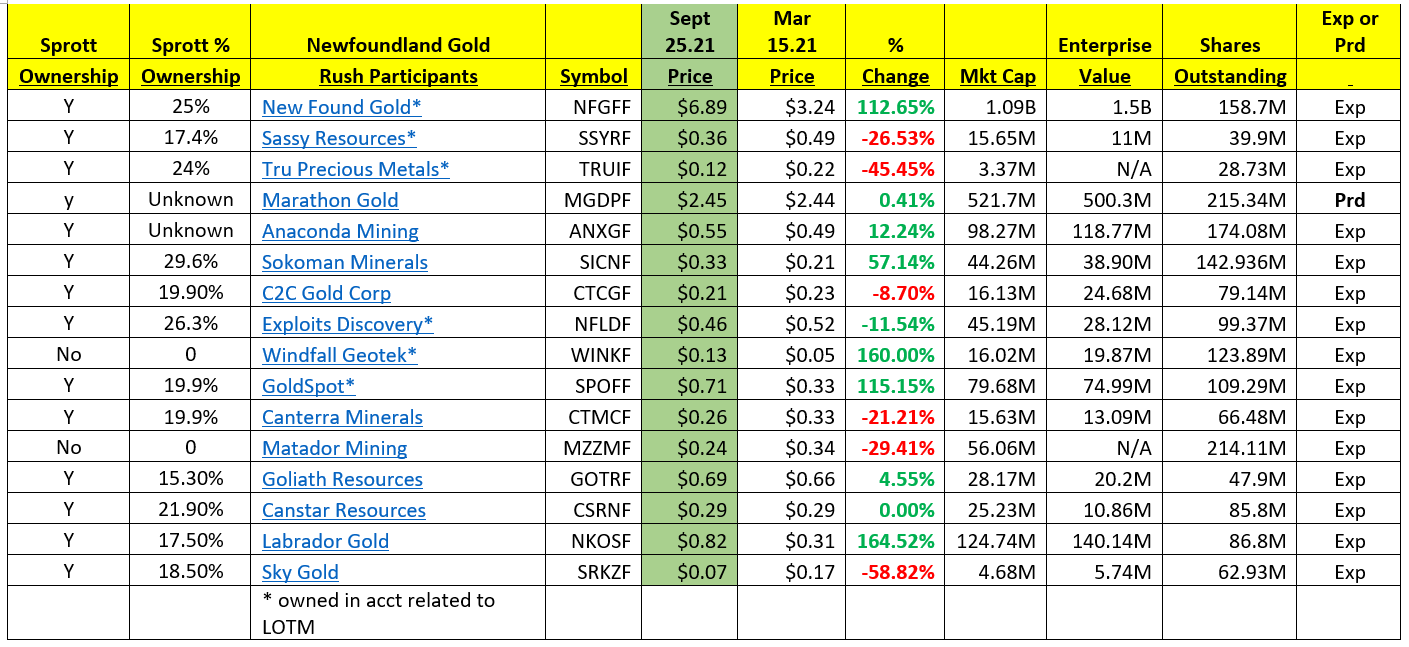

- Eric Sprott, perhaps the most aggressive individual mineral investor of all time, is very active in Newfoundland. We have tracked some of his activity below. Sprott was one of the original and largest investor in Kirkland Lake Gold. Sprott served as its chairman until recently. Kirkland Lake now appears to be up for sale. It is evident buy his activity he is moving from Kirkland lake to the isle of Newfoundland. Sprott, at 80 years of age, has always preferred exploration Vs production, so this movement is in harmony with his nature. He keeps pushing the envelope.

Below are some of the mining companies involved in Newfoundland – prices are Sept 24, 2021.

LOTM Selection of Silver Miners of Interest.

Available for Coaching, Training or Mentorships

Contact LOTM For One-on-One consultations.

Rate: $150 per hour / Monthly Retainer, Lowers Rate

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()