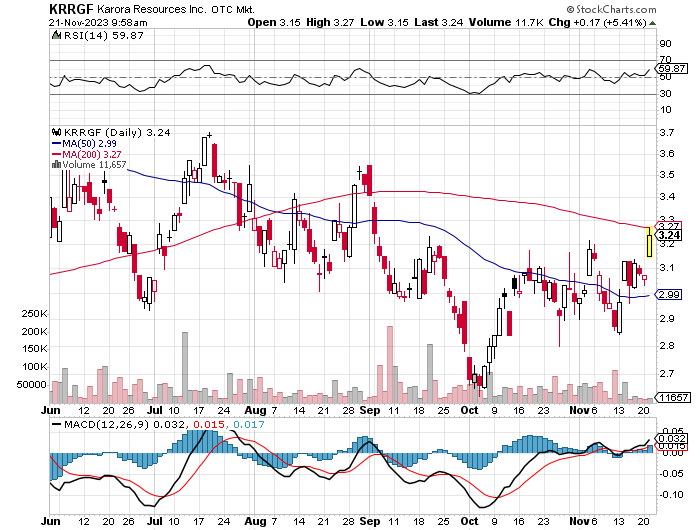

Karora (KRRGF*) Highlights November 21, 2023:

- At Beta Hunt:

- Gold Measured and Indicated Mineral Resources increased by 18% to 1.6 million ounces

- Measured and Indicated Mineral Resource grade at Western Flanks, Beta Hunt’s largest zone, increased by 12% from 2.6 g/t to 2.9 g/t (1.1 million ounces)

- Gold Proven and Probable Mineral Reserve increased by 6% to 573,000 ounces

- Consolidated Gold Measured and Indicated Mineral Resource inventory increased by 9% to 3.2 million ounces net of mining depletion

- At Higginsville:

- Maiden Probable Mineral Reserve produced for the Spargos deposit comprising 437,000 tonnes grading 4.6 g/t for 64,000 ounces

- The expanded Mineral Resource and Reserves further support extending mine life at Karora’s flagship Beta Hunt mine

Great numbers for Karora – Karora is a Junior miner. We like Pan American (PAAS) and Agnico (AEM) as two to the best positioned large cap precious metal companies. We are talking our book with Karora, Pan Am Silver and over-weight positions in gold and silver miners.

Michael Oliver is an excellent stock and commodity technician. He is an independent thinker with no fear of saying what he believes and sees in his work. This interview was just released on November 21. This is a 30 minute interview linked here. Highly recommend if for no other reason than building a 360 degree perspective of a his train wreck for the market projection.

This Stock Market Rally is Delusional! with Michael Oliver

Key points are that he believes the stock market is topping. Social unrest in the USA will happen no matter who is elected in 2024 presidential elections. Oliver believes gold and silver will breakout to new highs in weeks to months. Major Banks like Citicorp and JP Morgan have been hurt by the worst bond bear market in the history of Government bonds. If all banks were required to “Mark to Market” their bond positions, the Banking industry is insolvent. The Fed will do whatever it needs to do to protect the Government bond market and that is very positive for gold and silver.

Website link for Momentum Structural Analysis (MSA)

Written November 21 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()