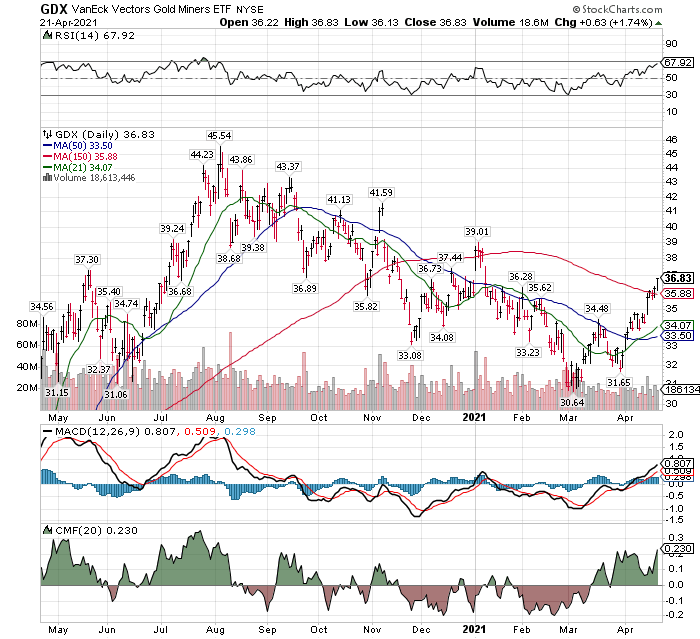

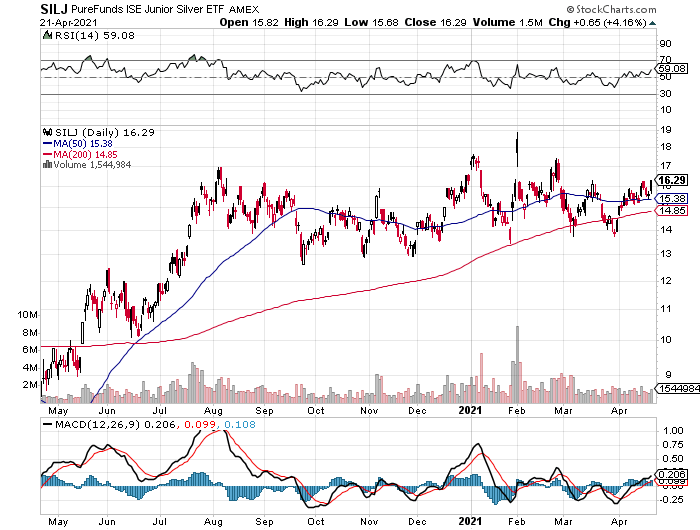

Two ETF Charts for you today: Small Cap Silver miner ETF SILJ and Large Cap Gold Miners ETF GDX

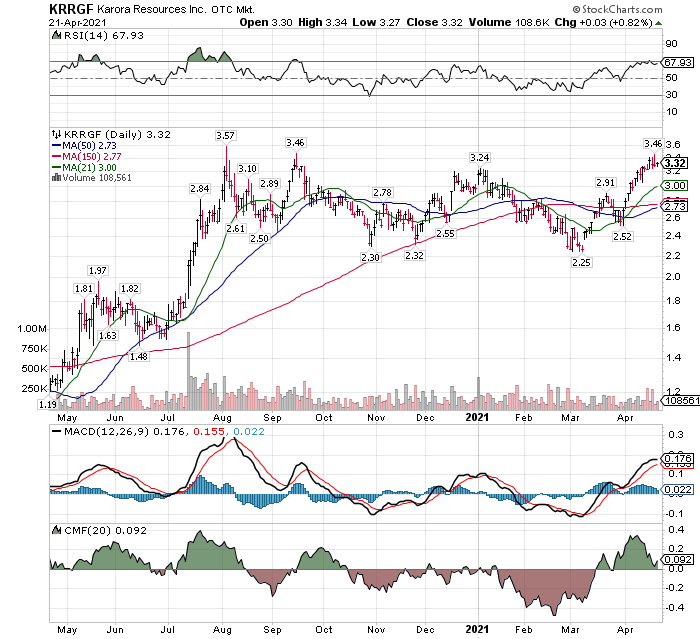

One individual miner stock chart to share: Karora Resources KRRGF)* $3.30

The eight-month correction in gold miners is over. Money is now flowing positive into the gold miners as seen in the chart above. Price is above the 50-day M.A. and the 150-day M.A. The price look vulnerable to a small pull back, but we suggest if it happens to add more to the position. There are also many gold miners large and small that have not moved yet and other that are up nicely. We have been pounding the table on Karora Resources (KRRGF)* $3.30 which from its low a month ago of $2.25 is now $3.30. A dollar-cost averaging risk management approach has worked well in a short period of time. See Karora chart below. It is not too late to buy Karora.

The next chart (below) is of the Junior Silver ETF, SILJ. Silver’s correction was not even a correction over the last eight months. It was a side-ways consolidation. Silver typically follows gold but, in this correction, silver miners held up better than gold miners. We’re still very positive on silver miners. Choose your vehicles if you want to participate. ETFs or Individual gold and silver miners. We own both in related accounts to LOTM.

Great day to you. May your thoughts, energy and action be in harmony with the flows of the market.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()