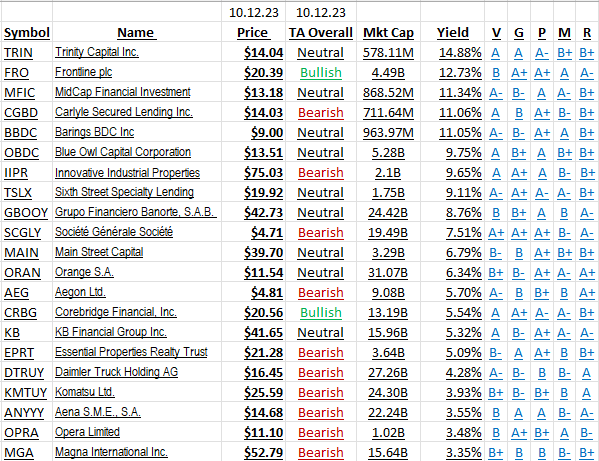

- 21 company names follow that are Buy or strong Buy Ideas from a quant study.

- Some dividends are high, and some are more modest.

- An Technical Analysis opinion of the names by StockTA is independent of the te Quant study

- Keep in mind there are three ways to determine if a company is worth buying: Fundamental, Technical and Behavioral. It is nice if they all align but frequently do not.

The names below are the highest ranked names out of thousands screened by Seeking Alpha and then we sorted as to those with higher dividends. The rankings change every day. We’ll work on doing a weekly update. The “TA Overall” is from StockTA.com. StockTA is a free service. It’s a mechanical ranking and also change on a daily basis. Seeking Alpha has multiple levels of subscription service. LOTM has not focused on Dividend paying ideas. We wanted to develop a repeatable process with a dividend focus within a Quant Study filtering process. Our goal is to build consistency and pattern recognition through the research process.

Here are twenty-one Buy and Strong Buy Ideas that also offer dividends that are screened with a quantitative process. An independent Technical Analysis view from StockTA is also included.

The headers are shortened. The meanings are above. The single letters are the Quantitative scores from Seeking Alpha. You can access these yourself. It requires a lot of time to put this together and to update so you might consider letting me do the work but know that you can check and do the work yourself, if you so choose. We are all about Education and self-reliance.

No need to concentrate money into a few names when shopping dividends. We’d suggest consider buying a package of five, ten or twenty names over time to make this process work. Some of these (above) are more volatile than others, so decide if you want to use a stop-loss or dollar-cost-average over time for risk management. Keep in mind, that new names will come regularly, and these above, will eventually fall from being Buy or Strong Buy suggestions. There are additional ways to manage portfolio risk and stock rotation. If you want to set up time to discuss building a working process, text or email me to set a date and time.

OFF TOPIC but Timely for regular LOTM readers:

I: Galaxy Digital (BRPHF)* just announced exciting news. Galaxy’s assets under management (AUM) jumped 69.8% from the previous month. Galaxy only deals with institutional clients. This suggests that institutional interest is ramping up ahead of the potential Spot Bitcoin ETF. Excellent news in an otherwise cautious market.

Oct. 13, 2023 5:00 PM ET

NEW YORK, Oct. 13, 2023 /CNW/ – Galaxy Digital Holdings Ltd . (BRPHF) (“Galaxy”) announced that its affiliate, Galaxy Asset Management, (“GAM”), reported preliminary assets under management of $3,927 million as of September 30, 2023. The 69.8% increase in preliminary AUM compared to the prior month was primarily driven by net inflows from new actively managed client mandates. Galaxy headline news linked here.

II: War is bullish for commodities – especially Oil, Gas and Gold. There was strong action in these areas this week. War is horrible for Humans. There is a lot of pain and agony in the world this week. Our thoughts are with those who had no interest in war, and who are suffering because of it. We can have no time for leaders who think war is an option for power and money.

Written October 13, 2023, by Tom Linzmeier, for Tom’s LOTM Blog at https://lotm.substack.com/.

Accounts related to LOTM and Tom Linzmeier can & will, buy or sell securities at any time.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Consult your investment advisor for investment advice appropriate for your situation.

To Unsubscribe, please select “return” and type Unsubscribe in the subject line.

Tom’s LOTM Blog page https://lotm.substack.com/

![]()