In this blog:

- Are we seeing early signs for a positive market trend change?

- A Bitcoin bottom?

Are we seeing early signs for a positive market trend change?

The markets are no longer fearful of Inflation. If they fear anything, it is the recession or even a depression.

It is way to early to call the end of the correction, but there is the potential for a two to three month counter-trend rally. Perhaps a rally between now and November elections and then we have to see what follows the November event.

Copper is an early bell-weather indicator of the economy. Check the copper price action since mid-April in the chart below. It is saying, “the economy has fallen off the Cliff.”

A number of times we have mentioned not to watch what the Federal Reserve is doing, but rather watch the action in the ten-year Treasury. Below is the positive action in the Ten-year note which is inverse to the action of the yield rate. Ten-year Treasury might be saying, “enough pain is coming, stop the pain.” Let’s see.

My suspicions are the Federal reserve will hike rates one more time in July and then pause in September and October. Keep in mind November elections. Human memory and emotions are very short. Humans can only hold a peak emotional state for about 90-days. If the last rate hike is in July, it is about 110 days to the November election. Coincidence? Just something to consider.

A Bitcoin bottom?

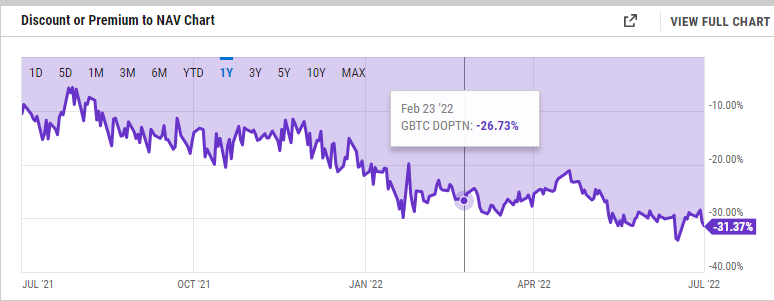

Leverage and Illiquidity have racked the crypto markets. Three Arrows tried buying the discount in Grayscale Bitcoin Trust (GBTC)* Vs the spot price. LOTM, thinks that was an excellent strategy. It is still an excellent strategy but with a longer time frame than as a trade and with no leverage. The discount to spot price today is 31.37%. Three Arrows’ problem is they did the trade with more borrowed money leveraged into the trade than they could handle when the price of Bitcoin fell. Bitcoin dropped more than 60% in 90-days. Without leverage, they survive. With the degree of leverage they used, they are bankrupt.

Bitcoin discount to spot July 1, 2022:

Terra Luna, BlockFi, Three Arrows, Voyager Digital and Celsius are troubled crypto entities. Money is being readily raised to buy the assets of BlockFi, Three Arrows and Celsius. The fact that money is easy to raise to buy the troubled assets, suggests the worst has occurred in the crypto world. A time to accumulate Blockchain and crypto related assets? Yes, in a dollar-cost-averaging way, I agree with doing that.

- Goldman Sachs Leading Investor Group to Buy Celsius Assets: Sources – CoinDesk June 24, 2022.

- Morgan Creek said to try to counter FTX’s BlockFi bailout – Yahoo Finance June 26, 2022.

Written by Tom Linzmeier, editor, LivingOffTheMarket.com

TAGS: #Blockchain #crypto #marketbottom #stocks #Copper #Tenyeartreasury

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()