Bitcoin has no fundamental value “at this time” as a measure of its price. That makes it perfect for trading technically with one exception. It is a thinly traded and some big coin players do manipulate the action, so technicals only work part of the time. We must always be alert to sudden price shocks if working Bitcoin. For this reason, I prefer using Osprey Bitcoin Trust (OBTC)* as a surrogate for directly trading Bitcoin. It gives a slightly delayed reaction to directly trading Bitcoin. A type of smoothing effect.

OBTC* was added to the LOTM: Ten Under $10 for the Double on June 14th at $5.75

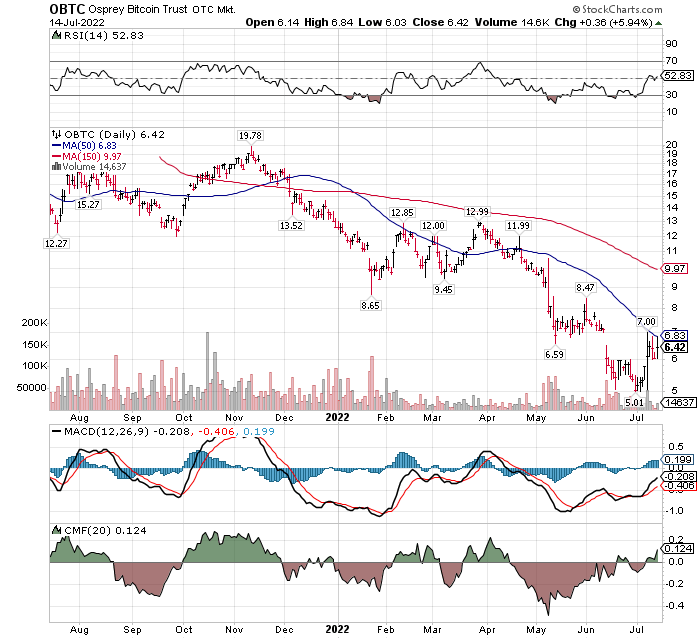

Technical Review:

- RSI is now performing better than 52% of the overall market. Positive.

- MACD, a short term trading signal is on a positive cross over. A Positive.

- CMF, a signal of longer-term accumulation or distribution. Above the zero line showing accumulation – a Positive.

Moving average crossovers.

- Price is still below the 50-day MA for an intermediate-term buy signal – a Negative.

- Not shown but the 20-day MA is still below the 50-day MA so no cross-over. A Negative

- Of course, without the two crossovers above, we have no long-term crossover above the 150-day MA. A Negative.

Conclusion: We have an over-sold bounce that “could” turn into something more positive. The most optimistic reading is the RSI (Relative Strength Index). Out-performing 52% of the market is an early alert that the action in Osprey (Bitcoin) could be changing.

LOTM is of the opinion that Bitcoin and Gold will be the first two assets that rally when the overall market environment improves. Let’s see.

Written July 15th, 2022, by Tom Linzmeier, editor, www.LivingOffTheMarket.com

- Key words: #bitcoin #crypto #equities #stocks #ETF #technicalanalysis

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()