- Growth of Blockchain might surprise you!

- Silver Price Breakout Soon?

Those who read us know we have taken a barbell approach to the market. On one end of the barbell, we have a value perhaps even a deep value view that gold and silver miners are “the” most undervalued sector of the market. While physical metal prices are firm and in a bull market Gold and Silver “miners” are underperforming the rally in physical metals. Because physical gold and silver prices are high, cash flows at many producing miners are extremely strong.

Silver Price Breakout Soon?

Silver especially is cheap compared to gold. The silver to gold ratio is around 90 to one. This means it takes 90 ounces of silver to buy one ounce of gold. Historically this number has been around 15 ounces of silver to buy one ounce of gold in the 1800s and early 1900s. More recently the number has been 50 to 70 silver oz to buy one oz of gold. There is potential for a re-valuation of Silver to gold in the area of

Production of silver has been in a deficit for four to seven years depending on the source and calculation. This is because of industrial use of silver. Uses include military applications like cruise missiles, solar panels, electronics, space applications and auto industry. We do not see these demands for silver shrinking anytime soon.

Our position is that silver and gold miners will play catch-up to the rally in physical metals and the expanding cash flows at producing miners. If the public does not recognize to opportunity the producing miners with strong balance sheets and grow cash flows will consolidate the industry through mergers and acquisitions.

Physical Silver to play catch-up to Physical Gold? We believe this is a probability

Third Party supporting Comments:

Interesting article & Videos:

Why It’s Silver’s Time to Shine Now – The Jerusalem Post – March 8, 2025

Detail analysis of the silver market rarely seen in news print.

“Tavi Costa: Gold’s Next Leg Higher, Silver’s Major Breakout Setup”

21 minute video interview – March 7, 2025

Tavi is a partner and Macro-economist at the investment firm – Crescat Capital.

Gold’s Making All-Time Highs, SILVER To Follow | Michael Oliver

Oliver predicts a major acceleration in gold and silver prices, noting that the prolonged staircasing pattern in both metals is nearing its end. With gold recently pulling back from its near $3000 high, Oliver believes the current dip is just a temporary pause and that gold will soon resume its upward trajectory, spurred by global stock market breakdowns. He highlights that stock market declines often lead to money flowing into safe havens like gold, especially when major indices show signs of breaking key momentum levels. This shift, along with central bank responses, will create the conditions for a faster-paced bull market in gold, with silver and gold miners likely to outperform. Ultimately, Oliver envisions a significant rally for precious metals, potentially reaching levels as high as $8,000 for gold, driven by both market dynamics and broader economic shifts.

The Massive Silver Shortage: What Bank’s Don’t Want You to Know

Keith Neumeyer Founder CEO First Majestic (AG*) with Daniela Cambone. 21 minutes March 7th 2025. Accounts related to LOTM own shares of First Majestic.

Growth of Blockchain might surprise you!

Blockchain Technology: Crypto and Blockchain are changing the financial world at breakneck speed. We do not like the current draw-down in the crypto / blockchain prices, but this is a major trend rapidly changing industry. It is more a back office revolution and largely unseen in everyday life. The upward trend of development into actual use can be expected to last a decade or more. Pull backs in market prices of stocks can be viewed as opportunities to accumulates additional shares if you use a position building strategy. Of course you also have to have the ability to hold the position through the sell off not in play.

FROM an INTERNET AI QUESTION – What is the industry adoption rate of blockchain?

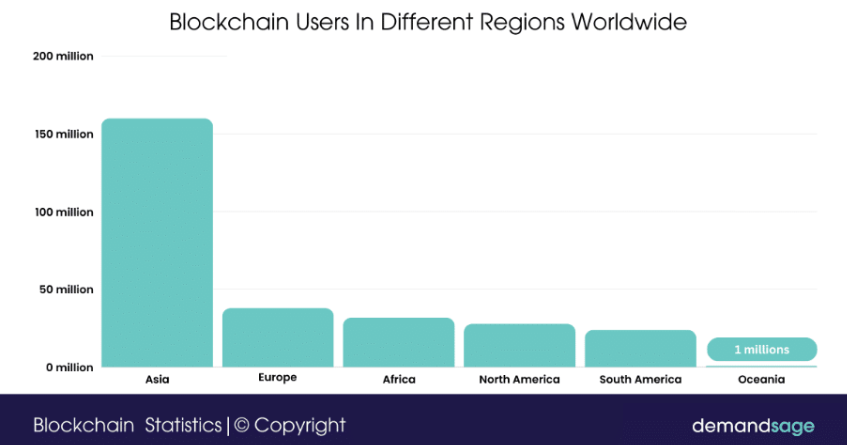

Currently, 81% of the world’s largest public companies are using blockchain technology. By digitizing and automating processes, blockchain fosters both speed and efficiency, with smart contracts automatically executing tasks once predefined conditions are met.

Which industry uses blockchain the most?

Here are what we believe to be the most pertinent blockchain use cases for enterprises, institutions, and governments.

- Healthcare and the Life Sciences. …

- Insurance. …

- Law. …

- Media and Entertainment. …

- Real Estate. …

- Retail Fashion and Luxury. …

- Sports and Esports. …

- Supply Chain Management.

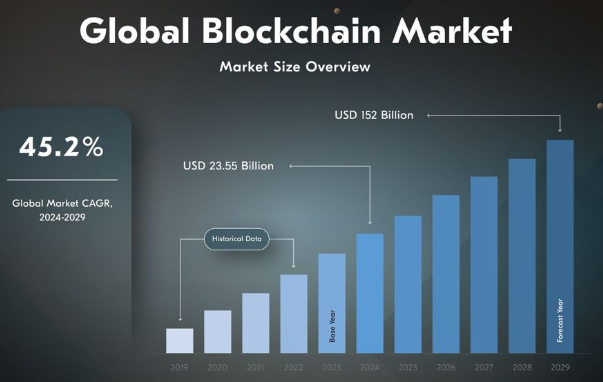

Blockchain market value increased from $4.19 billion in 2020 to $26.91 billion last year.

Blockchain Statistics 2025 — Adoption Rate, & Users

By Naveen Kumar / December 27, 2024

The blockchain market has steadily grown over the years. Its market value increased from $4.19 billion in 2020 to $26.91 billion last year.

It is fascinating to see that the blockchain industry is worth billions, even though just 3.9% of people worldwide use it. Follow title link for full article.

The longer-term use and application of Crypto and Blockchain is very bullish and though we will have and are currently having a crash in the crypto related market, we will recover and move to higher highs, in this technology sector. How each of us deal with this major trend and its corrections is our individual battle.

![]()