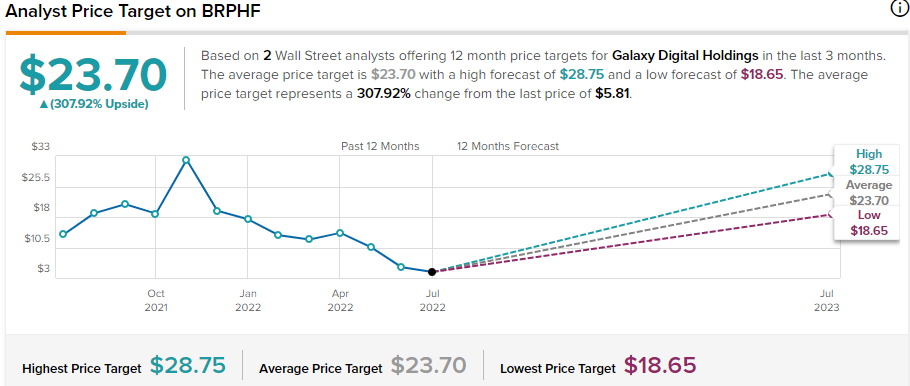

Galaxy Digital (BRPHF)* $5.81

Fear, Uncertainty and Doubt, otherwise referred to as FUD, has driven the price of Galaxy to a low of $3.49 in July. After all the liquidity pressures of the past ninety-days, Galaxy, the company, is still holding its own despite the collapse in its stock price. Evidence the company has no liquidity issues is that Galaxy initiated a 10 million share buy-back.

Item #1 Galaxy survived the liquidity crunch in Blockchain/crypto

Item #2 Bitcoin is experiencing a rally out of what looks like a bottoming chart pattern (below). A Bitcoin price above $30,000 is what we would consider the price is above the next resistance level for a confirmation.

We will be the first to say it is too soon to call a bottom on Bitcoin’s price. We will also say we will not know it’s a bottom until its too late to buy near the bottom. A bit of a conundrum. LOTM is a believer that blockchain and the major cryptos are here to stay – so in this, we are Bitcoin believers. We are willing to be early buyers of Galaxy and Bitcoin.

Galaxy needs the rally in Bitcoin to continue keeping its rally going. It is likely to be a choppy market for Bitcoin for the next three to six months, but we are of the opinion that the $14,000 to $20,000 level will hold as the low. In turn, we do not believe you will see Galaxy hit new lows while the upside in the world’s leading institutional blockchain banker is far greater than the downside.

That’s my pitch for owning. Chances of going out of business is small post this liquidity crunch.

One can say Mike Novogratz, founder & CEO of Galaxy, is bias towards Blockchain and Galaxy. You would not want him leading your company if he wasn’t. Here is his admission he was wrong on the leverage in crypto but that his target of $500,000 on Bitcoin in five years is still his core belief.

There is risk in Galaxy, but one has to weigh the upside of owning the industry leader Vs the “maybe” something more goes wrong. The maybe in looking at Galaxy, is that they have many moving parts where something “could” go wrong. Maybe the trading desk? Maybe the Venture Capital operations? Maybe crypto is a fad? The team is deep with former Goldman Sachs employees. Lots of experience at Galaxy, so very different from people at other crypto exchanges who grew up in crypto but without a deep investment banking experience.

It seems like peak intensity of the liquidity crisis in crypto is behind us and this is an opportunity to buy shares cheap.

Just an opinion.

Written by Tom Linzmeier, July 20, 2022, for LivingOffTheMarket.com.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()