LOTM Has been vocal on the Fintech Industry as benefiting from change coming due to Blockchain technology. Blockchain is changing how money transfers are made. This is a distinct challenge and risk to TradFi (traditional Finance). The short version is Blockchain is very secure way to transfer currency and documents (read title companies) that eliminates the middle men – TradFi. It is estimated that the global revenue generated by TradFi industry is $7 Trillion (source Morgan Creek Capital’s Mark Yusko) a year globally. Therefore, it is very clear why the Banking, Insurance, finance and title companies don’t want Crypto and Blockchain to progress or progress rapidly.

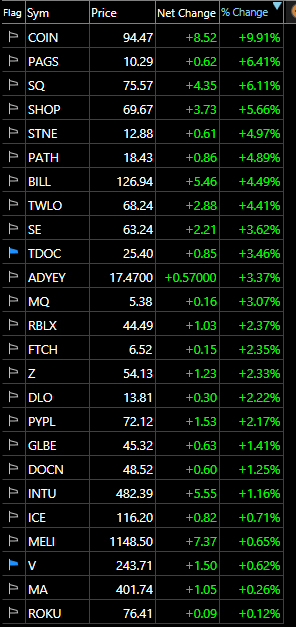

Favorite names to LOTM in no particular order, the symbols COIN, SHOP, STNE, PAGS, SQ, MQ and GLBE. Do your own due diligence from the list below. Long time readers know where we stand on this list. Some of these names have doubled or more from their two year-low price. We suggest that if interested in this group, you buy a package of five stocks or more, equal dollars invested in each name. Dollar cost average in the same way with three to four group purchases over your allocated time-line for buying. Once you are fully invested, use a trailing stop loss on the entire package at your predetermined percent loss. 10% or 15% are common stops. Your risk tolerance might be less or more than these common stop-loss numbers.

These names are leaders by and large in the digitization of money exchange and transfers. This is sent more of trade alert to movement in the industry. Whit that here is how LOTM breaks down different classes on people looking to spend money on equities.

Traders: Looking for price momentum to hop on and hop off. Buy high and sell higher.

Trend followers: identify a trend. Buy the trend and use a stop low to exit. The goal is to ride the trend as long and high as you can but not give back much from the highwater mark. This involves the use of a trailing stop loss. It could be a metal or a hard stop-loss.

Investors: Typically, investors establish a valuation for a stock or industry. When they see the pricing of the equity or industry is lower than the “normal valuation” longer term says it is worth they buy what that industry returns to normal or over-valued status they sell.

Speculator: Willing to own very long-term – three to ten years. They see the long-term potential for growth or expansion of the company or industry. Often Speculators are looking for the ultimate sales price to give them a 100% simple interest annual rate of return. In other words, they are looking for 5X to 10X on their investment as reward for the long holding period.

All labels have their own language of terms, guidelines and number structure to consider. If you cannot identify and know the guidelines and numerical structure to consider, you might be more of a gambler than you would consider yourself to be.

Gambler: does things because of emotion – impulse, fear or greed. Sell because of fear buy due to greed.

Counterintuitive: Buy when feeling fearful or selling when feeling greedy. Ease to say but hard to do when in the heat to the particular emotion.

The alert on Fintech names below is focused on traders but mostly Trend followers as defined above. As trend followers we are not so focused in a one time purchase but rather scaling and scaling out over a longer time period.

Consider Tom as your coach or confident if you want comments and feedback. You make the final decisions. We are not and investment advisor.

Fintech Stock performance on July 13, 2023

Consider buying a 20% of you capital into a number of names on this list. Look for a counterintuitive moment in time to buy into weakness with another 20%. Continue to look for counterintuitive opportunities to build the position. Look for pull backs from a highwater mark to use your stop-loss exit strategy.

Wealth Building – One Day at a Time

Available for Coaching, Training or Mentorships

Contact Tom through the LOTM website or by email

Rate: $150 per hour / Monthly Retainer, Lowers Rate

Text with interest at Six-five-one, Two-four-five, Six-six-zero-nine to arrange a conversation

Or subscribe at https://lotm.substack.com/

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()