The Daily Hodl – Alex Richardson, April 3, 2023

A new report, linked here, titled “Money, Tokens, and Games: Blockchain’s Next Billion Users and Trillions in Value,” Citi analysts say Citi predicts growth of digital assets will expand 80X by 2030.

“we believe we are approaching an inflection point, where the promised potential of blockchain will be realized and be measured in billions of users and trillions of dollars in value. Successful adoption will be when blockchain has a billion-plus users who do not even realize they are using the technology. This is likely to be driven by the adoption of central bank digital currencies (CBDCs) by large central banks as well as tokenized assets in gaming and blockchain-based payments on social media.

At the same time as Citigroup is saying 80X growth in seven-years, the SEC, led by Gary Gensler, is waging a war on Crypto through the tactic of targeting banks and exchanges (the on-ramps) that embrace and enable Blockchain and Crypto. The SEC is also attempting to labeling crypto as securities. The exception is Bitcoin, which has been labeled a commodity and is regulated as a commodity. An excellent discussion is linked here, titled – Attack On Crypto: What Biden’s White House Has To Say! April 3, 2023.

As suggested above by Citigroup, LOTM strongly believes in Blockchain and select crypto software that has utilitarian and enabling characteristics. Bitcoin and Ethereum qualify. The key to not being called a security appears to be qualified as decentralized. A discussion on this topic is linked here titled, Why Decentralization is Crypto’s Greatest Strength and Greatest Threat, March 2022. The key point is this – decentralization holds many advantages over centralized organizational control. The rewards and the risk. It is also the key issue in not being considered a security. Any number of altcoins have moved towards decentralization and are activily asking for regulation and clarification in this area so as not to be considered a security. The SEC has been silent in providing guidelines in this area. The courts and Congress will need to asert themselves in providing clarity. Obviously this will bankrupt many altcoins as the legal process is not cheap. The SEC appears to be using this filtertering process to control the industry. Just an opinion.

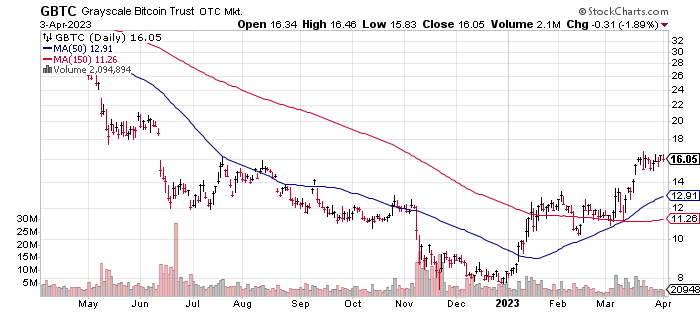

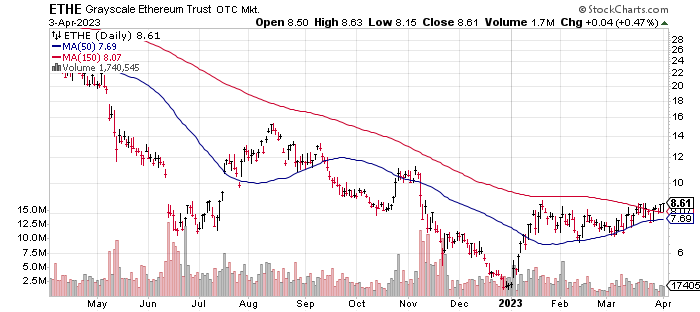

Bitcoin and Ethereum have the highest probability to survive this process. We like the Grayscale Trusts, GBTC* and ETHE* as ways to participate in a discounted way. GBTC trades at a 37% discount to NAV (Net Asset Value). ETHE trades at a 51.3% discount to NAV.

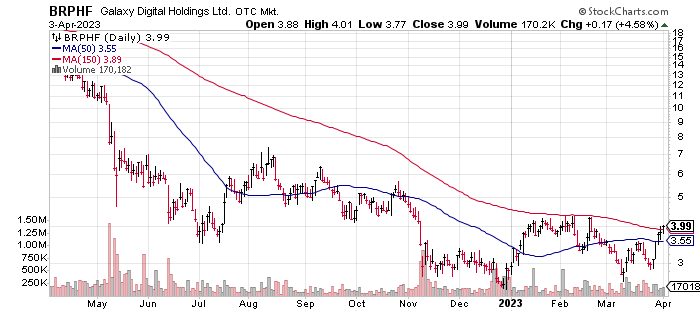

We also like and own Galaxy Digital (BRPHF)* $3.99. Galaxy is a leading global investment banker to institutions. They also have a venture capital arm that is invested in more than 80 blockchain application development companies. Galaxy safekeeps and manages crypto portfolios, trusts and ETFs for institutions on a global basis. Galaxy is a trading and liquidity provider to more than 650 institutional clients and mines crypto as well.

Galaxy Digital founder, Mike Novogratz says that challenges lay ahead in the digital asset space after a big “washout” in 2022, but that crypto is not going away. In the most recent conference call for Q4 ’22, Novogratz said the they expect to make about $150 million in profits for the quarter ending March 31, 2023.

Typically Crypto miners are a path to participating in crypto. We own some crypto miners, however we are strong proponents of the buying the “picks and shovels” that enables well as the companies that develop the applications that use various Altcoins or crypto. Typically, through out history, it is this category that has the highest survival rate and greatest investment return on investment.

For Actionable Stock Ideas, consider a subscription to Tom’s LOTM Blog.

Our Style – We are more a controlled speculator, than diversified investor or short-term trader. We allow a 100% loss/risk on some purchases. Often, we dollar-cost-average into losing positions. Volatility is our friend, not something to be feared. We let our winners win, as much as possible. We do not like paying taxes. We love value, yet watch charts. Our goal is to find value stocks that might double in one to three-years.

See our website for our doubling to a Million$ game. We were playing this game of doubles before Patrick Ben-David talked about it. Ideas in this blog are highly volatile and only for use by those who are comfortable with high-risk, high-reward investments.

Written April 4, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()