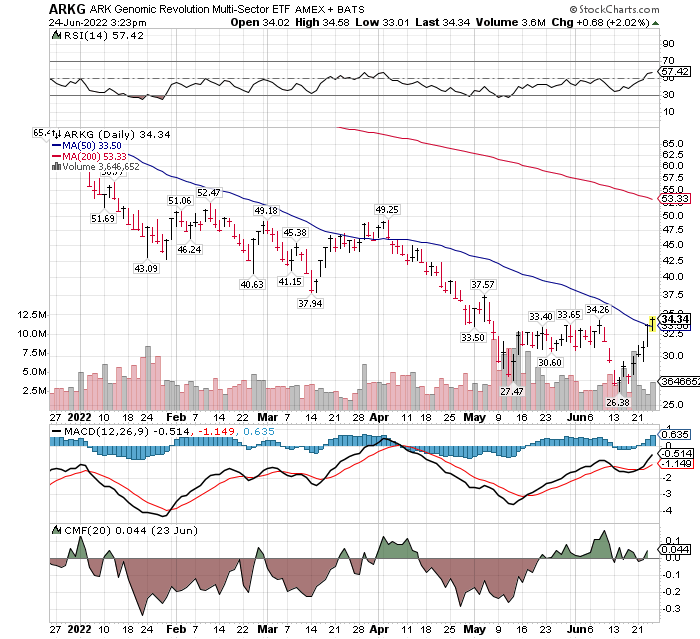

- ARK Genomic (ARKG)*

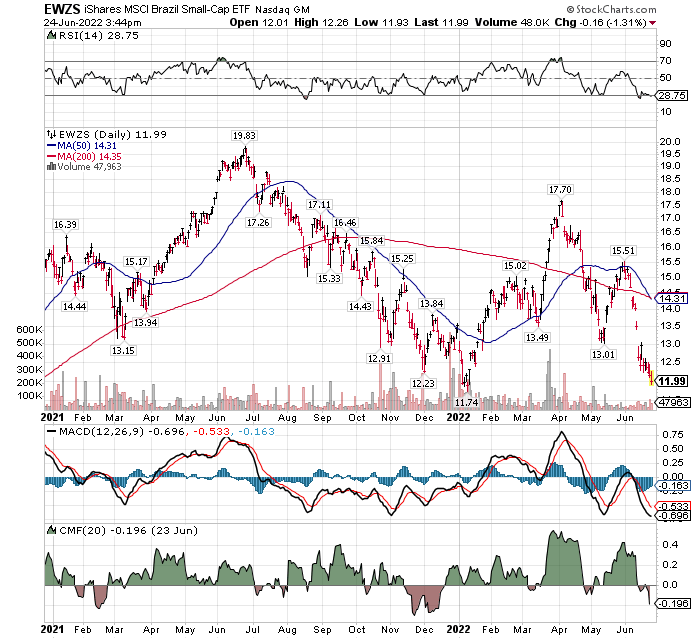

- Brazil small Cap ETF (EWZS)

Trading an ETF, we are more focused on the technical readings and the industry performance as it relates to the flow of funds more so than having concerns about company risk. As an industry, the fall has been from February 2021 to May 2022. Enough time to go from very over bought to very over-sold. The RSI has crossed above its 505 line. This indicates that ARKG is now performing better than 53% of the market. This is a plus. It shows money is being attracted to the industry. Price crossing the 50-day MA is also a positive. That is two of the four positives we like to see. MACD is on a trading buy. The shorter black average has crossed above the slower red average. Check mark #3 crossed off as positive. CMF has crossed above the zero line signifying a positive cross over. So, we have four out of four indicators positive.

We are still in a basing chart pattern. Stage 1 so we would look for down days to buy into a position rather than chase the price higher. All the indicators mentioned are on intermediate time frame – two to three, maybe four months. We would still call this a choppy market short term trading market Vs a trending market. if and when ARKG enters Stage 2 then we’d say the price is trending higher. For ARKG to cross into a stage 2 chart pattern, we’d like to see the ETF trading above $42.50, a resistance level, correct downwards and then rally to a higher high than the previous rally. Until that happens, we are more two week to four week traders or buy stock sell at the money or in the money call options against the stock owned.

OVERSOLD:

The Brazil Small Cap ETF above is negative on all technical indicators. It is so negative and at a support level that I believe it will bounce and give us and oversold bounce that is tradable. I am guessing we have support from the January 2022 lows. Perhaps a double bottom. It is easy to keep a relatively close stop loss if I am wrong.

I am watching (and own in related account) two Brazil FinTech stocks, StoneCo (STNE)* and PagSeguro (PAGS)*. Both of these stocks are in stage one chart patterns, but my “judgement” call is the decline has ended but an uptrend has not yet started. In StoneCo and PAGS I was way too early in buying shares. However, I think I going to do just fine with them and within a reasonable time-line (less than eighteen months). I can learn from that too early experience in PAGS and StoneCo and apply it forward to the Brazil economy and Brazil stocks in general. The ETFs are an added tool in trading and maximizing my knowledge gained from experience with Brazil fintech companies. Maybe I turned what could have been bad initial trades into a supply line of opportunistic trades. We’ll see, right?

I think Brazil is ahead of the USA in dealing with its inflation and interest rates cycle. See previous LOTM emails for comments about Brazil inflation / interest rates / STNE / PAGS. Should the US$ decline, it is my projection that money will flow from the USA to countries like Brazil. Commodity rich countries who gain from the sales of their natural resources to the rest of the world.

- See Brazil Inflation comments at Trading Economics linked here

- See Brazil Interest rate comments at Trading Economics linked here.

Not mentioned much or often is the topic of reshoring manufacturing from SE Asia. This isn’t just back to the USA. It is back to the vertical of North and South Americas. We will see Brazil, Panama and Mexico benefit from reshoring of manufacturing.

Portuguese classes anyone? Maybe Spanish for Mexico.

Written June 24, 2022, by Tom Linzmeier, editor, LivingOfftheMarket.com

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

Pingback: LOTM: ARK Genomic ETF Continuing its Rally Phase -