Goldman cuts U.S. GDP forecast to a full point below consensus, as it says recession odds are as high as 35%

Published: March 11, 2022

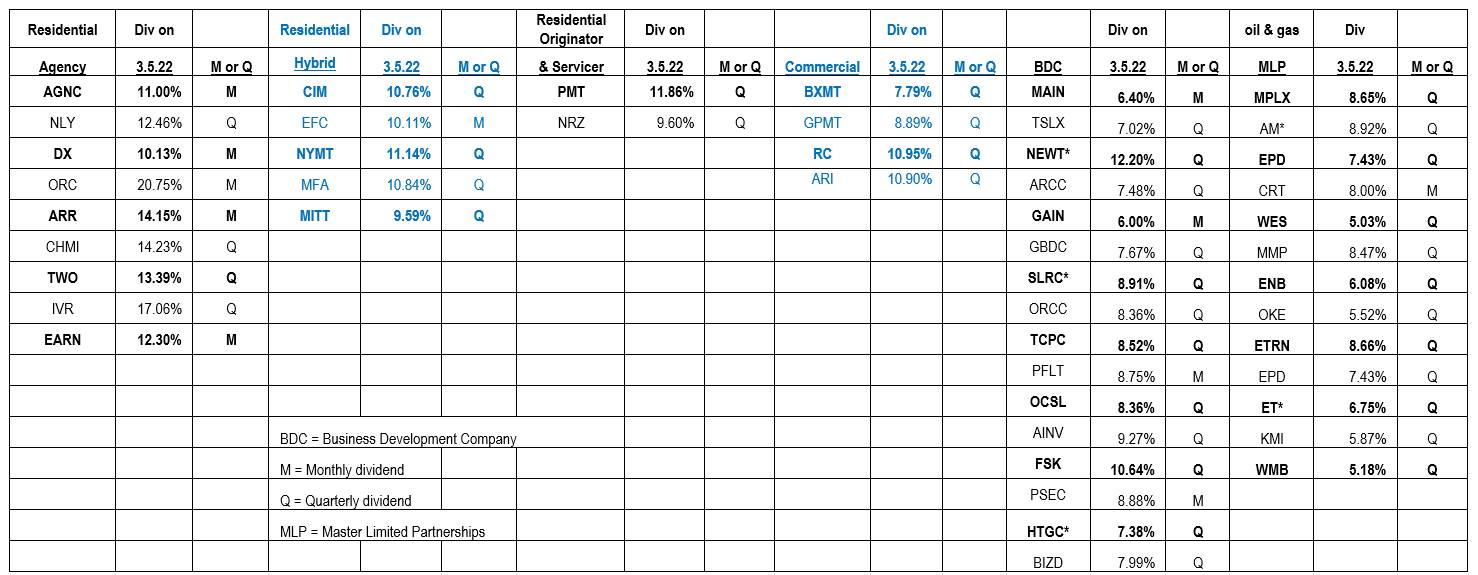

If we are heading into an economic slow-down, looking for dividend paying stocks is one way to get more conservative.

- Listed above are a number of dividend paying equities.

Personally, I prefer the Business Development Companies (BDC) and MLP (Master Limited Partnerships) over the mortgage related companies.

Do your background checks on these companies as this is not a recommended list of names – only a list of potential dividend paying stocks.

At this time, I prefer items linked to Pipelines (MLP) as they will transport gas and oil which are in High demand

Suggest being wary of residential and commercial mortgages as – Covid hurt commercial and residential mortgage dividend payers

“might” be levered up as much as six to eight fold in a borrowing ‘short to lend long’ strategy. This defaults back to “know your company.”

- There is a reason MLP’s are paying lower rates of dividend payment than Residential Mtg. That reason is for the risk adjustment. Be Aware.

Not on the list, but owned in related accounts of LOTM, is Soluna Holdings Preferred (SLNHP)* $19.25, paying a monthly dividend at an annual payout of 11.79%. Soluna is a small company but healthy. Soluna id using this preferred offering to finance its growth into Alt-energy powered Batch Computing Data Centers. At the present time the primary batch computing is used for crypto mining.

Do your background checks on these companies as this is not a recommended list of names – only a list of potential dividend paying stocks.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()