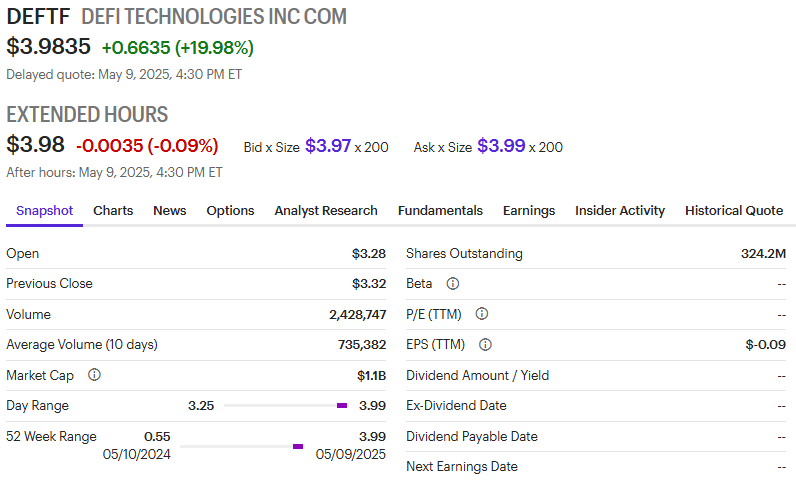

High Volume Breakout on news of NASDAQ Listing on May 12th 2025

LOTM is sharing this not as a news pump but as a reason to celebrate.

Congrats to those of you who bought DeFi and held or added to the position during the March market correction. The same goes for Galaxy Digital (BRPHF*) – Galaxy will begin trading on the NASDAQ on May 16, – four days after the May 12th listing of DeFi Tech on NASDAQ.

This is a goal reached, and a project completed – Anticipating and seeing Galaxy Digital and DeFi listed on NASDAQ. I absolutely believe Bitcoin and Crypto are still in their early days – early years. There will be fireworks in the stock price as we approach the listing dates. Much of it may be priced in now. Over the next month or two, don’t be surprised if there is a price pull back in each companies’ stock price. Decide this weekend what, when and how you are going to react to every scenario that may present itself. Selling some shares to celebrate and enjoy the fruits of this project is warranted.

Mara Holding’s (MARA) Volume doubled the ten day average today as well. The shares had a technical breakout.

As an indicator of my contrarian views on the market I started buying an old favorite today, Vermilion Energy (VET) $6.42. Over the past three years the stock price has retreated while they made acquisitions, increased the dividend (they pay a 5.8% dividend), and reduced their debt level substantially. I did not buy many shares and plan to DCA into a position over the next year baring market actions that might give one pause.

Good luck – Good fortune and have a great weekend! Tom

NEWS May 9, 2025:

/PRNewswire/ – DeFi Technologies Inc. (the “Company” or “DeFi Technologies”) (CBOE CA: DEFI) (GR: R9B) (OTC: DEFTF), a financial technology company that pioneers the convergence of traditional capital markets with the world of decentralized finance (“DeFi”), is pleased to announce it has received approval to list its common shares (the “Common Shares”) on the Nasdaq Capital Market (“Nasdaq”). Trading is expected to commence on Nasdaq under the symbol “DEFT” on May 12, 2025.

NEWS: 05/06/2025 – 06:30 AM

- AUM & Continued Monthly Net Inflows: Valour reported assets under management (AUM) of C$988 million (US$715 million) as of April 30, 2025, reflecting an 11.7% increase month-over-month. Net inflows for April remained strong at C$10.8 million (US$7.8 million), bringing year-to-date inflows to C$81.1 million (US$58.7 million) — underscoring accelerating investor demand for Valour’s ETPs.

- Strong Financial Position & Treasury Strategy: The company maintains a total cash, USDT, and treasury balance of C$61.9M (US$44.7M), comprising C$15.4M (US$11.1M) in cash and USDT, reflecting a 19.5% decrease from the previous month, and C$46.5M (US$33.6M) in its digital asset treasury, a 11.2% increase from the previous month as of April 30, 2025. These amounts do not include the DeFi Arbitrage trade completed as of May 5, 2025.

- DeFi Alpha Trading Revenue: Since its Q2 2024 launch, DeFi Alpha has generated C$162.4 million (US$118.8 million) in revenue, including a C$30.3 million (US$22 million) one-time arbitrage trade in May 2025. This strategy has materially strengthened the Company’s balance sheet, enabling debt elimination and supporting the growth of its digital asset treasury.

NEWS May 5th 2025:

DeFi Technologies Reports a Return of C$30.3 Million (US$22 Million) From an Arbitrage Trade by DeFi Alpha

- Opportunistic Trade Execution: DeFi Alpha, DeFi Technologies’ specialized arbitrage trading desk, generated a one-time return of approximately C$30.2 million (US$22 million) from an arbitrage trade.

- Strengthened Financial Position: The return from this trade will be reflected in the Company’s Q2 2025 financial statements, enhancing DeFi Technologies’ overall liquidity.

- Strategic Alpha Generation: This result underscores DeFi Alpha’s ability to swiftly execute on market inefficiencies, reinforcing the Company’s commitment to disciplined trading strategies that drive shareholder value.

Links to all three news stories linked here

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()