I: How Expanding Global Liquidity Could Drive Bitcoin Price to New All-Time Highs

April 16, 2025 = Written by Mark Mason for Bitcoin Magazine

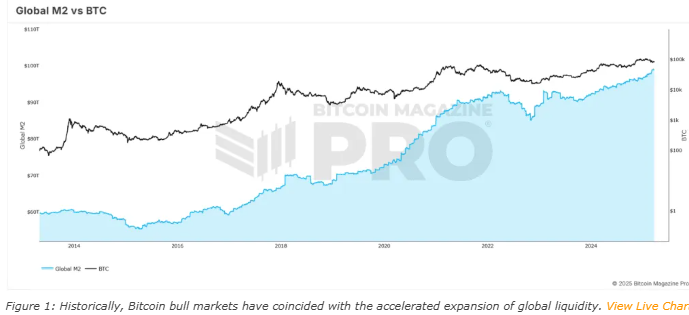

Bitcoin’s price trajectory is once again capturing headlines, and this time the catalyst appears to be global liquidity trends reshaping investor sentiment. In a recent comprehensive breakdown, Matt Crosby, Lead Analyst at Bitcoin Magazine Pro, presents compelling evidence tying the digital asset’s renewed bullish momentum to the expanding global M2 money supply. His insights not only illuminate the future of Bitcoin price but also anchor its macroeconomic relevance in a broader financial context.

II: Bitcoin Decouples from Nasdaq Amid Rising US Treasury Risks

Blockchain News: April 21, 2025

According to André Dragosch, the recent decoupling of Bitcoin from the Nasdaq is attributed to rising systemic risks associated with US Treasuries, which favor Bitcoin as an independent asset. Unlike previous analyses suggesting that the decoupling was due to factors harming Nasdaq margins but not global liquidity, Dragosch emphasizes the increased risk perception surrounding US Treasuries as a critical driver. This perspective is crucial for traders considering Bitcoin’s potential as a hedge against traditional financial instrument instability.

III: VanEck Confirms China and Russia Settling Energy Trades in Bitcoin — A Major Step in De-Dollarization

April 13, 2025 – 4 min read – nickthomas+editorial@benzinga.com

IV: Bitcoin Reserve ‘Crucial’ for Brazil’s Prosperity: Lula Administration

A remark earlier this week by the chief of staff to Brazil’s vice president underscored the country’s heightened interest in Bitcoin.

Decrypt: By Jose Antonio Lanz – Mar 28, 2025

Brazil is the eighth largest economy in the world

V: BIG BITCOIN NEWS! MARKET MANIPULATION is JUST A DISTRACTION!

10 minutes – April 21, 2025 Altcoin Daily

#bitcoin #crypto #stocks #investing #equities #blockchain

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()

hi