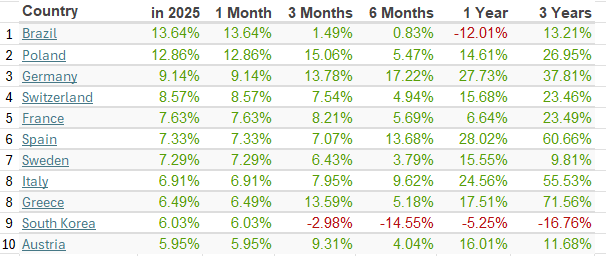

- The Best Global Country Equity Markets (2025) – A system to work country finds for performance.

- Follow-up on MEXX (2-x Levered Mexican ETF) and TV (Grupo Televisa*)

If you follow this link, it will take you to the website from which the graphic above was sourced. I have edited the date in the graphic above to condense the information I wanted to share. One way one might apply the data provided from the web site is to buy the top five performing country ETFs every month. We’d suggest selling the ETF that drop out of the top five list. This will create taxable activity so best done in a IRA or other tax advantaged account. The goal is to catch the ETFs that “trend higher for the longest time. One could also use the three month or six month period to screen the top five performers. If you have questions, please ask them.

Listed on the website linked above is also the ETFs available to trade and each ETFs performance in graphic format.

This service is free at the moment, but I suspect they are working toward being a pay wall service.

Accounts related to LOTM have been purchasing companies and ETFs from other countries. We will take some time to see how the Trump Tariffs policy plays out. We are of the belief that the US Dollar must fall if the Trump reshoring and export plan is to work. It is our position that the Tariffs with Mexico and Canada are intended as a wake-up call related to negotiations on an immigration and drug interdiction agreement is worked out.

- MEXX and TV from Mexico

In related accounts we own the 2-X leveraged Mexico ETF (MEXX*). We will close (sell) that position because it is a leveraged and aggressive play on owing Mexico stocks. We are selling simply because of uncertainty of the application of Trump Tariffs on Mexico. I don’t want to deal with this style of uncertainty. We like the ETF and see it as a useful tool in working Mexican stocks, As of Fridays close, we have a small profit in the position. Selling is to avoid a potential headache. We don’t need or want to swim against the headlines at this time with this position.

Two year weekly chart above

I believe the Tariffs are priced into the shares of MEXX at this time, but we bought the shares as a trade and will consider re-entry at a future date. Longer-term, we want to own MEXX on a trading basis not as a core holding.

As for our new and larger position in Grupo Televisa (TV*), we will own the position. It is a deep value buy. From multiple sources we hear comments that the company has assets worth from $4.00 per share to as high as $12 per share. The company is profitable, has a strong cash flow and has cash of about $4.90 per share. The company has a high debt load but from our work the debt is not a problem. We are approaching TV as a core holding.

Two year weekly chart above

![]()