Technology changes but the Human Condition never changers 😊

Success in life is as simple as

1) knowing what patterns, you are looking for

2) recognizing patterns before others – AI makes this easier, but you still need to know what pattern you are looking for. To keep things interesting, there are multiple successful patterns. They rotate over time. Conclusion, is there is no one single successful pattern as “the constant.”

The First Baseline Truth of Investing:

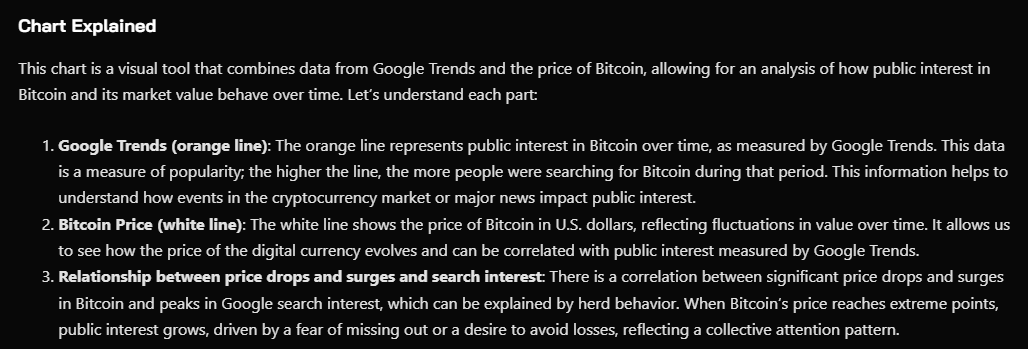

Human Behavior is the most consistent of all patterns. We are programs to fight or run when threatened. Most of us choose to run. It is hardwired into us for our survival. The trading markets are counter intuitive. Success in the market is watching for fear, starting to buy in late apathy stage and early greed stage. This has a name – It is stage analysis. Description linked here.

Or here https://www.investopedia.com/articles/investing/070715/trading-stage-analysis.asp

This is as basic as Investing needs to be buy quality when no one wants it and wait. There are many ways to improve this baseline truth.

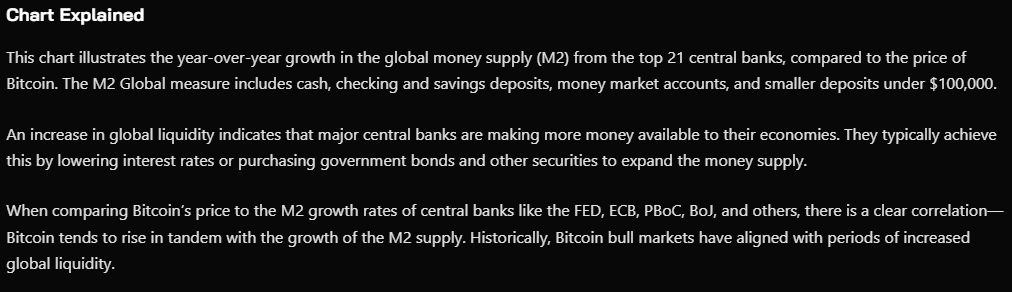

The Second Baseline Truth is available money for investment. This is best shown for Global Assets, like gold, silver and Bitcoin by the Global M2 expansion and contraction. Also posted on the site linked above.

The Third Major Baseline Truth of Investing is Simply – Demand Exceeds Supply.

When 3) demand exceeds supply and 2) money is plentiful to spend and 1) fear and apathy turns to greed – we have lift off on prices.

We are near or started lift-off for Gold, Silver and Bitcoin. All three are in growing demand and limited sup[ply situations.

All charts and graphs were sourced from https://bitcoincounterflow.com/charts/

![]()