Cryptocurrencies:

LOTM has taken a decided shift towards owning Cryptocurrencies in the past week. We are seeing major financial institutions and money managers committing to Cryptocurrencies. This is a simple investment theme. Supply and demand.

Bitcoin To $500,000? Plus, Fidelity Files for New Bitcoin Fund Forbes – Aug 30, 2020

Fidelity Is A 1,000 Pound Bitcoin Gorilla in The Making – Forbes – Aug 27, 2020

In the coming weeks, months and years, we are seeing pools of money being formed to own Cryptocurrencies. First it has been private Venture Capital, now it is SEC approved publicly traded Trust Companies (below) – next it will be ETF’s and Mutual Funds. These pools of money will own single focused funds in Cryptocurrencies like Bitcoin or Ethereum and others. Or they will own a basket of multiple cryptocurrencies. Our point is two-fold – 1) “the” establishment is embracing cryptocurrencies 2) great sums of money will be pooled to buy Cryptocurrencies. Big Demand – Limited Supply – does not get any simpler than that. We suggest you buy ahead of the commercializing and publicity of the migration to mass market ownership of Cryptocurrencies.

Four Publicly Traded Trusts of Cryptocurrency with more on the way. All are from Grayscale.

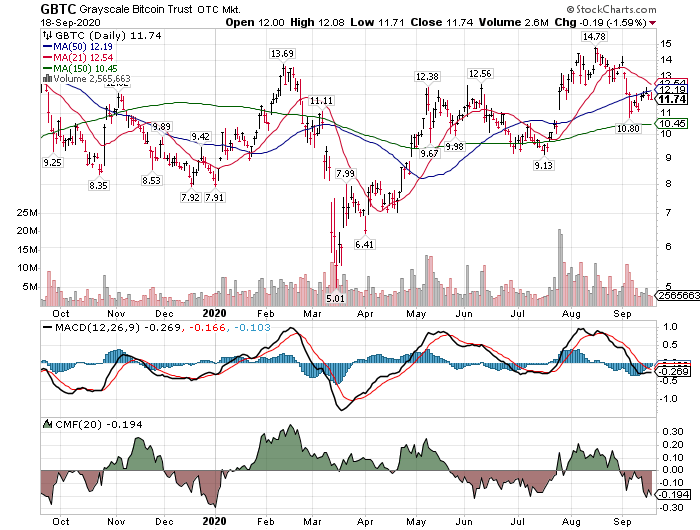

GBTC – Grayscale Bitcoin $11.29

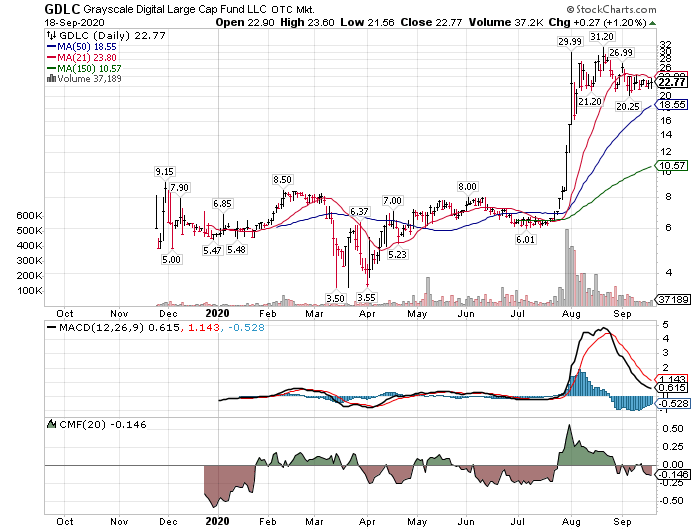

GDLC – Grayscale Large Cap (cryptocurrency) Fund $22.77

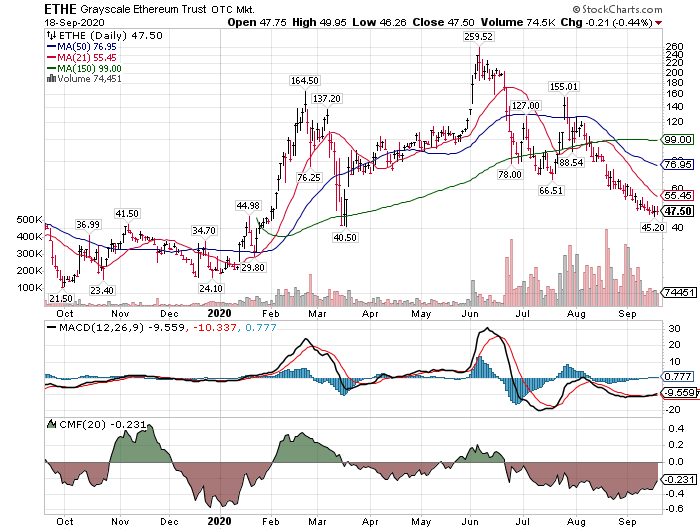

ETHE – Grayscale Ethereum Trust $47.50

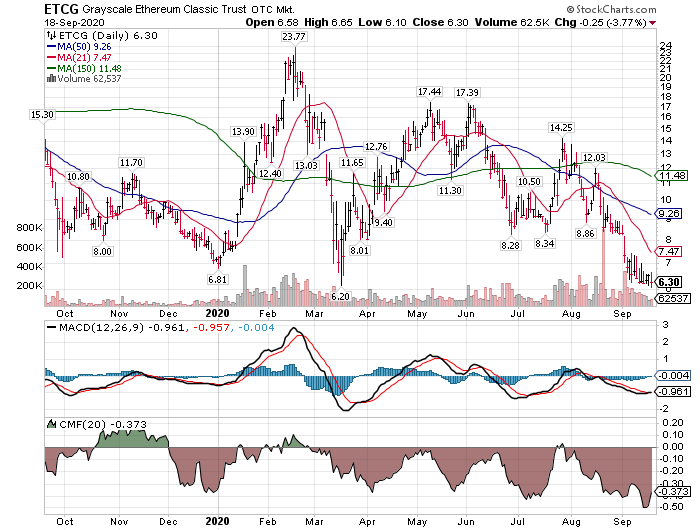

ETCG* – Grayscale Ethereum Classic $6.30

- Charts below

Long term investors might consider the fund of multiple cryptocurrencies GDLC.

Traders will find more volatility and fun in the individual cryptocurrencies. Profit depends on your skill set 😊

Unique feature of Bitcoin:

To the best of my knowledge Bitcoin is the only Cryptocurrency that has a limit on the maximum number of coins issued. This creates a backstop for the accumulation of shares to push against. No dilution. This is why some are saying Bitcoin could rise to $100,000 per coin or higher – some say much higher, $500,000.

Buying Bitcoin is like buying a professional sports teams.

There are on a small number and limited number of teams: Pro basketball – 30 teams / Pro Football – 32 teams.

Example – National Football League:

Getting in on the ground floor of football was a shrewd investment

With the value of a typical NFL franchise hovering around $2.5 billion, it’s easy to see how owning a football team is considered a solid — if expensive — investment.

That wasn’t always the case. There was a time when the cost of ownership was less than the price of a new car today.

Even in the mid-1980s (when purchase prices jumped to about $70 million), few could have predicted the runaway financial giant that the NFL would become.

However, those who did predict it — and managed to pass the business on to their families — have seen near miraculous long-term growth in their investments. Source Linked here.

Charts

GBTC – Grayscale Bitcoin $11.29

GDLC – Grayscale Large Cap (cryptocurrency) Fund $22.77

Charts

ETHE – Grayscale Ethereum Trust $47.50

ETCG* – Grayscale Ethereum Classic $6.30

Where Value meets Buy Signals!

Schedule a Q&A secession? Contact us at Tom @ LivingOffTheMarket.com

We don’t tell you what to do – We tell you your options from 360-degree perspective

Hourly rates

LOTM is a free newsletter. Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

These Investments are bought and sold constantly.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

tom Bud Her

I’ve been buying btc and other tokens for 2 and 1/2 years. I was hoping you’d eventually endorse it. Gives me a feeling of relief, kinda.

Bud Dauphin