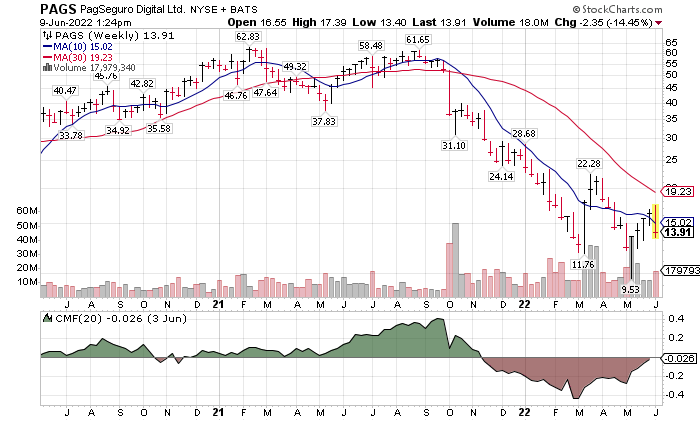

- PagSeguro (PAGS)* $13.74 Down 21% on Thursday

- DC Blockchain Summit last month Comment:

PagSeguro (PAGS)* $13.74 Down 21% on Thursday

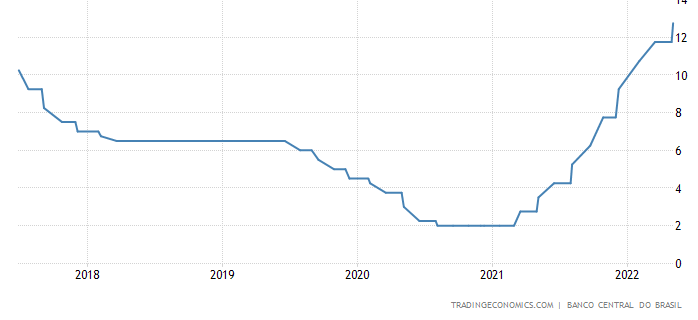

Very tough day for PAGS on Thursday. I read through the conference call. I did not hear anything that was out of line as to be alarming to cause the price drop. A number of analysts announced downgrades to hold from buy. Here again, no real reason that I saw attached to the downgrades. Interest rates in Brazil have risen from 2% to 12%. But that is in the past. When interest rates fall, I expect a rapid rise in the price of PagSeguro. Brazil stocks have been strong this year Vs weak USA stocks. See table at the end.

PagSeguro Digital Ltd. (PAGS) came out with quarterly earnings of $0.21 per share, in line with the Zacks Consensus Estimate. This compares to earnings of $0.18 per share a year ago. These figures are adjusted for non-recurring items.

A quarter ago, it was expected that this company would post earnings of $0.21 per share when it actually produced earnings of $0.23, delivering a surprise of 9.52%.

LOTM: Since earnings were flat YOY and next quarter is projected to be flat, perhaps a loss of upward momentum triggered the dumping of shares. PAGS might have fallen out of the “Growth Stock” definition for Growth / Quant investors. That is the best we can give you at this time.

Brazil’s PagSeguro Digital stock craters as Q1 revenue falls short of consensus

Jun. 09, 2022, 11:12 AM ET

- Brazilian-based fintech PagSeguro Digital (NYSE:PAGS) shares are falling around 19% in Thursday morning trading, as first-quarter revenue missed the average analyst estimate.

- Q1 revenue of R$3.43B ($700.1M) fell short of the consensus of R$3.62B, but rose from R$3.2B in Q4 2021 and R$2.1B in Q1 2021. Adjusted EPS of R$1.1145 ($0.23) matched the Wall Street estimate.

- Total payment volume of R$152.2B increased from R$147.1B in Q4 2021 and R$81.4B in Q1 of last year.

- PagBank active clients totaled 14.3M in Q1 compared with 13.1M in Q4 2021 and 9.1M in Q1 of last year. Moreover, “PagBank has been also diversifying its revenue streams, mostly driven by interest income, and we also plan to launch new secured loan products to be deployed in second half of 2022,” Co-CEO Ricardo Dultra said during his company’s earnings conference call on Wednesday.

- Expenses of R$2.9B gained from R$2.8B in Q4 2021 and R$1.6B in Q1 2021.

- Adjusted EBITDA was R$665M in Q1, up from R$612M in the previous quarter and R$573M in Q1 2021.

LOTM: The headline is much worse than the numbers. If the shares close below $14.00 and are weak on Friday’s opening, I would consider this as a trading buy for very short-term. It might be a good entry for those looking for six months to 18 month time-line or building on the position. Maybe not worth the money in buying for a trade in what I think is an over-reaction. Revenue missed by 0.05% and the stock drops 21%.

Brazil Interest rates have climbed from 2% in 2021 to 12.75% in May 2022.

June 14 & 15 will be another opportunity for Brazil to raise rates again. I have no insight if they will. They aggressively rated interest rates before the USA. It would appear that the majority of the interest rates hike is behind Brazil just from the percentage increase. Brazil will probably be a leader in reducing rates. At such time margins for PAGS (and STNE) will likely expand as they will be slow to reduce rates to clients. PAGS’s is the industry leader in the Brazil digital payment market at 11% market share. They have a very clean balance sheet.

Longer-term Chart View:

Our though is to accumulate of PAGS shares slowly. A drop in Brazilian interest rates would be a trigger for the stock to move higher. Fundamentally the company looks strong. Link to stats at Finviz.

Brazil stocks have been strong this year Vs weak USA stocks. Follow the linked ETF names to view charts.

| Symbol | ETF Name | Total Assets | YTD | Avg Volume |

| EWZ | iShares MSCI Brazil ETF | 6020.51M | 19.42% | 27,656,598 |

| FLBR | Franklin FTSE Brazil ETF | 399.36M | 18.43% | 156,280 |

| EWZS | iShares MSCI Brazil Small-Cap ETF | 100.55M | 4.66% | 69,060 |

| Desc Link | Linked to Finviz chart |

DC Blockchain summit last month Comment:

Kevin O’Leary attended the DC blockchain summit last month, and sat down with Brian Dixon, president of Off the Chain Capital

- New York Banning Bitcoin Mining? | DC Blockchain summit 2022 June 3, 2022. 15 minute video.

-

-

- Lots of discussion on Crypto / Blockchain that brings us forward on the state of Blockchain.

-

-

- USA is trailing many countries in its regulation of Crypto. Frustration is expressed at the – WHY?

LOTM Thinking: Crypto / Blockchain is software. It is the “new” technology that is changing the world. It is not going away. We should have exposure to it in some way shape or form.

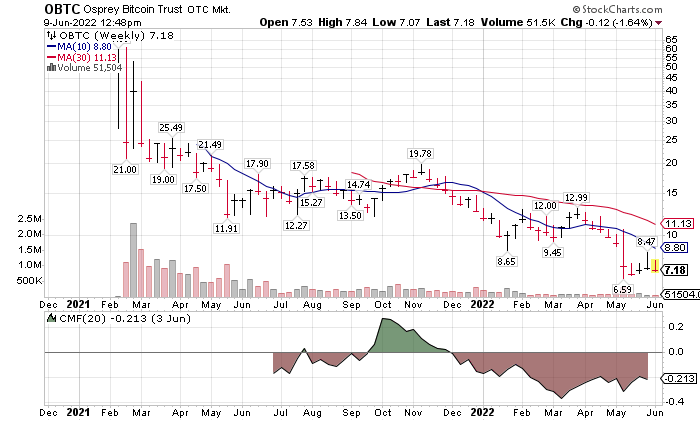

One way to be invested in Bitcoin is through the Osprey Bitcoin Trust*.

1.5 year weekly chart.

Bear markets are for accumulating positions the same as planting seeds if gardening.

LOTM Research & Consulting Service

* An account related to LOTM holds a position in this security.

Neither LOTM nor Tom Linzmeier is a Registered Investment Advisor.

Please refer to our web site for full disclosure at www.LivingOffTheMarket.com ZTA Capital Group, Inc.

To Unsubscribe please select “return” and type Unsubscribe in the subject line.

![]()