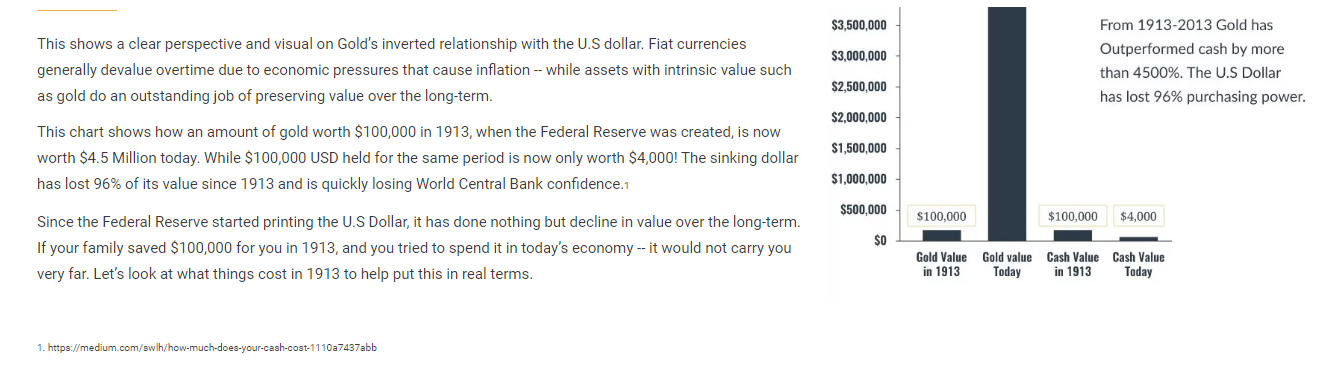

- Gold’s long-term perspective is best!

- Shorter-term, it is harder to see Gold’s direct benefit.

- On a multi-decade basis Gold scores very high.

Here are some facts.

This addresses holding physical gold. For a period of time the price of gold was “fixed” and in the 1930’s, owning physical gold was outlawed in the USA.

- Price of physical gold last 22 years: 2000 Gold’s price was $274.5 U.S. dollars – June 2022, Gold was $1,827 up 6.6557 times.

- S&P 500 last 22 years: the S&P 500 in 2000 was 1,437 at its mid-point – June 2022 it was 3,911 up 2.72 times

- Purchasing power of USD last 22 years: $1 in 2000 is equivalent in purchasing power to about $1.70 today.

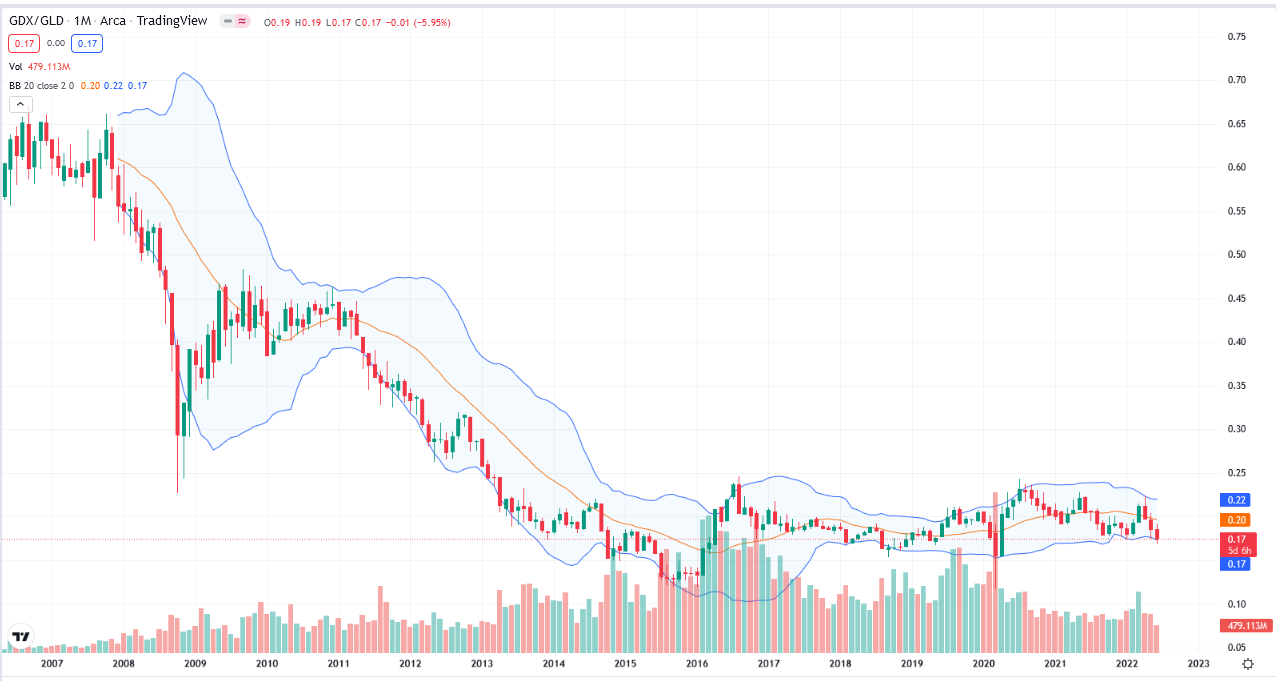

Gold miner’s price oscillates at a premium or discount to physical gold price depending on investors sentiment at the moment. Today, Miners trade at a steep discount in its relationship to the price of physical gold.

In the chart below, we have divided VanEck’s GDX, a large cap gold mining fund by the physical price of Gold. We have then placed Bollinger Bands on the ratio of Gold miners / Physical Gold. This gives us a trading band to see visually when the miners are cheap or expensive Vs the price of Physical Gold.

The fact that Gold Miners are trading at a historic discount to physical Gold suggests Gold Miners are a better buy than Physical Gold at this time.

However – Gold miners are a lot more volatile than Physical Gold. That is a trade-off to consider. If you want less volatility, buy Physical Gold.

If you want greater appreciation potential and don’t mind the volatility (dollar-cost average), buy the Gold Miners. The real answer is in-between – Own some of both.

Emerging from the Correction:

I happen to believe the best performers longer-term coming out of the current selloff, will be commodity related investments. LOTM likes Nat Gas, Gold & Silver. We also believe revenue and cash flow growth that is faster than the actual inflation rate, will do well. Blockchain technology is the fastest growing technology ever. It is not going away. We like companies that apply blockchain technology to solve problems and improve productivity the best. We like Bitcoin as a crypto investment. The top twenty market cap coins or high use crypto software applications are attractive as well. Owning a basket of these crypto coins in addition to Bitcoin is suggested.

I am not a gold bug. Just a facts and probability guy. The facts say, own some gold long-term.

Great Day to you all.

Written June 26, 2022, by Tom Linzmeier, editor, LOTM newsletter.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()