Foresight Autonomous (FRSX)* $3.38 is added to the LOTM: Ten Under $10 for the Double List.

Chart source Finviz.com

ABOUT:

Foresight is a spin out from the Israeli Military. Foresight can detect any object on any road,

in any lighting and weather condition. It is a mature technology, field proven. It is automotive-grade, and a cost-effective solution for a wide range of markets.

The sales are negligible, but multiple world class OEM companies have early-stage signed contracts to work with Foresight. Applications include passenger cars, public transportation and fleets, commercial vehicles, defense and security platforms.

STATS:

Link to Finviz.com for chart, news & stats

Shares outstanding: 69 million.

Market Cap: $215 million

Sales: N/A

Link to most recent quarterly

Cash: $43 Million

Debt: None

Technical Price Observations

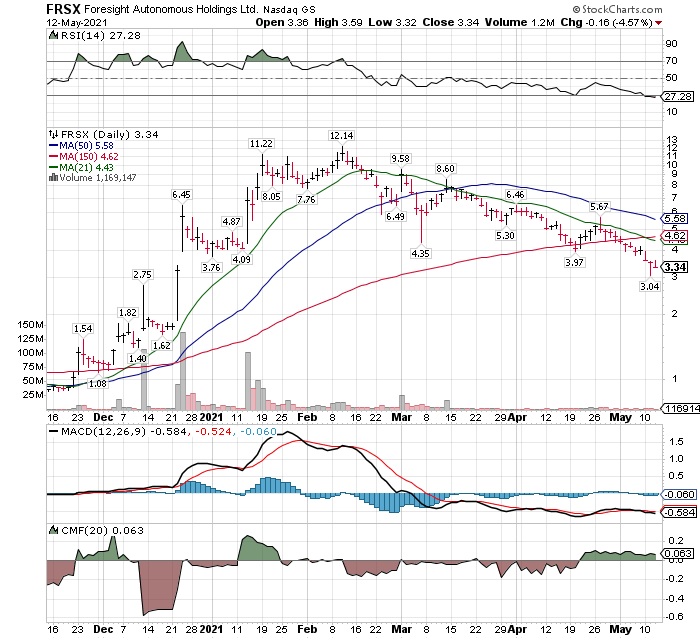

- Price is in a down-trend.

- Moving averages are still in a declining trend.

- Downward momentum beginning to wane. See MACD in chart below.

- Price has not based or entered Stage One chart pattern. Still stage four declining pattern.

- Likely over-sold. Decline from $12 to current $3.38 price in three months. See RST in chart below.

- CFM indicates institutional accumulation has begun – about April 20.

See chart below:

Suggested approach to positioning:

Revies the web site for familiarity to the company and technology. Review the most recent Quarterly report Dec 31, 2020. Linked above. This is a strong forward technology and autonomous driving a real emerging event that we suggest scale-in approach typically called dollar-cost-averaging. There is the probability that we will see a V shaped recovery in the price, rather than a saucer shaped Stage One basing pattern.

LOTM is adding FRSX to its LOTM: Ten Under $10 for the double list this week.

We are certainly looking Forward to what might be. We have no future price target. This is not based on a Value approach, based on current revenue, cash flows and balance sheet.

An account related to LOTM has initiated a small position in the shares of FRSX.

LOTM Research & Consulting Service

Where Value meets Buy Signals!

Feel free to forward or recommend to others.

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()