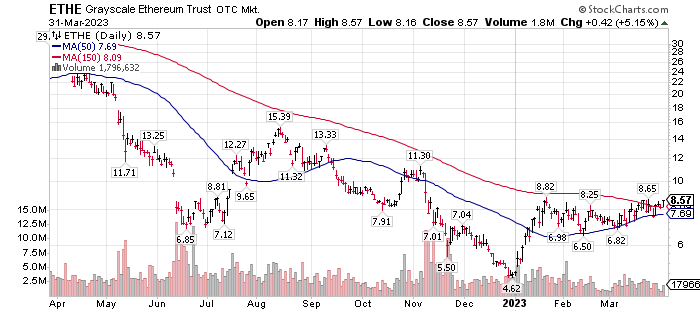

Grayscale Ethereum Trust (ETHE) $8.

One-year Chart.

ETHE has a number of recent closes above its 150-day moving average (MA). The 50-day moving average is still below the 150-day MA. We suggest we’ll see the 50-day do a Golden Cross above the 150-day MA in the coming weeks.

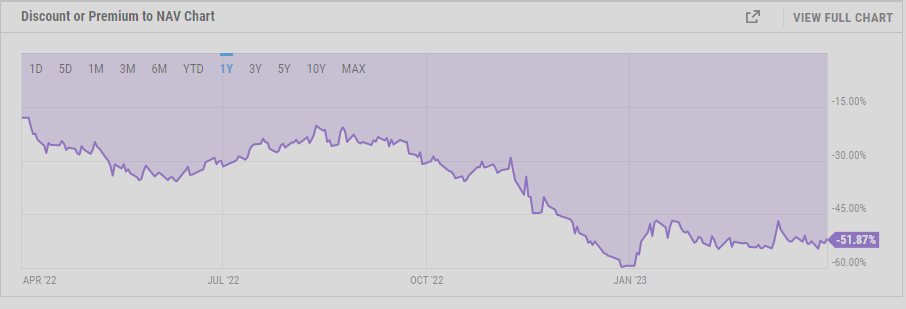

ETHE trades at a significant discount to its Net Asset Value (NAV). Below is the Y-Chart showing the discount.

The price discount to NAV on April 1, 2023 is still deep at 51.87%.

As ETHE’s price breaks out above its 50-day and 150-day moving average, we would expect ETHE’s discount to NAV to shrink. ETHE is a member of our LOTM: $10 Under $10 for the Double with an entry price of $5.30 on 12/23/22. Enjoy the ride.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

LOTM’s Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow for a 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April 3, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()