- Energy is the topic and Oil and Gas is still the Big Dog in Energy.

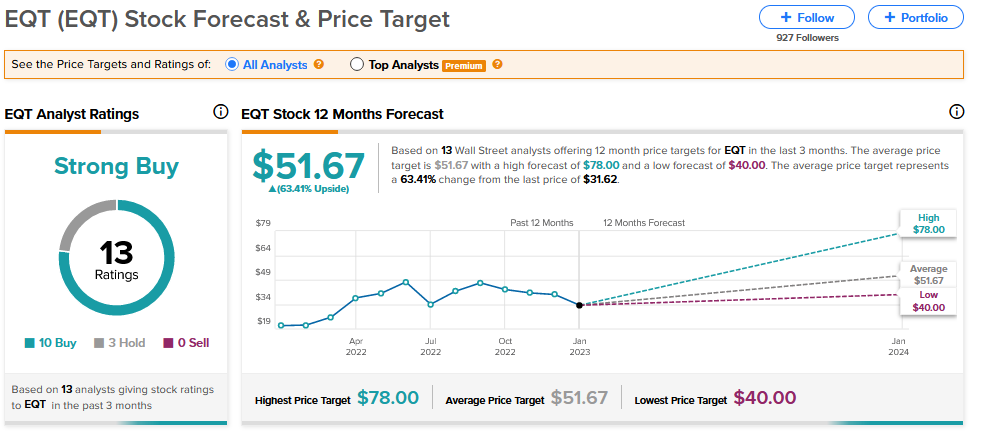

- EQT Corp (EQT) is a leader in Natural Gas with large cash flows for Dividends and share buy-backs

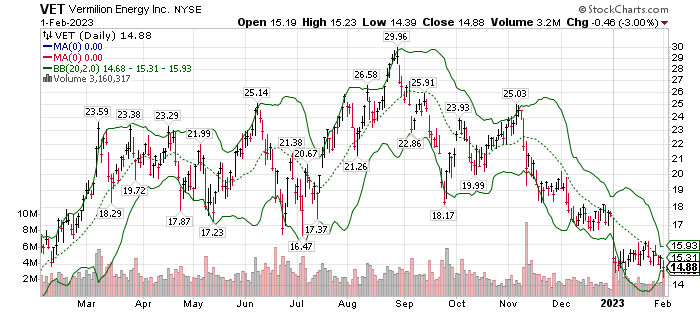

- Vermilion Energy (VET) an International company with operations in the North Sea and Eastern Europe. Company is paying down debt, raising dividends and buying back stock.

- Selling in the price today in EQT & VET, Feb 1, looks like a good entry for a short-term trade.

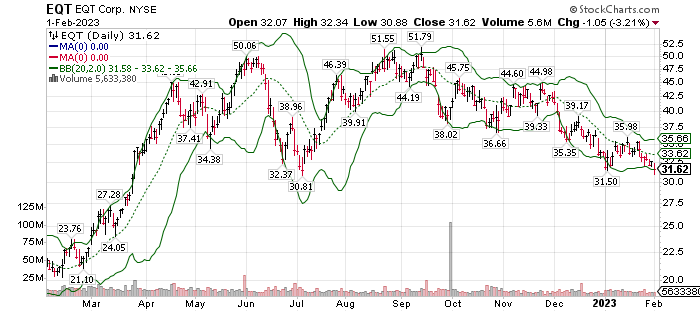

EQT Corp (EQT)

Bollinger Bands are trading bands that indicate extended moves (Over-bought or Over-sold) from the current 20-day moving average trend. Short-term trades and often be made when the price extends to the out-side bands. Both companies are strong low P/E companies with share buy backs and growing dividends. The push downs in price today could well be short-term buy for a trade. We certainly like both for buying now for longer term holdings. We like the macro view for oil & gas going into the year-end. On a long-term basis, we might be early but GasBuddy is saying $4.00 gasoline could be here by April ’23.

FROM TIPRANKS:

Written February 1, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()