BRICS Nations To Adopt Bitcoin For Global Trade: VanEck Exec

LOTM: It is hard to know if this is RUMOR or Advanced Intel.

In an appearance on CNBC’s “Squawk Box,” Matthew Sigel, Head of Digital Assets Research at investment firm VanEck, forecasted a significant shift in global trade dynamics with the potential adoption of Bitcoin by BRICS nations. Sigel’s insights come amid growing fiscal policy concerns in the United States and increasing efforts by emerging economies to circumvent traditional financial systems.

“We think once the election result is finalized, Moody’s is going to downgrade US sovereign debt, and that could be a catalyst for Bitcoin,” Sigel stated. He emphasized BTC’s unique properties, noting, “Bitcoin is a chameleon. It’s hard to predict what it’s correlated with. Because of the 21 million and fixed amount out there, it’s a non-US asset.”

Full written story is linked in the headline. Video Interview is linked in the word appearance here and above.

Elan Musk comment on The rate of growth of the American Debt:

In a recent Trump campaign rally appearance, Tesla CEO Elon Musk raised alarms over the unprecedented scale of the U.S. national debt. Musk emphasized the issue by stating, “Just the interest payments on the debt are 23% of all federal tax revenue,” pointing out that interest payments alone now surpass the Defense Department’s $1 trillion annual budget. He described the situation as a “financial emergency,” a message he later reiterated on X.

Full story linked here as in The Economic Times.

LOTM: This debt realization is what is driving Alternative Assets Values higher. Gold – Silver and Bitcoin are the assets referenced as Alternative Assets.

-

ACTIONABLE IDEA:

New ETFs or Mutual funds have an advantage over established ETFs or mutual fund that can result in better performance than established ETFs or mutual Funds.

The advantage is new ETFs has a steady stream of new money coming into the fund. This allows the ETF to move forward in a timely manner that has no past investment that might be a drag on the newer ideas it is buying. This is more commonly called baggage. Dollar-Cost-Averaging works especially well when new money is consistently flowing into the fund, that is small and has no past investments.

A New ETF engaged in owning companies that participate in Blockchain / Crypto industry is:

DECO – SPDR Galaxy Digital Asset Ecosystem $33.77

Galaxy Digital (BRPHF*) $13.84 is the manager of DECO. We cannot think of a better manager that knows more about what is happening inside the digital asset world than Galaxy. The DECO ETF just came public on September 7, 2024. The shares have rallied 35% so far in its seven-weeks of existence.

An account related to LOTM purchased it initial position yesterday with a purchase of 20 shares. We plan to increase this position in coming weeks. We plan to run this stock as long as it is rally mode (Crypto-blockchain but we do own it through the use of borrowed funds sip will exit quickly with trading stop loss risk management tactics.

The fund size is tiny at this time standing at $7.4 million as of October 29, 2024. Position held at this time are heavily in the Crypto mining sector. A comment about the industry that we view as a positive is that Crypto mining industry is being recategorized as Infrastructure / Data Center sector as the group expands towards Artificial Intelligence computing as well as crypto mining. Fresh money coming into the pool with no or little baggage allows the manager the ability to dollar cost average which acts as a stabilizer should stocks in the fund pool decline in value.

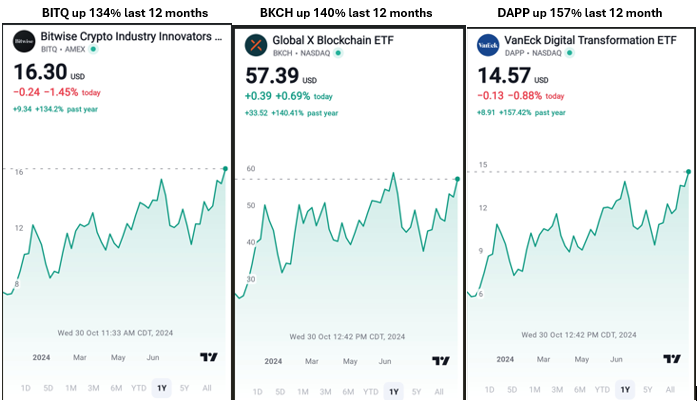

Past Performance of Three ETFs related to Crypto/Blockchain as samples of how hot this sector has been:

The purpose of sharing these three ETFs, is to demonstrate that LOTM wasn’t so smart that we are excellent stock pickers, but rather we identified a sector trend and got on board. There are multiples of more ETFs in Crypto/Blockchain the provided similar return to the three above over the past 12-months. Allow me to remind you and myself that past performance does not imply that future performance will be repeated. Selecting sectors of the market that out-perform others, and in turn companies that are the better performers within said sector is an ongoing process.

- INTERESTING COMMENT BY B Riley Securities about seven days ago.

“we believe we are experiencing a once-in-a-generation global shift in the market from fiat money controlled by government central banks to network-based money, more commonly called ‘cryptocurrency,’ with this transition still in the early stages,” Source link here

- In a different direction related to the Israeli strike directly against IRAN –

Macro-economist David Woo, living in Israel, reports the stick was so successful he believes Iran will pause in its aggression in the Middle East. David has been a repeat “best” Macro Economist, globally, while at Bank of America. David now runs his own shop based in Israel.

David Woo: Why Israel’s Iran Strike & A Trump Win Are Bearish for Oil

Published 10.29.2024

SUMMARY: David Woo accurately predicted that an Israeli strike on Iran was imminent exactly two weeks ago here on Wealthion. We’re privileged as James Connor welcomes David back to update us on the geopolitical and market implications of last Saturday’s events. Calling the strike a “stroke of genius,” Woo discusses its impact on Middle Eastern stability and why it’s bearish for oil. He also shares his predictions for the upcoming U.S. elections, forecasting a Trump win and the potential impact of a Republican administration on the U.S. economy, equity markets, an increase in oil production, and its effects on the global geopolitical landscape.

Have a great Day. May good fortune find us and our families. Tom

Tom “at” Livingoffthemarket.com

![]()