Sprott Inc was originally founded by Eric Sprott and Rick Rule as an investment banker / broker focused on Mining companies. Both Sprott and rule have retired from active management at Sprot in but remain shareholders. In the case of Rick Rule, he is the largest shareholder in Sprott Inc.

This is a better trading stock than it is a buy and own. I happen to believe we will get a break out move higher in mining stocks. Therefore, I have been waiting to a dip in the price to buy that shares.

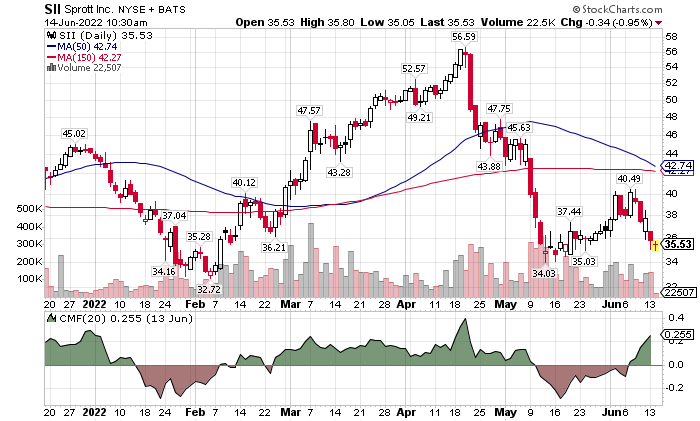

Note the drop in the share price but the rise in the CMF indicator. CMF is a measure of accumulation and distribution. Green indicates accumulation. That is really nice to see when a share price id dropping. Stocks have personalities just like people. If you watch this stock over time you might get in harmony with other traders who work this stock as a trading vehicle.

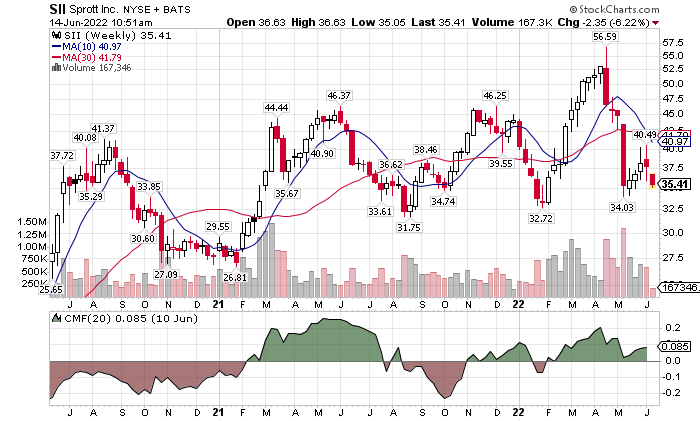

It is always good to look at a longer term weekly chart (above) for perspective. The weekly chart is also positive green with the CMF indicator.

Thoughts on enhanced trades:

- We think now, is a good time to buy for a trade back to the moving averages now at about $42.74.

- At that point you might consider selling some call options on the shares.

- Another tactic is to buy the shares now, and immediately sell the $40.00 calls about 60 days out. The Aug $40 calls are quotes as having a time and volatility value of $1.05. Should the shares rise above $40 in the Aug 19 period that would be a 15.5% gain in 65 days. Annualized that is about 85% return.

Written by Tom Linzmeier, June 14, 2022.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()