We are adding two new purchases to positions already held in the LOTM: Ten Under $10 for the Double.

- WonderFi (WONDF)* $0.42

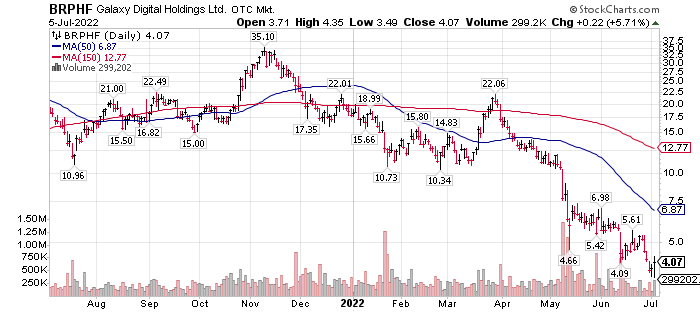

- Galaxy Digital (BRPHF)* $4.11

Both are Canadian companies, and both participate in Blockchain and Crypto. We own both from higher prices. This is a dollar-cost-averaging move to lower our average cost but is to also build position size.

There has been a liquidity squeeze in the industry not to mention a number of bankruptcies, near-bankruptcies and on-going attempts at restructurings in hoped for company survival. This is still an ongoing industry drama. We do not know the final outcomes however we believe these two companies are squeezed down because of industry conditions rather than internal company problems. Having said that, this industry is still in a highly unstable environment.

https://www.youtube.com/watch?v=YrWyXjosAFk link to interview with Wonderfi by Paul Barron Network 36 minutes – General intro interview with Ben Samaroo Co-Founder & CEO WonderFi.

Key Founders / Investors:

- Kevin O’Leary, well known from Shark Tank, Founder/Chairman, O’Shares Investment Advisers

- Sam Bankman-Fried Founder/CEO at FTX Exchange – link to FTX I believe Sam was the youngest self-made Billionaire at age 26.

- Bill Koutsouras Chairman of WonderFi, Lead Director at Galaxy Digital, President of Kouts Capital, Chairman of the Board, Wheaton Precious Metals International

We mention these people involvement in WonderFi because they are all very successful business men with substantial assets. It helps greatly to have people like this involved in your organization.

Galaxy Digital:

Recent Interview with Mike Novogratz June 15th linked here. This interview was also sent as an email on July 5th.

Personally, I am of the opinion that peak intensity within crypto is behind us. Whether crypto goes lower of not, frankly, I don’t know. As previously mentioned in an LOTM email, multiple players in Blockchain are raising substantial amounts of money in Vulture Funds to buy into assets in bankruptcy or restructuring. This tells me the industry is not going away. This is a watershed event brought about because of lack of regulation, greed, certainly now fear and too much leverage. For Galaxy Digital, the current price is half the IPO price of $8.00. Galaxy Digital is “the’ leading Institutional Investment Banker in Blockchain & Crypto. They are healthy enough now to initiate a 10% of floating shares, buy-back of stock. That’s 10 million shares if fully enacted.

If not now when would buy shares of Galaxy? The probable answer is when the shares move to a positive technical trading signal. So, I am more of a Fundamental, Value guy first and a technical guy second. I am buying at this price because of an opinion that Galaxy avoided the carnage showing up in other crypto companies. I will manage the position for taxes and to lower my cost basis.

At some future date, it is very likely, I will sell some Galaxy shares previously bought at higher prices – at a break even on average cost or as a loss. You can say I am “managing the position” to increase share size, lower my averages cost and at some point, raise cash by selling higher cost shares – ideally above my average share cost price.

This is a form of risk management in a high conviction position. Some people use stop losses for risk management. I never been fond of that method of risk management. Some people only accumulate shares in a dollar-cost averaging manner. This is my risk management process.

I will send out a completed update on the LOTM: Ten Under $10 for the Double, later this week.

Written July 6, 2022, by Tom Linzmeier. #Livingoffthemarket.com

Key Words #bottonpicking #valuestocks #actionabletrade #microcaps #blockchain #crypto

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()