Crypto miners are deeply oversold and set-up for a rally – Which one is Best for you?

Crypto / Blockchain Application ETFs are very different from each other when looked at from what they own. Some focus on crypto miners – some focus on asset management companies and others look at traditional companies that are using Crypto applications already. Others look at owning companies that have Bitcoin Treasury reserves. There are many different perspectives on how to approach this sector.

In this report we will provide our views of five Crypto-Blockchain Application ETFs

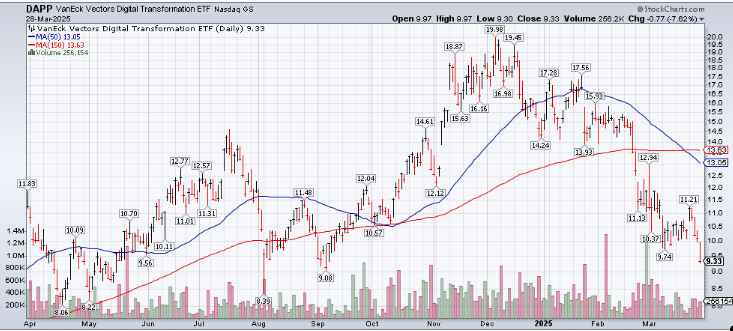

VanEck – DAPP $9.33

ARK-21 – ARKD $36.56

Invesco Alerian Galaxy Crypto Economy ETF (SATO) $14.01

First Trust SkyBridge Crypto Industry and Digital Economy (CRPT) $12.62

Bitwise Crypto Industry Innovators (BITQ) $14.12

Global X Blockchain ETF (BKCH) $34.02

VanEck – DAPP $9.33

Excellent portfolio with a focus on Crypto Miners. Strategy, DeFi Tech and Metaplanet provide exposure to companies with strong crypto reserve holding. MARA and some of the other miners also hold bitcoin as a crypto reserve. This provides strong exposure to a run-up in Bitcoin and crypto going into year-end 2025. This ETF makes a good longer-term trading vehicle in the three to six-month time frame. In my personal opinion we are close to a uptrend in crypto and this might be a timely buy. Trading DAPP avoids individual company risk yet gives excellent exposure to participating in a Bitcoin run.

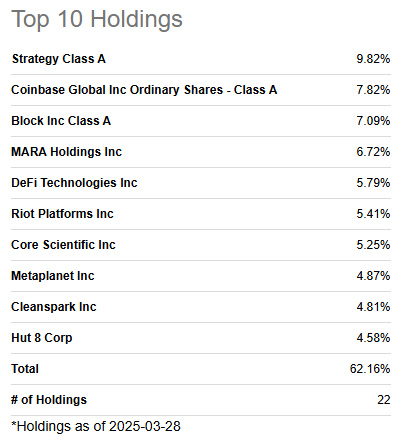

.ARK-21 – ARKD $36.56

Note the concentrated number of positions in the ETF holdings below. Two of the positions are direct ownership of Bitcoin and Ethereum. Ten equity positions. Most of these are traditional companies that are applying the use of Crypto and Blockchain in their current businesses. This seems to be a very good portfolio for those who don’t want to venture too far from traditional investing ideas yet have some exposure to new crypto technology.

The trading volume is not great for liquidity purposes BUT because of the thin trading, ARKD might be a ETF to watch for spikes in trading volume to signal trend changes.

We have a volume spike that might signal the end of the correction for the sector.

Small portfolio of excellent companies. No creative thinking or new discoveries. Conservative, solid selections but concentrated.

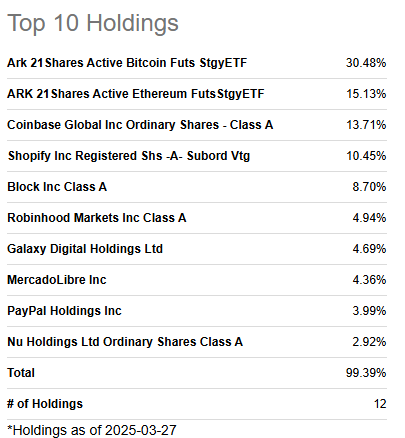

Invesco Alerian Galaxy Crypto Economy ETF (SATO) $14.01

The top ten of this portfolio, most closely tracks with our LOTM thought process. Of the top ten positions, LOTM owns and/or is active in five of the positions. These five are Sol Strategies, MARA, Strategy, Neptune Digital and Exodus Movement. Galaxy Digital is further down the list of holdings. Many on the top ten list hold Bitcoin as a treasury reserve holding. That feature is one that is of strong interest to LOTM. Overall, the 54 position covers all applications that crypto and Blockchain impact. The total portfolio can be seen with this link.

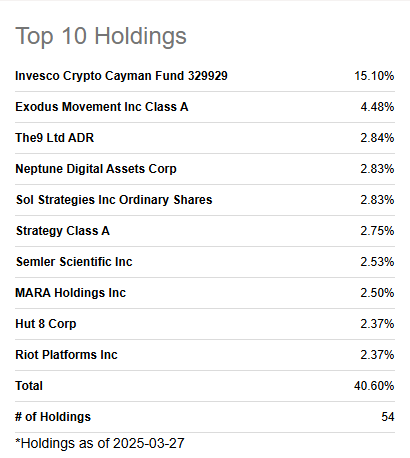

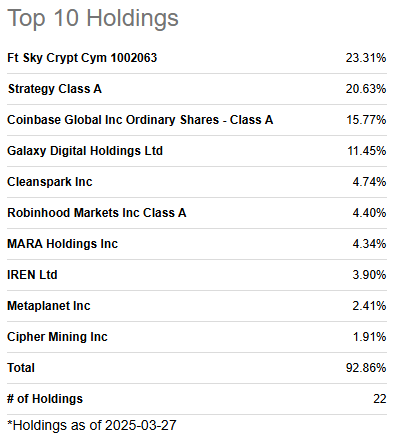

First Trust SkyBridge Crypto Industry and Digital Economy (CRPT) $12.62

SkyBridge holdings are in line with group think of the bitcoin miners and some Bitcoin Treasury holdings. It is nothing special within the ETF group. What bothers me a bit is that I don’t know what is in its largest holding Ft SkyBridge Crypt Cym. It is a conflict-of-interest issue and an unknown. I am not saying they have anything wrong, only with many ETF choices, personally I would pass or treat it as a trading vehicle.41% of the fund is in two names.

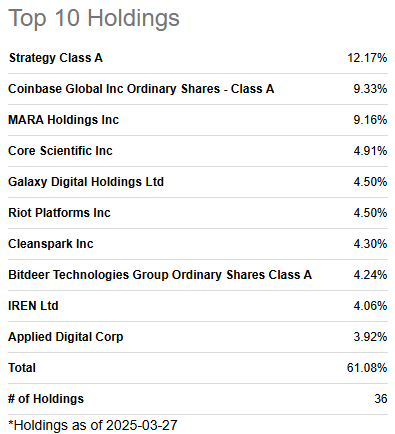

Bitwise Crypto Industry Innovators (BITQ) $14.12

Good solid names that represent the Crypto / Blockchain industry. Volatile enough to trade – solid enough to catch a good uptrend. All these ETFs look over sold and ready to bounce.

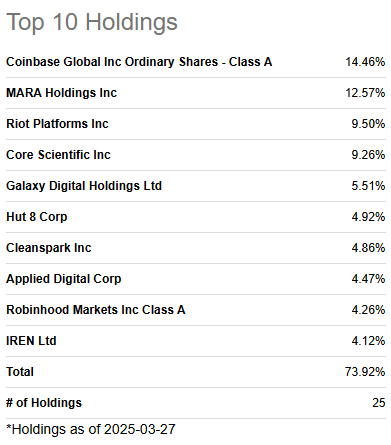

Global X Blockchain ETF (BKCH) $34.02

I like this company even though on the surface it resembles the majority of crypto / blockchain ETFs. Differences I notice are BKCH does not have Strategy in its top ten list. That is not good or bad just different. They are heavy in Coinbase and MARA with about 28% of the portfolio in those two stocks. Coinbase, MARA and Galaxy were all hit very hard to the downside in the last two weeks. No particular reason – institutions exiting the group rotating into what? Maybe Gold, Biotech and Pharma. Crypto / blockchain is a very viable industry sector. This ETF could rebound strongly. I know the names and own some. When Bitcoin moves this will rebound hard led by the likes of MARA, Coinbase, Galaxy Cleanspark and Hut 8. This is a good one IMHO.

If you want to hop aboard the “Bitcoin Train” but don’t want to buy bitcoin direct of a single company, then my suggestion would be look at DAPP and BKCH. I believe they will rally fast. The companies involved in crypto and blockchain are more volatile than crypto itself. That is saying a lot so understand this.

DAPP and BKCH are the timeliest at this moment.

In the future companies that use bitcoin and blockchain in their applications will. ARKD has some of these names in their ETF.

Accounts related to LOTM currently holds positions in MARA Holdings, Galaxy Digital, Defi Technologies, BLOCK and Neptune Digital. We do not own them currently but often trade Strategy, Sol Strategies, Exodus Movement.

#blockchain #galaxydigital #bitcoin #stocks #crypto

![]()